Stocks with Notable Option Volatility: EOSE, TUP and AMC.

Implied volatility is a measure of the market's expectation of the potential price movements of the stock in the future. Here are the stocks with the most notable implied volatility today.

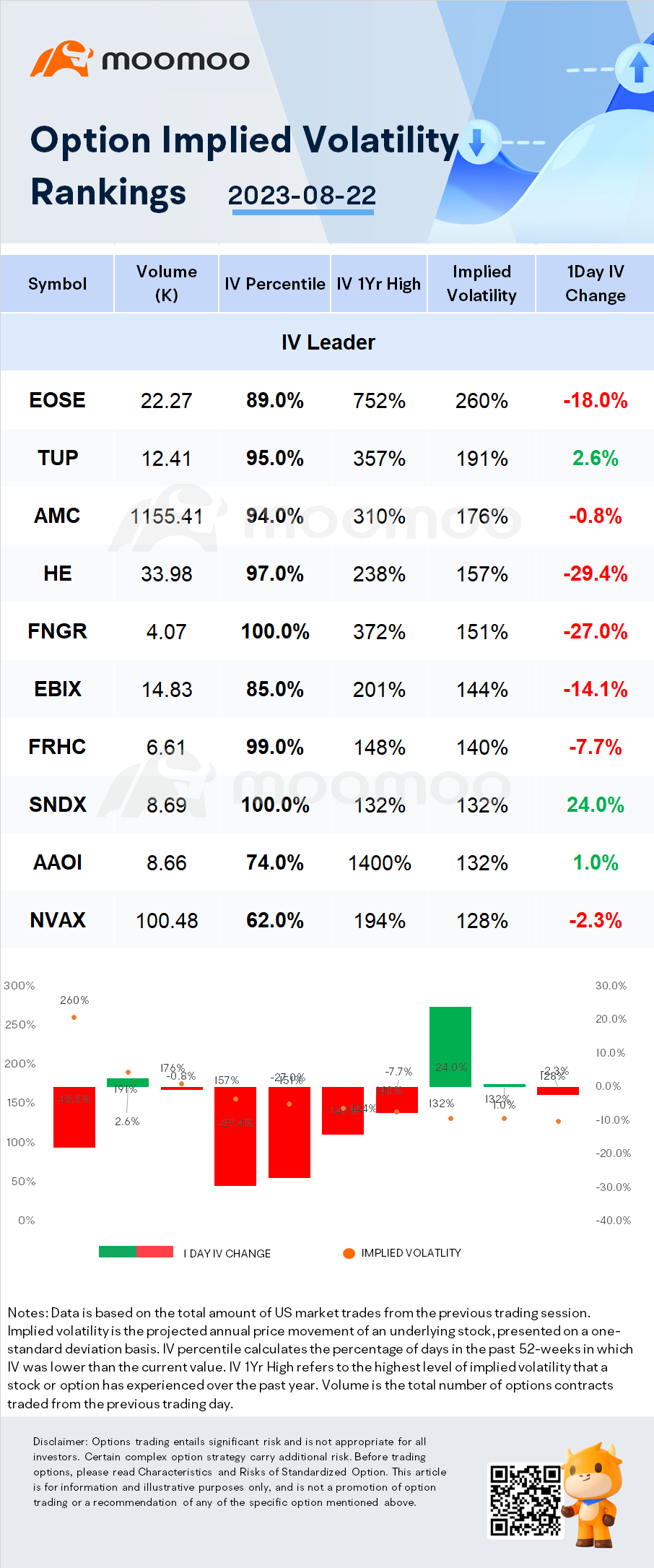

$Eos Energy(EOSE.US$'s stock experienced a slight decrease of 2.20% during the previous trading session. The company's options data indicated an Option Volume of 22.27K, which showed moderate investor interest in the stock. Additionally, EOS's Implied Volatility percentile was at 89%, indicating that option prices for the stock were relatively expensive compared to historical levels.

Furthermore, the Current Implied Volatility for EOS was measured at 260%, which is significantly higher than its 1-year high of 752%. This suggests that investors expect substantial price movements in the stock over the next year. However, the 1-Day IV change showed a negative shift of -18%, indicating a decrease in investors' expectations of volatility over the short term.

Here is the IV Ranking of the day:

The chart only includes any company with market cap of over 100 million and share price of over$2.5.

Top Option Volatility Change:

Conclusion And Risk Management

Option implied volatility is a measure of the market's expectation for how much an asset's price will fluctuate in the future, as implied by the prices of options on that asset.

Options are financial contracts that give the holder the right, but not the obligation, to buy or sell an underlying asset at a predetermined price and time. The price of an option is influenced by various factors, including the current price of the underlying asset, the strike price, the time to expiration, and the implied volatility.

Implied volatility represents the level of uncertainty or risk that market participants perceive in the future price movements of the underlying asset. When investors expect greater volatility, they may be more willing to pay a higher price for options to help hedge their risk, which leads to higher implied volatility.

Implied volatility is usually expressed as a percentage and is calculated using an options pricing model, such as the Black-Scholes model. Traders and investors use implied volatility to assess the attractiveness of options prices, to identify potential mispricings, and to manage their risk exposure.

Source: Benzinga, Dow Jones, CNBC

Disclaimer:

Options trading entails significant risk and is not appropriate for all customers. It is important that investors read Characteristics and Risks of Standardized Options before engaging in any options trading strategies. Options transactions are often complex and may involve the potential of losing the entire investment in a relatively short period of time. Certain complex options strategies carry additional risk, including the potential for losses that may exceed the original investment amount. Supporting documentation for any claims, if applicable, will be furnished upon request. Moomoo does not guarantee favorable investment outcomes. The past performance of a security or financial product does not guarantee future results or returns. Customers should consider their investment objectives and risks carefully before investing in options. Because of the importance of tax considerations to all options transactions, the customer considering options should consult their tax advisor as to how taxes affect the outcome of each options strategy.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

71739576 : why do I keep getting these emails and I've asked ed this company to clear up why when I wanted to start getting into this you asked me for my social security number why do you need that for me to get started