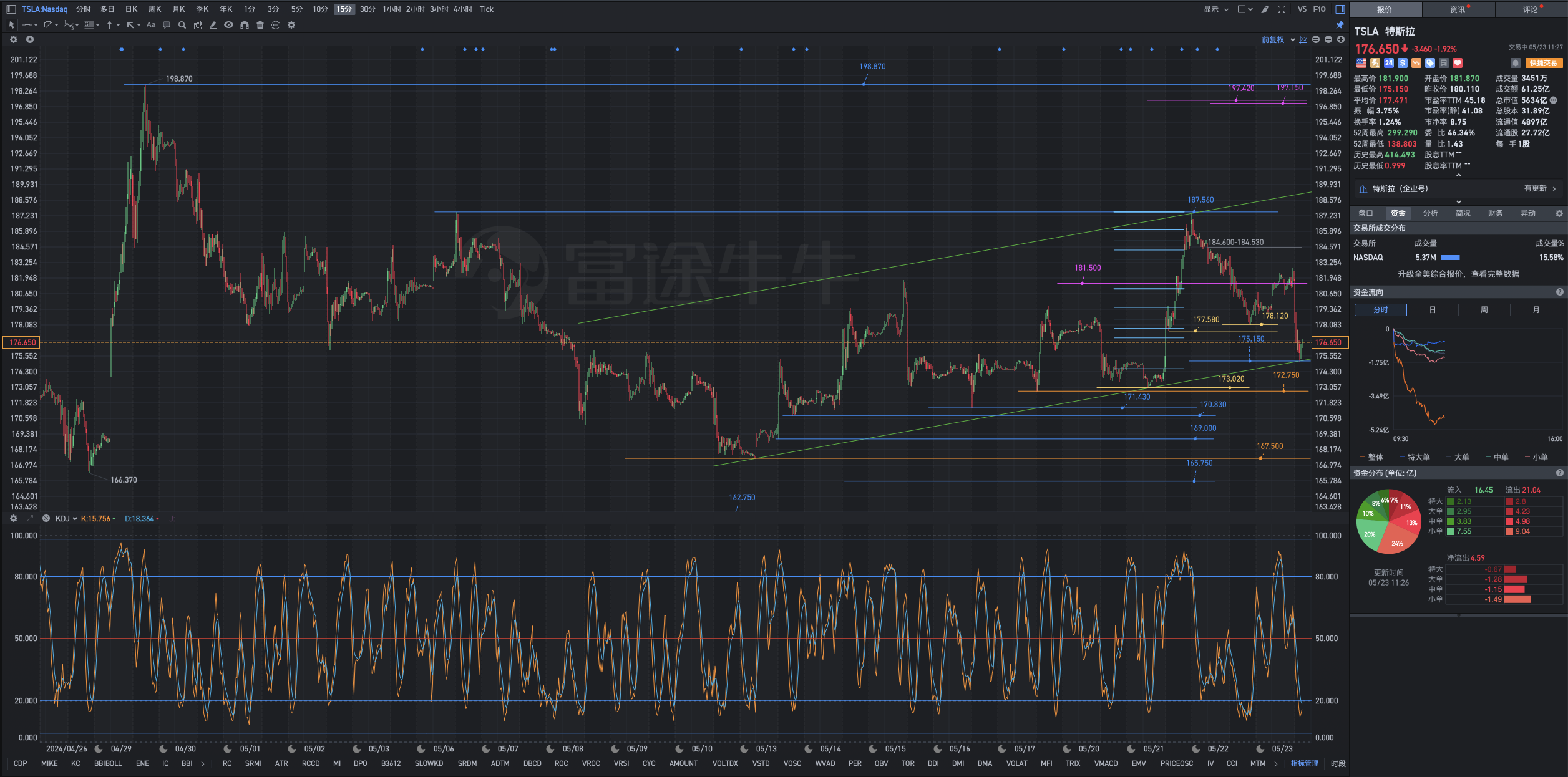

$Tesla(TSLA.US$

Keep shoveling until the sky is full of color.

There was no increase; there was a buy-up trend.

The chart is for interested people to see, and the world is full of poetry.

Paying attention to “basic work” is a top priority.

1. Time only changes things that aren't strong enough in the first place.

2. Only those who have no new stories will remember the old ones.

3. People see benefits without harm; fish see food without being hooked.

4. Work hard for everything you want, and be relieved as soon as possible for everything you don't get.

5. As long as life is fun, that day's life is worth the ticket price.

6. Instead of striving for perfection and getting frustrated, it's better to persevere in a clumsy way.

Life needs four kinds of people

Famous Teachers Guide the Way, Noble People Help Each Other, Incurable Support, Villains Remembers. If you can integrate others, it means that you have the ability. If you are integrated by others, it means that you are involved. No...

Keep shoveling until the sky is full of color.

There was no increase; there was a buy-up trend.

The chart is for interested people to see, and the world is full of poetry.

Paying attention to “basic work” is a top priority.

1. Time only changes things that aren't strong enough in the first place.

2. Only those who have no new stories will remember the old ones.

3. People see benefits without harm; fish see food without being hooked.

4. Work hard for everything you want, and be relieved as soon as possible for everything you don't get.

5. As long as life is fun, that day's life is worth the ticket price.

6. Instead of striving for perfection and getting frustrated, it's better to persevere in a clumsy way.

Life needs four kinds of people

Famous Teachers Guide the Way, Noble People Help Each Other, Incurable Support, Villains Remembers. If you can integrate others, it means that you have the ability. If you are integrated by others, it means that you are involved. No...

Translated

$Tesla(TSLA.US$

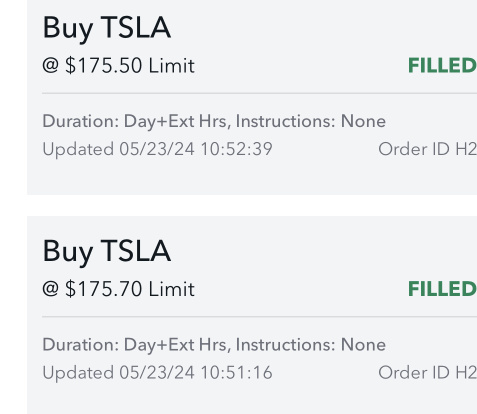

Comparatively “greedy” because it's cheap:

Dynamic position technology

Flexibility is the best ability to solve problems:

Surgical collection of low quality cheap chips:

Some aerial combat was carried out:

Comparatively “greedy” because it's cheap:

Dynamic position technology

Flexibility is the best ability to solve problems:

Surgical collection of low quality cheap chips:

Some aerial combat was carried out:

Translated

+5

1

$Tesla(TSLA.US$

1. Jerome, who has a background in theoretical physics and applied mathematics, usually uses mathematical models and quantitative analysis as the basis for investment transactions, and then finds where the traditional technical analysis basis chain is to support the former's conclusion. Also, pay attention to collecting information from famous reverse indicators in some review areas. This is an important step for targeting medium- to long-term surgical and relatively accurate framework investment transactions. One of the US military's most powerful tactics is electronic warfare, using anti-radiation missiles to destroy and paralyze the opponent's reconnaissance and counterattack systems.

2. Reverse indicators are an important asset given to us by God. They spend time and energy to speak freely and provide high-dimensional strategic investors with valuable first-hand and complete anti-finger information free of charge. It's a great thing. They don't even need to pay to be grateful. They are willing to share and contribute. They can't stop them, stop them whatever they want, and let them grow. It's just that as a high-dimensional medium- to long-term surgical and relatively accurate framework strategic investor, the investor itself needs to have a certain ability to identify, because some of it is disguised toxic anti-finger information.

3. A pullback of close to 50% can turn the crowd upside down, lose their spirits, and get dizzy. I sincerely admire the two major restrictions set by the Creator God in the financial market: (1) Unfathomable principles. (2) The principle of spatial orientation disorder.

4. All of Jerome's opinions are clearly expressed in the chart, which tells us everything...

1. Jerome, who has a background in theoretical physics and applied mathematics, usually uses mathematical models and quantitative analysis as the basis for investment transactions, and then finds where the traditional technical analysis basis chain is to support the former's conclusion. Also, pay attention to collecting information from famous reverse indicators in some review areas. This is an important step for targeting medium- to long-term surgical and relatively accurate framework investment transactions. One of the US military's most powerful tactics is electronic warfare, using anti-radiation missiles to destroy and paralyze the opponent's reconnaissance and counterattack systems.

2. Reverse indicators are an important asset given to us by God. They spend time and energy to speak freely and provide high-dimensional strategic investors with valuable first-hand and complete anti-finger information free of charge. It's a great thing. They don't even need to pay to be grateful. They are willing to share and contribute. They can't stop them, stop them whatever they want, and let them grow. It's just that as a high-dimensional medium- to long-term surgical and relatively accurate framework strategic investor, the investor itself needs to have a certain ability to identify, because some of it is disguised toxic anti-finger information.

3. A pullback of close to 50% can turn the crowd upside down, lose their spirits, and get dizzy. I sincerely admire the two major restrictions set by the Creator God in the financial market: (1) Unfathomable principles. (2) The principle of spatial orientation disorder.

4. All of Jerome's opinions are clearly expressed in the chart, which tells us everything...

Translated

+8

1

$Tesla(TSLA.US$

Spend less, own more.

The world is mine and yours; wealth is mine and yours, but at the end of the day it is mine.

You will be the icing on the cake and doing the work of falling to the bottom of the earth.

I am solely responsible for providing blessings and promoting justice.

Spend less, own more.

The world is mine and yours; wealth is mine and yours, but at the end of the day it is mine.

You will be the icing on the cake and doing the work of falling to the bottom of the earth.

I am solely responsible for providing blessings and promoting justice.

Translated

+1

3

1

Elias Chen

commented on

$Tesla(TSLA.US$

The overbought technical indicators have been effectively revised, which is more conducive to the further development of the market in the future.

Following the general trend, anti-technology, anti-humanity.

Surgical relatively accurate framed investment transactions

The overbought technical indicators have been effectively revised, which is more conducive to the further development of the market in the future.

Following the general trend, anti-technology, anti-humanity.

Surgical relatively accurate framed investment transactions

Translated

+11

1

2

Elias Chen

commented on

$Tesla(TSLA.US$

1. When Tesla shakes, it's a landslide and a tsunami, and the earth shakes. Because its texture is so good, it has great potential.

2. Tesla is a large natural gemstone that has already been cut and has shown the texture of some high-quality jade. Because I believe, I see. By the time everyone has seen it all with the naked eye, then the mysterious and valuable uncertainty has come to fruition, and it is too late to take action.

3. Wealthy strategic investors have strengths and advantages that other (her) participants cannot hope to have in terms of insight into the market and market conditions. They are generally reluctant to make short-term deals. Tesla's short-term technical indicators are seriously overbought, and there is a high probability that the stock price will fall and pull back. It is this kind of pullback that gives Tesla strategic investors in the market a valuable opportunity to get on the market — or add new or additional investment.

4. Without going through a strong sharp decline, it is difficult for Tesla to have upward momentum across the 198.870-205.600 region. Pay attention to basic work and silently cooperate with Tesla's fundamental improvements. This stage takes time and patience. If you don't have a clear mind or scientific method, you are forced to speculate and predict wishfully, and go out of your way to gamble, and you will surely pay a high price for your own recklessness and foolishness.

5. Abusing the bilateral mechanism of the mature US market, randomly putting on short sales without knowing how to stop in time, you will eventually die, and nothing will happen again.

6. I am reasonable...

1. When Tesla shakes, it's a landslide and a tsunami, and the earth shakes. Because its texture is so good, it has great potential.

2. Tesla is a large natural gemstone that has already been cut and has shown the texture of some high-quality jade. Because I believe, I see. By the time everyone has seen it all with the naked eye, then the mysterious and valuable uncertainty has come to fruition, and it is too late to take action.

3. Wealthy strategic investors have strengths and advantages that other (her) participants cannot hope to have in terms of insight into the market and market conditions. They are generally reluctant to make short-term deals. Tesla's short-term technical indicators are seriously overbought, and there is a high probability that the stock price will fall and pull back. It is this kind of pullback that gives Tesla strategic investors in the market a valuable opportunity to get on the market — or add new or additional investment.

4. Without going through a strong sharp decline, it is difficult for Tesla to have upward momentum across the 198.870-205.600 region. Pay attention to basic work and silently cooperate with Tesla's fundamental improvements. This stage takes time and patience. If you don't have a clear mind or scientific method, you are forced to speculate and predict wishfully, and go out of your way to gamble, and you will surely pay a high price for your own recklessness and foolishness.

5. Abusing the bilateral mechanism of the mature US market, randomly putting on short sales without knowing how to stop in time, you will eventually die, and nothing will happen again.

6. I am reasonable...

Translated

+14

5

4

$Tesla(TSLA.US$

Although time is the friend of good companies, it is the worst enemy of bad companies. 138.800-160.510 will be a major historic region for Tesla's stock price in the future. A recovering stable stock price of 160.510 is the prelude to a rise in the bull market; a recovering stable stock price of 205.600 will return to Tesla's bull market; a recovering stock price of 220.280 will start the main upward wave of Tesla's market; and a recovering stable stock price of 265.130 will open a record high. There is a plan to open positions in a systematic manner when the bargain falls.

The way of thinking determines success:

1. Reverse thinking helps you break through dogma;

2. Critical thinking helps you break through shackles;

3. Associative thinking helps you break through common sense;

4. Empathic thinking helps you break through subjectivity;

5. Systematic thinking helps you break through one-sided aspects;

6. Open thinking helps you break through rigidity;

7. Image thinking helps you break through boredom;

8. Logical thinking helps you break through representation;

9. Forward-thinking helps you break through shortfalls.

Although time is the friend of good companies, it is the worst enemy of bad companies. 138.800-160.510 will be a major historic region for Tesla's stock price in the future. A recovering stable stock price of 160.510 is the prelude to a rise in the bull market; a recovering stable stock price of 205.600 will return to Tesla's bull market; a recovering stock price of 220.280 will start the main upward wave of Tesla's market; and a recovering stable stock price of 265.130 will open a record high. There is a plan to open positions in a systematic manner when the bargain falls.

The way of thinking determines success:

1. Reverse thinking helps you break through dogma;

2. Critical thinking helps you break through shackles;

3. Associative thinking helps you break through common sense;

4. Empathic thinking helps you break through subjectivity;

5. Systematic thinking helps you break through one-sided aspects;

6. Open thinking helps you break through rigidity;

7. Image thinking helps you break through boredom;

8. Logical thinking helps you break through representation;

9. Forward-thinking helps you break through shortfalls.

Translated

4

$Tesla(TSLA.US$

[Core Tips 🔔: Because we believe, we can see, seer foresight, first enemy discovery, firing first enemy, first enemy profit, seizing advantage. Because I don't believe it, I can't see it, I can't feel it, and I miss the opportunity. Because they don't believe it, blind people look at financial reports in a static way. Thinking is solidified and rigid, they are narrow-sighted, happy and tired of falling, sharp and mean, inflamed (secondary trends, short-term trends, and even short-term trends), and chasing short-term or even short-term interests is common to mediocre people. The truth is often held in the heart and brain of a few people; it is impossible for you to gain popular opinions and become a few successful profiteers.]

1. If you don't plan to hold a stock for 10 years, don't hold it for 10 minutes. Ronald Stephen Baron (Ronald Stephen Baron), CEO of Baron Capital (Duke Capital, also known as Barron Capital, also an important shareholder and strategic investor of Tesla), which has more than 45 billion dollars, believes through mathematical models and quantitative analysis that Tesla's stock price will rise to 1000-1500 within 3-5 years. The mathematical model and quantitative analysis of CEO Cathie Duddy Wood (Kathryn Duddy Wood, Sister Mu) of ARK Investment Management LLC (Ark Investment Management Co., Ltd., Ark Investment) concluded that:...

[Core Tips 🔔: Because we believe, we can see, seer foresight, first enemy discovery, firing first enemy, first enemy profit, seizing advantage. Because I don't believe it, I can't see it, I can't feel it, and I miss the opportunity. Because they don't believe it, blind people look at financial reports in a static way. Thinking is solidified and rigid, they are narrow-sighted, happy and tired of falling, sharp and mean, inflamed (secondary trends, short-term trends, and even short-term trends), and chasing short-term or even short-term interests is common to mediocre people. The truth is often held in the heart and brain of a few people; it is impossible for you to gain popular opinions and become a few successful profiteers.]

1. If you don't plan to hold a stock for 10 years, don't hold it for 10 minutes. Ronald Stephen Baron (Ronald Stephen Baron), CEO of Baron Capital (Duke Capital, also known as Barron Capital, also an important shareholder and strategic investor of Tesla), which has more than 45 billion dollars, believes through mathematical models and quantitative analysis that Tesla's stock price will rise to 1000-1500 within 3-5 years. The mathematical model and quantitative analysis of CEO Cathie Duddy Wood (Kathryn Duddy Wood, Sister Mu) of ARK Investment Management LLC (Ark Investment Management Co., Ltd., Ark Investment) concluded that:...

Translated

3

$Tesla(TSLA.US$

Abusing the bilateral mechanism of the mature US market and selling short at random, they will eventually die, and all will be ruined.

Elias=Jerome told the world the truth: even in the 198.870-205.600 region, half of the shares were not sold. How about a share?

There is no reason to be anxious; all who are anxious are Jumblat, who is deeply bitter, and has a bitter heart.

The big fish hunters are all strategic investors - Rasmussen.

The differences between Jumblat and Rasmussen are:

Abusing the bilateral mechanism of the mature US market and selling short at random, they will eventually die, and all will be ruined.

Elias=Jerome told the world the truth: even in the 198.870-205.600 region, half of the shares were not sold. How about a share?

There is no reason to be anxious; all who are anxious are Jumblat, who is deeply bitter, and has a bitter heart.

The big fish hunters are all strategic investors - Rasmussen.

The differences between Jumblat and Rasmussen are:

Translated

+10

2

$Tesla(TSLA.US$

Laurence Douglas Fink: bullish on Tesla; Ronald Stephen Baron: Tesla has bottomed out; hedge fund manager Per Lekander: Tesla may “go bankrupt” and its stock could plummet to $14.

The sharp and mean idiots are the best at it: icing on the cake and falling off the ground.

Tesla Bear said: Elon Musk's electric car company “could go bankrupt” as shares could plummet 91% amid disappointing first-quarter results. A well-known bear market at Tesla is a dire warning about the company's future. Per Lekander, Tesla's hedge fund manager who has been shorting since 2020((Per Lekander) has predicted that the electric vehicle (EV) manufacturer could “go bankrupt” and that its stock could plummet to $14. Rykander, managing partner at the investment management company Clean Energy Transition, described the first quarter results as “the beginning of the end of the Tesla bubble.” “I actually think the company might go bankrupt,” he said. He said the company's business model, which relies on strong revenue growth, vertical integration, and direct-to-consumer sales, could falter if sales decline. He asserted that his assessment was based on the company's earnings per share for the full year of this year...

Laurence Douglas Fink: bullish on Tesla; Ronald Stephen Baron: Tesla has bottomed out; hedge fund manager Per Lekander: Tesla may “go bankrupt” and its stock could plummet to $14.

The sharp and mean idiots are the best at it: icing on the cake and falling off the ground.

Tesla Bear said: Elon Musk's electric car company “could go bankrupt” as shares could plummet 91% amid disappointing first-quarter results. A well-known bear market at Tesla is a dire warning about the company's future. Per Lekander, Tesla's hedge fund manager who has been shorting since 2020((Per Lekander) has predicted that the electric vehicle (EV) manufacturer could “go bankrupt” and that its stock could plummet to $14. Rykander, managing partner at the investment management company Clean Energy Transition, described the first quarter results as “the beginning of the end of the Tesla bubble.” “I actually think the company might go bankrupt,” he said. He said the company's business model, which relies on strong revenue growth, vertical integration, and direct-to-consumer sales, could falter if sales decline. He asserted that his assessment was based on the company's earnings per share for the full year of this year...

Translated

+3

1

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)