老股董

commented on

$DBS Group Holdings(D05.SG$ will go to 37 in this week ma?

3

4

老股董

commented on

$Grab Holdings(GRAB.US$ I am staying clear of this stock as the company is not doing business. deposited money and cannot use it even when the account is verified. customer service just brush me off... definitely shady

1

老股董

liked and commented on

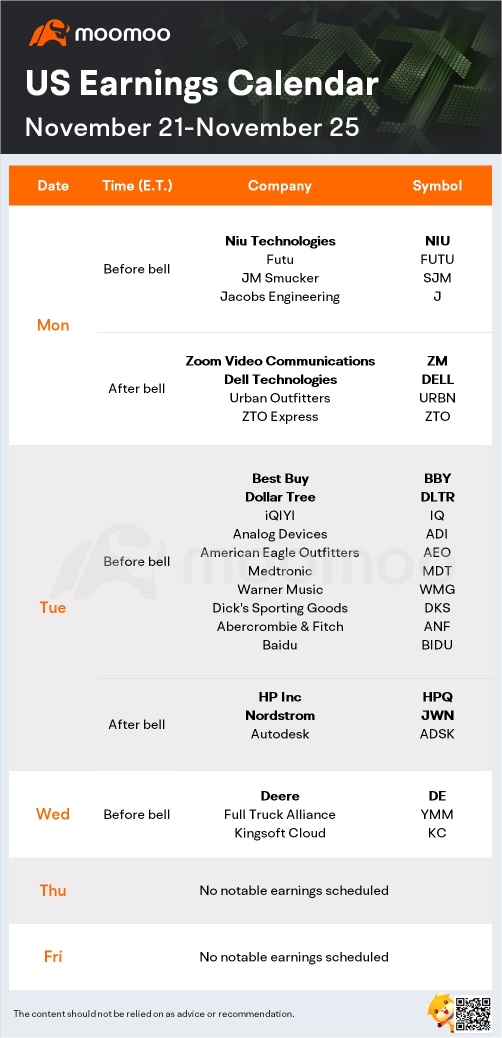

It will be a short week of trading, with markets closed on Thursday for Thanksgiving and then closing early on Black Friday as the holiday shopping rush begins.

Earnings season is winding down but there will still be some notable reports next week, including $Zoom Video Communications(ZM.US$ and $Dell Technologies(DELL.US$ on Monday; $Best Buy(BBY.US$, $Dick's Sporting Goods(DKS.US$, $Nordstrom(JWN.US$, and ����...

Earnings season is winding down but there will still be some notable reports next week, including $Zoom Video Communications(ZM.US$ and $Dell Technologies(DELL.US$ on Monday; $Best Buy(BBY.US$, $Dick's Sporting Goods(DKS.US$, $Nordstrom(JWN.US$, and ����...

+3

72

11

老股董

liked

$NASDAQ 100 Index(.NDX.US$ Economic Observer reporter Liang Ji's inflationary pressure has not abated, and monetary tightening continues. The central banks of the US and Europe recently released the minutes of monetary policy meetings one after another, reaffirming that they will continue to tighten monetary policy to curb inflation.

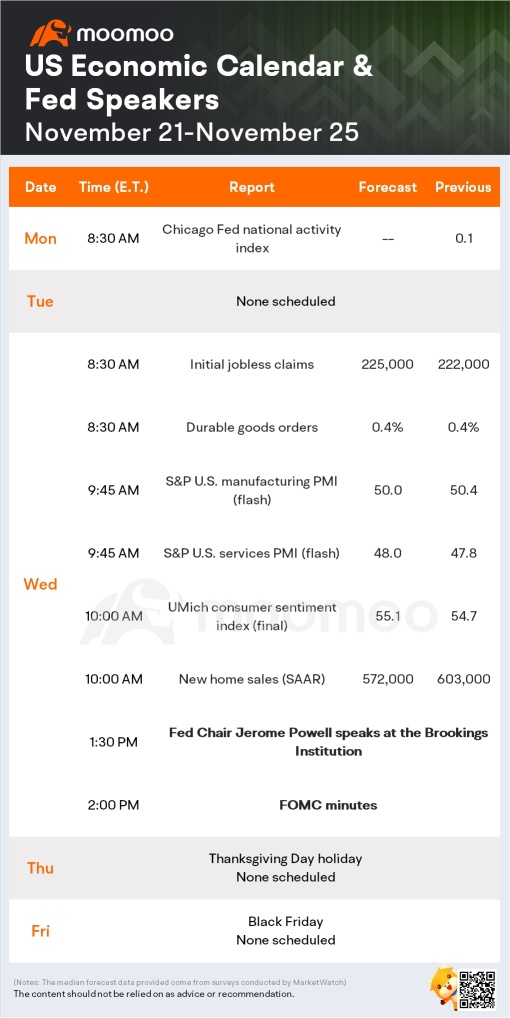

On November 23, 2022, local time, the Federal Reserve released the minutes of the November interest rate meeting. It shows that the Federal Reserve will continue to raise interest rates, but the pace of rate hikes will slow down and begin considering policy changes after the recession. The market expects that the Federal Reserve will raise interest rates by 50 basis points (BP) in December as expected, and the aggressive rate hike may come to an end.

On the other side of the North Atlantic, the ECB conveyed an interest rate hike message quite firm. On November 24, local time, the ECB released the minutes of the October monetary policy meeting. It shows that member states all agree that in view of current inflation prospects, easing policies should be abolished to normalize monetary policy and ensure that demand is no longer sustainable. The market expects the ECB to raise interest rates further to prevent the risk of inflation expectations becoming unanchored.

As monetary policies in Europe and the US continue to tighten, the market is beginning to look at the signs of economic decline. “In November, the US and Europe Purchasing Managers' Index (PMI) both fell into a contraction range. The inflection point of US monetary policy may not yet be reached. The Federal Reserve may continue to raise interest rates to 5%. Continued interest rate hikes will increase the downside risk of the economy, and a 'stagflationary' recession or a probable event in 2023;” CICC believes, “Although the US is in October...

On November 23, 2022, local time, the Federal Reserve released the minutes of the November interest rate meeting. It shows that the Federal Reserve will continue to raise interest rates, but the pace of rate hikes will slow down and begin considering policy changes after the recession. The market expects that the Federal Reserve will raise interest rates by 50 basis points (BP) in December as expected, and the aggressive rate hike may come to an end.

On the other side of the North Atlantic, the ECB conveyed an interest rate hike message quite firm. On November 24, local time, the ECB released the minutes of the October monetary policy meeting. It shows that member states all agree that in view of current inflation prospects, easing policies should be abolished to normalize monetary policy and ensure that demand is no longer sustainable. The market expects the ECB to raise interest rates further to prevent the risk of inflation expectations becoming unanchored.

As monetary policies in Europe and the US continue to tighten, the market is beginning to look at the signs of economic decline. “In November, the US and Europe Purchasing Managers' Index (PMI) both fell into a contraction range. The inflection point of US monetary policy may not yet be reached. The Federal Reserve may continue to raise interest rates to 5%. Continued interest rate hikes will increase the downside risk of the economy, and a 'stagflationary' recession or a probable event in 2023;” CICC believes, “Although the US is in October...

Translated

3

老股董

liked

$Baidu(BIDU.US$ Investments require a bit of persistence, and when it comes to price investing, there are only many bear market opportunities. There is an awesome F1 driver named Elton Senna. He once said that when the weather is nice, you can't overtake 15 times; you can only do it when it's raining, because opportunities are always at a turning point. With this statement, I doubt he is borrowing a racing car and talking about stock trading. He must be trading stocks too.

There isn't much that needs to be manipulated in the bear market. Supported by the great belief of “saving capital,” we resolutely say no to all foolish and ridiculous operations. All that's left to do every quarter is to sort out my investment portfolio over and over again and check how each F1 car is in good condition, is there not enough fuel? Do you want to protect your tires, Yunyun.

So let's review Baidu's earnings report from an investor's perspective.

1. Value-based cash flow business

Baidu's business is complex, but using Occam's razor to break it down, it can simply be divided into two parts. This does not refer to the official financial report's classification: core income+non-core (iQiyi+Ctrip+Kuaishou's equity); rather, my personal favorite division: 1. Value-based cash flow operations and 2. Growing businesses require cash flow, which are mainly reflected in financial reports as marketing (advertising) revenue and non-marketing (non-advertising, mainly including cloud and AI-related) revenue. The valuation of advertising revenue can generally give a price-earnings ratio of 8-10 times, and the current cash flow base...

There isn't much that needs to be manipulated in the bear market. Supported by the great belief of “saving capital,” we resolutely say no to all foolish and ridiculous operations. All that's left to do every quarter is to sort out my investment portfolio over and over again and check how each F1 car is in good condition, is there not enough fuel? Do you want to protect your tires, Yunyun.

So let's review Baidu's earnings report from an investor's perspective.

1. Value-based cash flow business

Baidu's business is complex, but using Occam's razor to break it down, it can simply be divided into two parts. This does not refer to the official financial report's classification: core income+non-core (iQiyi+Ctrip+Kuaishou's equity); rather, my personal favorite division: 1. Value-based cash flow operations and 2. Growing businesses require cash flow, which are mainly reflected in financial reports as marketing (advertising) revenue and non-marketing (non-advertising, mainly including cloud and AI-related) revenue. The valuation of advertising revenue can generally give a price-earnings ratio of 8-10 times, and the current cash flow base...

Translated

3

老股董

liked

$Tesla(TSLA.US$ $Micro E-mini Nasdaq-100 Index Futures(JUN4)(MNQmain.US$ $Apple(AAPL.US$ Recently, I've sorted out some information about $Tesla (TSLA) $, mainly referring to some information from Troy Teslike and the US.

Judging from the current data:

1) The production volume of Q4 Tesla is estimated at 46,6165 units, and the production volume for the full year of 2022 is estimated at 1.396 million units

2) Tesla's delivery estimate for Q4 is 420,000, of which the main delivery locations are 165,000 in the US and Canada, 120,000 in China, 101,000 in Europe, and 33,000 in other regions

3) Looking at the order pool, there are currently 285,000 in the world, and China's estimate at the end of October is 32,000 (after the price reduction, the number of orders increased)

Judging from the distribution of battery demand

1) The supply of LFP this year, Chinese batteries have mitigated US demand, but the IRA will change the supply in the US market in the future

2) Next year, 4680 and 2170 batteries will be the main supply in the US market

Judging from Tesla's performance this year, we have seen that the focus on developing autonomous driving technology has not been exchanged for direct order changes. This order pool is rapidly being consumed in a competitive market. The biggest problem in China is the change in Model 3 data.

...

Judging from the current data:

1) The production volume of Q4 Tesla is estimated at 46,6165 units, and the production volume for the full year of 2022 is estimated at 1.396 million units

2) Tesla's delivery estimate for Q4 is 420,000, of which the main delivery locations are 165,000 in the US and Canada, 120,000 in China, 101,000 in Europe, and 33,000 in other regions

3) Looking at the order pool, there are currently 285,000 in the world, and China's estimate at the end of October is 32,000 (after the price reduction, the number of orders increased)

Judging from the distribution of battery demand

1) The supply of LFP this year, Chinese batteries have mitigated US demand, but the IRA will change the supply in the US market in the future

2) Next year, 4680 and 2170 batteries will be the main supply in the US market

Judging from Tesla's performance this year, we have seen that the focus on developing autonomous driving technology has not been exchanged for direct order changes. This order pool is rapidly being consumed in a competitive market. The biggest problem in China is the change in Model 3 data.

...

Translated

+1

4

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)

老股董 : Judging from technical indicators, next week will still be a volatile upward trend