Rising Options Demand Calls for Fastracked Options Availability of IPOs

Wall Street exchanges have quietly made options trading available earlier for new large initial public offerings, fastening from four days to two days.

This month's large IPOs — $Arm Holdings(ARM.US$, $Instacart(Maplebear)(CART.US$, and $Klaviyo(KVYO.US$ — all saw options trading two days after shares started to trade, rather than four sessions under old rules. All three companies are eligible for early options trading— they must have a market capitalization of at least $3 billion.

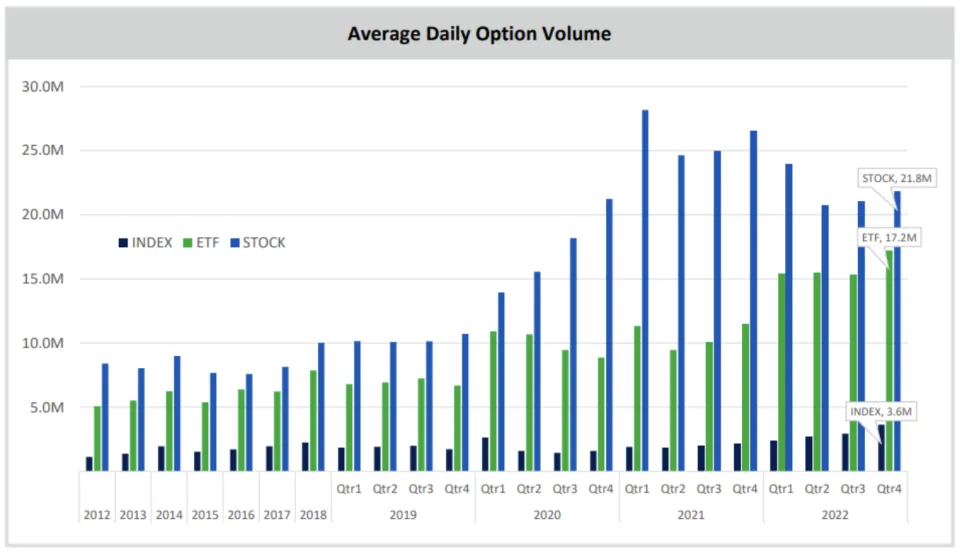

The change could be a reflection of how important options trading has become in capital markets. These contracts are increasingly important to institutional and retail investors, with volume for individual stock options and ETFs tripled between Q4 of 2019 and Q4 of 2022.

The recent revision of the option rule, reducing the post-IPO waiting period from four days to two, marks a notable evolution in the trading landscape," said Rohan Reddy, director of research at Global X Management. "It equips investors with previously unavailable data, allowing for more informed decision-making during a company's initial days of trading."

Investors flocked to the recent IPOs' options. Instacart drew 23,000 options contracts on Thursday, two days after the shares began trading, approximately split between calls, betting on a stock rise, and puts, positioning for the opposite. Arm witnessed volumes triple that much on its first day of options trading, heavily favoring bearish bets. Despite having a market valuation equivalent to Instacart's, Klaviyo saw less attention, with open interest in its first day closer to 1,000 contracts.

With so many new issues, industry members requested to have options listed faster than the listing process allowed at that time, assuming listing criteria were met," Rohan added.

Collectively, we all came to the consensus that essentially, options being available sooner helps mute volatility" in the shares, said Greg Ferrari, Nasdaq's head of exchange business management. "The transparency and the resiliency of the listed options market helps investors make some prudent choices around how the stock is going to perform."

Source: Bloomberg, CBOE

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

71625088 : excellent reporting!

Options NewsmanOP 71625088: Thank you