$Roivant Sciences (ROIV.US)$ Why ROIV seems to be often very...

$Roivant Sciences(ROIV.US$ Why ROIV seems to be often very sensitive to Nasdaq fluctuations?

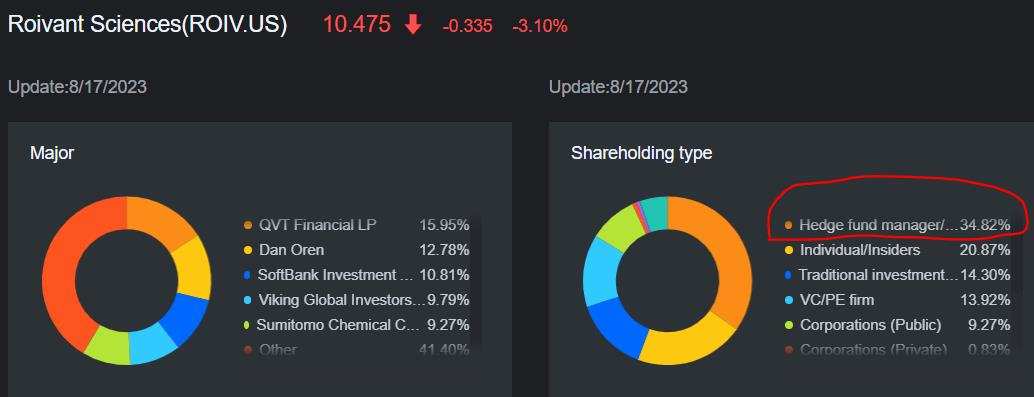

This may be because hedge funds are its major shareholders (~35%) as hedge funds are typically more active traders than other types of investors, and they are more likely to sell their shares when the market is volatile.

Hedge funds are also more likely to sell their shares when the market is volatile. This is because they are more concerned with protecting their profits than with maximizing their returns. When the market is volatile, there is a greater risk of losing money, and hedge funds may sell their shares to reduce their risk.

As a result of these factors, stocks with hedge funds as major shareholders are more sensitive to Nasdaq fluctuations. This means that these stocks are more likely to go up or down in price when the Nasdaq Composite Index moves.

This may be because hedge funds are its major shareholders (~35%) as hedge funds are typically more active traders than other types of investors, and they are more likely to sell their shares when the market is volatile.

Hedge funds are also more likely to sell their shares when the market is volatile. This is because they are more concerned with protecting their profits than with maximizing their returns. When the market is volatile, there is a greater risk of losing money, and hedge funds may sell their shares to reduce their risk.

As a result of these factors, stocks with hedge funds as major shareholders are more sensitive to Nasdaq fluctuations. This means that these stocks are more likely to go up or down in price when the Nasdaq Composite Index moves.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment