Today's Morning Movers and Top Ratings: FDX, GIS, DFS, CRM and More

Morning Movers

Gapping up

$Discover Financial Services(DFS.US$ shares rose nearly 1% pre-market today after Citi upgraded the company to Buy from Neutral and raised its price target to $133.00 from $93.00.

The analysts explained that the upgrade is due to several anticipated catalysts in the next year. These include the reinstatement of regular share repurchases, the sale of its student loan portfolio/business, an expected peak in credit losses in 2024, and reduced expense pressure from business simplification.

$Paramount Global-B(PARA.US$ shares rose more than 1% pre-market today after Wells Fargo upgraded the company to Equal Weight from Underweight and raised its price target to $18.00 from $15.00.

Gapping down

$FedEx(FDX.US$ fell about 10% in trading before the bell on Wednesday, a day after the parcel delivery firm missed expectations for quarterly profit and trimmed its revenue forecast for the fiscal year. Earnings per share came in at $3.99, worse than the consensus estimate of $4.19.

Volatile macroeconomic conditions and lower demand from the U.S. Postal Service, which has been shifting more packages from higher-margin air services to more economical ground services, dealt a blow to the company's largest Express business. Operating income for its air-based Express unit dropped 60% during the quarter as a result.

$General Mills(GIS.US$ shares fell 1.1% in early Wednesday trade after the company slashed its full-year forecast. For FQ2, adjusted EPS was $1.25, compared to $1.10 in the same period last year, and above the estimate of $1.15. Net sales fell 1.6% YoY to $5.14 billion, missing the expected $5.35 billion.

$Lowe's Companies(LOW.US$ Shares in Lowe's inched down in U.S. premarket trading on Wednesday after analysts at Stifel downgraded their rating of the home improvement retailer to "hold" from "buy."

In a note to clients, the analysts cited a "more cautious approach" to Lowe's fiscal year 2024 and uncertainty over its ability to "contend with a more anemic category."

$Salesforce(CRM.US$ Shares declined 1.3% after Wells Fargo on Wednesday downgraded Salesforce to equal weight from overweight as it evaluates stocks that will benefit from what it expects will be a steady shift toward growth in 2024.

Source: CNBC; Investing.com

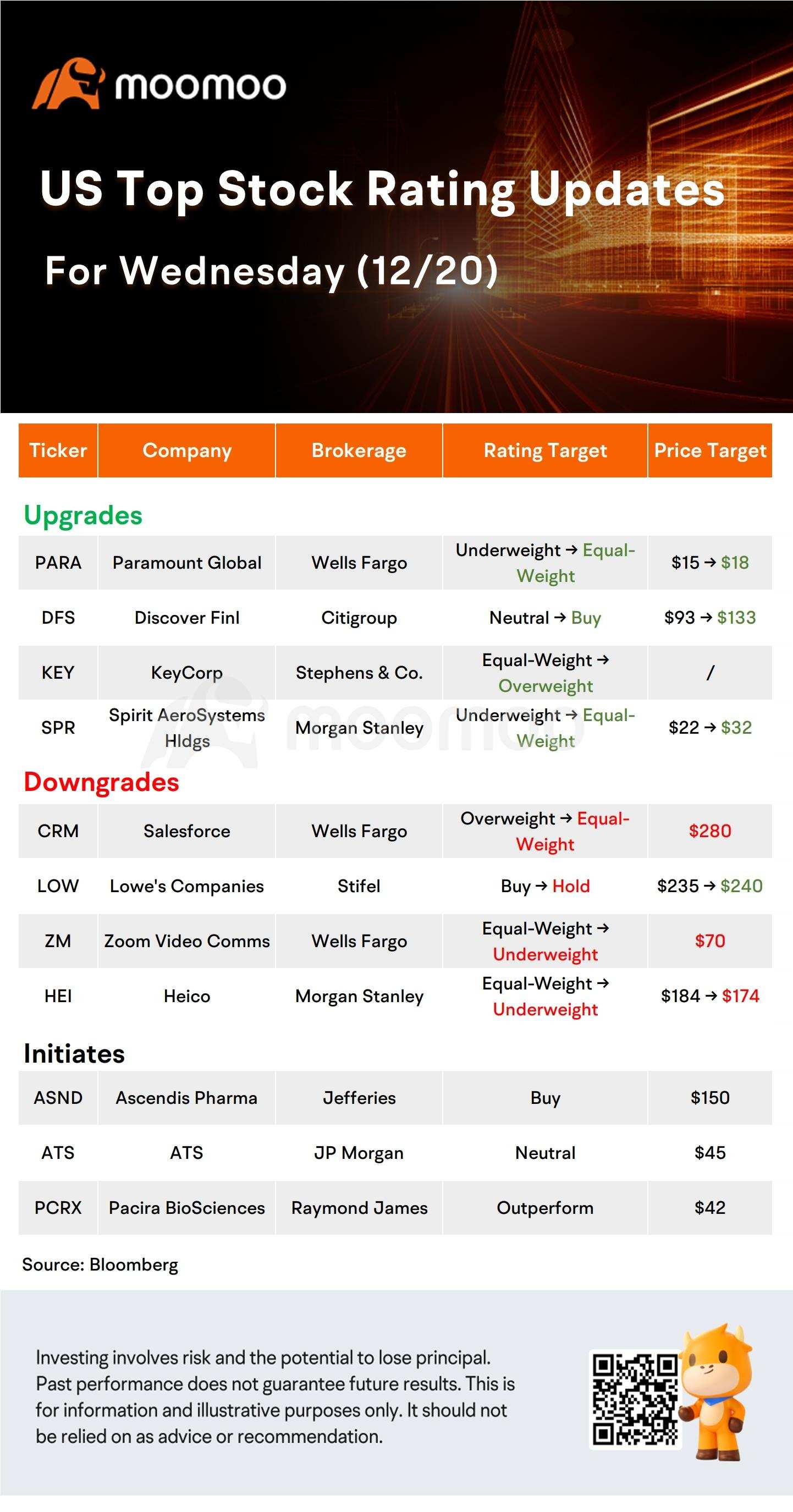

US Top Rating Updates on 12/20

Source: Dow Jones

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

Ilya Jucius : Useful information