Tiptopptrader

liked

They finally touched the 50MA after wedging up for a month. I don’t have a crystal ball whether this time just a pull back or correction. Mid-term picture they are still holding up 50MA, however with an individual stock price action, i am holding large amount of cash and wait for new setup.

My strategy 登录或注册即可查看

$FTSE Malaysia Index(.KLSE.MY$

My strategy 登录或注册即可查看

$FTSE Malaysia Index(.KLSE.MY$

31

Tiptopptrader

liked

Well, today sharing gonna be longer than usual. I want to identify the relationship between geopolitical tension, international crude oil prices and Malaysia oil & gas stocks: Are they correlated?

I will analyse from $Crude Oil Futures(JUN4)(CLmain.US$ WTI chart, zoom into Malaysia oil & gas sector $Oil & Gas(BK9052.MY$ , then further into individual oil & gas stock like $YINSON(7293.MY$

Background

Heightened geopolitical tension between Is...

I will analyse from $Crude Oil Futures(JUN4)(CLmain.US$ WTI chart, zoom into Malaysia oil & gas sector $Oil & Gas(BK9052.MY$ , then further into individual oil & gas stock like $YINSON(7293.MY$

Background

Heightened geopolitical tension between Is...

25

2

Tiptopptrader

liked

Tiptopptrader

liked

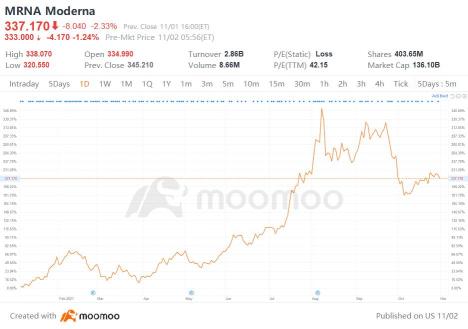

$Moderna(MRNA.US$ shares are falling today as investors react to a delayed timeline for the company COVID-19 shot targeted at adolescents.

On Sunday, Massachusetts-based biotech said that the FDA is unlikely to complete its review on the vaccine for use in those aged 12 – 17 years.

Until that evaluation is complete, the company said it would not file an FDA submission seeking its clearance for use in the 6 – 11-year age group.

Jeff Zients, President Biden’s Covid-19 response coordinator, and CDC Director, Rochelle Walensky, brushed off its impact on the anticipated rollout of $Pfizer(PFE.US$ / $BioNTech(BNTX.US$ COVID-19 shot for kids aged 5 – 11 years.

“There’s plenty of supply of Pfizer vaccine, and we look forward to parents having the opportunity to vaccinate their kids,” Bloomberg quoted Zients as saying.

However, the twin setbacks have hurt Moderna, with shares recording the biggest intraday decline since Oct. 22.

Yet, as the following graph indicates, the stock has added over 200% since the start of the year.

On Sunday, Massachusetts-based biotech said that the FDA is unlikely to complete its review on the vaccine for use in those aged 12 – 17 years.

Until that evaluation is complete, the company said it would not file an FDA submission seeking its clearance for use in the 6 – 11-year age group.

Jeff Zients, President Biden’s Covid-19 response coordinator, and CDC Director, Rochelle Walensky, brushed off its impact on the anticipated rollout of $Pfizer(PFE.US$ / $BioNTech(BNTX.US$ COVID-19 shot for kids aged 5 – 11 years.

“There’s plenty of supply of Pfizer vaccine, and we look forward to parents having the opportunity to vaccinate their kids,” Bloomberg quoted Zients as saying.

However, the twin setbacks have hurt Moderna, with shares recording the biggest intraday decline since Oct. 22.

Yet, as the following graph indicates, the stock has added over 200% since the start of the year.

17

6

Tiptopptrader

liked

ColumnsAMD stock's expected returns

$Advanced Micro Devices(AMD.US$ Since AMD's expected return is equivalent to ~15%, it is only a modest buy at the current price. However, buying AMD via Xilinx could improve future returns, making it a worthy option. We will discuss this merger arbitrage play in just a moment, but before we do so, let's discuss something critical to our valuation.

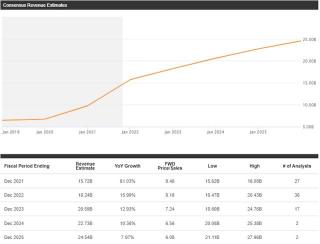

The growth assumption of 15% CAGR from a base of $24B implies a 2031 revenue figure of $100B. If AMD fails to win a monopolistic market share (comparable to Intel's past dominance) over the next decade, these revenue growth targets may not be achieved. We must be cognizant of the fact that AMD is up against the likes of $NVIDIA(NVDA.US$ , $Apple(AAPL.US$ , $Intel(INTC.US$ , ARM-based chip makers, and all other big-tech companies making their own chips in-house. Now, let's take a look at consensus analyst estimates for AMD's revenue growth rates:

As you can see, AMD's growth rate is expected to decelerate significantly over the coming years. Now, I understand that Wall Street analysts are wrong most of the time, and I can envision a world where AMD does $100B in revenue every year. However, I don't think we have an ample margin of safety while investing in AMD due to aggressive growth projections priced into its stock.

With the acquisition of Xilinx, AMD is expanding its total addressable market from ~80B to ~$110B. Currently, AMD's product portfolio is not as broad as Intel and Nvidia (AMD project's data center TAM for its products at just $45B, Intel and Nvidia have data center TAM's of ~$230B); however, this should be viewed as an opportunity for growth. With that being said, AMD's 3rd Gen EPYC processors (the fastest x86 server CPUs) are winning market share in the data center (still heavily dominated by Intel), and the company has a strong product roadmap for further enhancing its presence in high-performance computing, AI, and data center markets.

With the impending 2022 launches of Zen4 powered EPYC CPU processors and CDNA2-powered GPUs, AMD is set to maintain its product leadership over Intel, and capture more market share in the data center in 2022 and beyond. As we know, Intel is struggling with its manufacturing process, and a move to outsource advanced node manufacturing (to $Taiwan Semiconductor(TSM.US$ for Ponte Vecchio and a few other upcoming Intel products) is not enough to stop AMD's higher-performing, less power consuming products from winning market share (at least in the medium term). Hence, AMD can deliver another spectacular year of sales growth in 2022 (far better than what analyst estimates suggest).

After years of solid execution, AMD has regained customer trust in the data center markets as evidenced by its recent partnerships with some of the largest cloud providers in the world. Under the exemplary leadership of Dr. Lisa Su, AMD can become a true heavyweight in the burgeoning semiconductor industry over the next decade and beyond.

The growth assumption of 15% CAGR from a base of $24B implies a 2031 revenue figure of $100B. If AMD fails to win a monopolistic market share (comparable to Intel's past dominance) over the next decade, these revenue growth targets may not be achieved. We must be cognizant of the fact that AMD is up against the likes of $NVIDIA(NVDA.US$ , $Apple(AAPL.US$ , $Intel(INTC.US$ , ARM-based chip makers, and all other big-tech companies making their own chips in-house. Now, let's take a look at consensus analyst estimates for AMD's revenue growth rates:

As you can see, AMD's growth rate is expected to decelerate significantly over the coming years. Now, I understand that Wall Street analysts are wrong most of the time, and I can envision a world where AMD does $100B in revenue every year. However, I don't think we have an ample margin of safety while investing in AMD due to aggressive growth projections priced into its stock.

With the acquisition of Xilinx, AMD is expanding its total addressable market from ~80B to ~$110B. Currently, AMD's product portfolio is not as broad as Intel and Nvidia (AMD project's data center TAM for its products at just $45B, Intel and Nvidia have data center TAM's of ~$230B); however, this should be viewed as an opportunity for growth. With that being said, AMD's 3rd Gen EPYC processors (the fastest x86 server CPUs) are winning market share in the data center (still heavily dominated by Intel), and the company has a strong product roadmap for further enhancing its presence in high-performance computing, AI, and data center markets.

With the impending 2022 launches of Zen4 powered EPYC CPU processors and CDNA2-powered GPUs, AMD is set to maintain its product leadership over Intel, and capture more market share in the data center in 2022 and beyond. As we know, Intel is struggling with its manufacturing process, and a move to outsource advanced node manufacturing (to $Taiwan Semiconductor(TSM.US$ for Ponte Vecchio and a few other upcoming Intel products) is not enough to stop AMD's higher-performing, less power consuming products from winning market share (at least in the medium term). Hence, AMD can deliver another spectacular year of sales growth in 2022 (far better than what analyst estimates suggest).

After years of solid execution, AMD has regained customer trust in the data center markets as evidenced by its recent partnerships with some of the largest cloud providers in the world. Under the exemplary leadership of Dr. Lisa Su, AMD can become a true heavyweight in the burgeoning semiconductor industry over the next decade and beyond.

+4

19

3

Tiptopptrader

liked

$Alibaba(BABA.US$ Shares of Alibaba have been in for a roller-coaster ride this year. Alibaba was caught in the middle of a major crackdown on multiple sectors of the Chinese economy in 2021. After the CCP decided to strengthen regulatory oversight and force Chinese enterprises to consider China's national security interests as part of their business strategies, valuations for major Chinese growth stocks cratered. The crackdown started off with financial service providers which made cryptocurrencies available to their customers and quickly spread to e-commerce companies, internet firms offering gaming products for children, for-profit businesses and even food delivery startups. The justification for Beijing in all of these instances has been to uphold rules of economic fairness by cracking down on companies that are said to engage in monopolistic behavior. Most large Chinese companies were targeted by China's anti-trust watchdog, the State Administration for Market Regulation, including Alibaba and $TENCENT(00700.HK$.

Most recently, enforcement regulations have taken a backseat to a new force emerging in the Chinese stock market: Multiple Chinese real estate and development firms are nearing bankruptcy as a downturn in property prices created a liquidity crisis that might get worse. Relying on massive amounts of easy debt, these firms have built development projects on speculation. Now that prices are dropping, the supply-demand mismatch is creating serious liquidity problems for firms like Modern Land, China Properties Group or $EVERG SERVICES(06666.HK$ .

Alibaba may be able to escape the selling pressure in the Chinese market if the company tables an impressive earnings card for the last quarter next week and I believe Alibaba will be able to do this! Although there is no official earnings date announcement, the earnings card is expected for November 4, 2021, according to Nasdaq information.

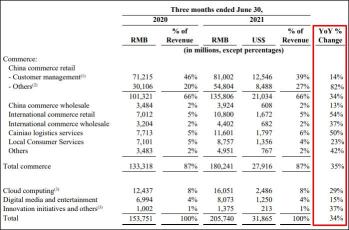

Alibaba's e-commerce business is soaring, and the segment's growth even accelerated during the global Coronavirus pandemic. Alibaba's e-commerce business, responsible for 88% of revenues and 92% of EBITDA profits, is far and away the most important business driver for Alibaba. An additional breakdown of Alibaba's e-commerce revenues shows that international e-commerce retail and Alibaba's logistics business, branded under the name Cainiao, saw the highest year-over-year growth rates of 54% and 50%. The Cainiao network is expanding rapidly in China but also invests in a smart logistics network to deal with accelerating cross-border transactions.

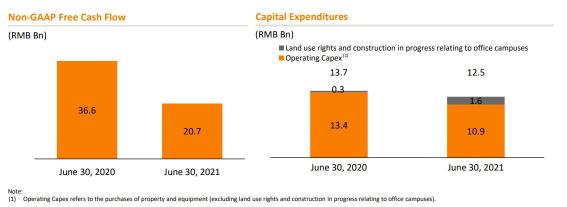

Alibaba is also looking forward to generating higher free cash flow in the future, which could drive a revaluation of Alibaba's shares. This is because the company's free cash flow in the last quarter was impacted by China's anti-monopoly fine which lowered the firm's free cash flow by 9.1B Chinese Yuan ($1.4B). The total fine was 18.2B Chinese Yuan ($2.8B) and was levied on Alibaba due to alleged anti-competitive practices. Although Alibaba recognized 50% of the anti-trust fine, the free cash flow was still 20.8B Chinese Yuan ($3.3B). Alibaba's free cash flow margin, after accounting for the anti-trust fine, was 10%. In the year-earlier period, Alibaba's free cash flow margin was 24%. I believe Alibaba could return to a 20% free cash flow margin next year.

Looking ahead into the future, we can see that Alibaba's revenues are modeled to grow at a rate of 17% annually between FY 2021 and FY 2026. After receiving a big fine this year, Alibaba played nice with the CCP which could reduce the probability of receiving new fines in the future.

Let's assume that Alibaba will not get any more anti-monopoly fines and grow revenues at a rate of 17% annually, which is implied in revenue forecasts until FY 2026.

By 2026, Alibaba is expected to have revenues of $263.7B. If Alibaba's free cash flow margin stabilizes around 20% over the next five-year period, which I believe is plausible, then it could become a $52B a year free cash flow business… and the estimates have upside because Alibaba's other two businesses, digital media and cloud computing, will also start to make positive cash contributions to the firm. After all is said and done, I believe Alibaba could generate $52B in annual free cash flow by FY 2026, which is twice the free cash flow the firm generates currently. The firm's free cash flow is cheap compared to last year.

Revenue estimates are rising and should continue to rise after results for the September quarter have been submitted. Alibaba's P-S ratio is just 2.4, less than half the ratio from last year!

Most recently, enforcement regulations have taken a backseat to a new force emerging in the Chinese stock market: Multiple Chinese real estate and development firms are nearing bankruptcy as a downturn in property prices created a liquidity crisis that might get worse. Relying on massive amounts of easy debt, these firms have built development projects on speculation. Now that prices are dropping, the supply-demand mismatch is creating serious liquidity problems for firms like Modern Land, China Properties Group or $EVERG SERVICES(06666.HK$ .

Alibaba may be able to escape the selling pressure in the Chinese market if the company tables an impressive earnings card for the last quarter next week and I believe Alibaba will be able to do this! Although there is no official earnings date announcement, the earnings card is expected for November 4, 2021, according to Nasdaq information.

Alibaba's e-commerce business is soaring, and the segment's growth even accelerated during the global Coronavirus pandemic. Alibaba's e-commerce business, responsible for 88% of revenues and 92% of EBITDA profits, is far and away the most important business driver for Alibaba. An additional breakdown of Alibaba's e-commerce revenues shows that international e-commerce retail and Alibaba's logistics business, branded under the name Cainiao, saw the highest year-over-year growth rates of 54% and 50%. The Cainiao network is expanding rapidly in China but also invests in a smart logistics network to deal with accelerating cross-border transactions.

Alibaba is also looking forward to generating higher free cash flow in the future, which could drive a revaluation of Alibaba's shares. This is because the company's free cash flow in the last quarter was impacted by China's anti-monopoly fine which lowered the firm's free cash flow by 9.1B Chinese Yuan ($1.4B). The total fine was 18.2B Chinese Yuan ($2.8B) and was levied on Alibaba due to alleged anti-competitive practices. Although Alibaba recognized 50% of the anti-trust fine, the free cash flow was still 20.8B Chinese Yuan ($3.3B). Alibaba's free cash flow margin, after accounting for the anti-trust fine, was 10%. In the year-earlier period, Alibaba's free cash flow margin was 24%. I believe Alibaba could return to a 20% free cash flow margin next year.

Looking ahead into the future, we can see that Alibaba's revenues are modeled to grow at a rate of 17% annually between FY 2021 and FY 2026. After receiving a big fine this year, Alibaba played nice with the CCP which could reduce the probability of receiving new fines in the future.

Let's assume that Alibaba will not get any more anti-monopoly fines and grow revenues at a rate of 17% annually, which is implied in revenue forecasts until FY 2026.

By 2026, Alibaba is expected to have revenues of $263.7B. If Alibaba's free cash flow margin stabilizes around 20% over the next five-year period, which I believe is plausible, then it could become a $52B a year free cash flow business… and the estimates have upside because Alibaba's other two businesses, digital media and cloud computing, will also start to make positive cash contributions to the firm. After all is said and done, I believe Alibaba could generate $52B in annual free cash flow by FY 2026, which is twice the free cash flow the firm generates currently. The firm's free cash flow is cheap compared to last year.

Revenue estimates are rising and should continue to rise after results for the September quarter have been submitted. Alibaba's P-S ratio is just 2.4, less than half the ratio from last year!

23

9

Tiptopptrader

liked

$Alibaba(BABA.US$ BABA is likely going to present a strong earnings card for the last quarter, mostly because e-commerce is surging and Alibaba is the largest and most important e-commerce platform in China. Alibaba's risks are chiefly macro-style and the firm's free cash flow is set to improve significantly in the future. Due to Alibaba's attractive valuation based off of sales and free cash flow, BABA shares have a great future!

10

2

Tiptopptrader

liked and commented on

Gainers: $Meten(METX.US$ +11%. $Ford Motor(F.US$ +8%. $Lucid Group(LCID.US$ +25%. $Digital Brands Group(DBGI.US$ +54%. $Ambev SA(ABEV.US$ +7%.

Losers: $Twilio(TWLO.US$ -15%. $Remark Holdings(MARK.US$ -5%. $eBay(EBAY.US$ -7%. $Altria(MO.US$ -6%. $AgriFORCE Growing(AGRI.US$ -7%.

Losers: $Twilio(TWLO.US$ -15%. $Remark Holdings(MARK.US$ -5%. $eBay(EBAY.US$ -7%. $Altria(MO.US$ -6%. $AgriFORCE Growing(AGRI.US$ -7%.

47

5

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)