Is Gemany a Good Investment Yet?

Unusual Bullish Options Activity

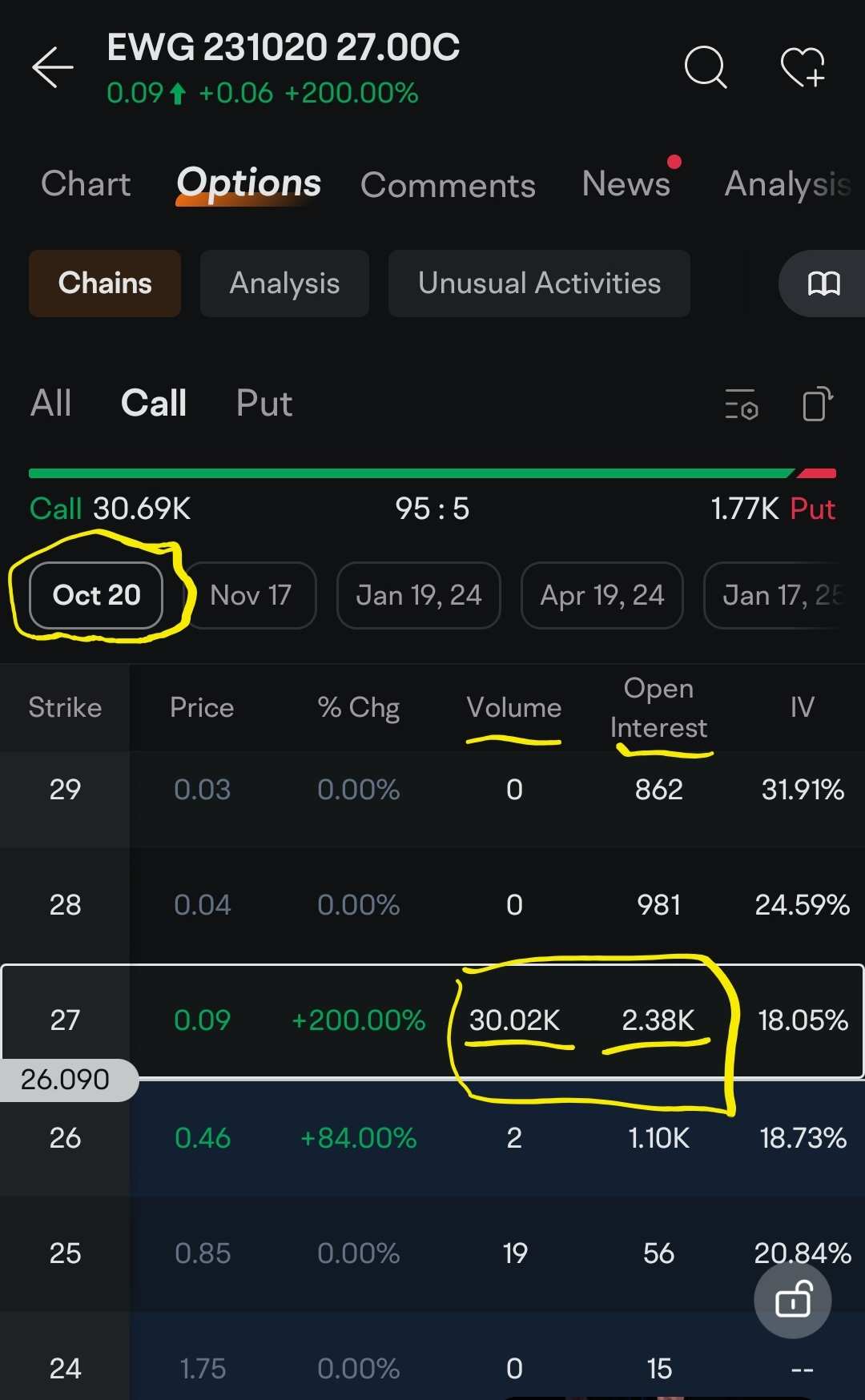

Last Friday, we saw some very unusual bullish options activity within the ticker $iShares $iShares MSCI Germany ETF(EWG.US$ This is the ETF that tracks the main German index, $German DAX30 Index(.GDAXI.DE$ . It appears as if one or a few investors placed some very large block orders on options contracts expiring October 20th with a strike price of $27.00.

All of the large orders were placed during the last hour of trading on Friday. They were all bullish calls that were purchased. This is a very bullish bet. And the $27.00 strike price is right next to the money. So there is not a lot of upside needed for these contracts to be in the money, which is necessary with an expiration date that close.

Poor Economic Conditions

Why would investors make such a bullish call in one of the worst performing European economies this year? Are they calling a local bottom in the market? Do they think that the economy will improve in the very near future? Or are they just placing a very bullish trade based on the technical setup within the charts?

The next three charts will give you a slight idea of the health of the German economy. Other than a slight uptick in manufacturing over the past couple of months, the German economy is doing poorly. Consumer confidence has been completely terrible for the past 12 months. And German GDP seems to be getting worse and worse each quarter. So far, things are looking very bad in the German economy.

Poor Technical Structure

Based purely on macroeconomic data, I dont see any reason why anybody should feel bullish about Germany. But there might be a reason to feel bullish in the short-term if you look at the technicals within the charts.

The first thing that stands out is the fact that the index has formed lower highs on the weekly candles. This indicates a possible downtrend may be forming in the long-term picture. That is not what you want to see if you were bullish. But the current uptrend we have been in this past year might not be over yet. If there is a rebound incoming, then when would be a good time to enter back into a long position or average down for a continuation to the upside?

The TDS 9 indicator printed a 9 on the weekly candles. This could signify that the near-term downtrend that we are in is overextended and is due for a small rebound in price action.

In the chart below, I have highlighted the current near-term price channel that the index has been confined within for over two months. If there is a solid support level to watch for a potential rebound out of this channel, then it would be the $25.50 price.

This price has acted as both resistance and support in the recent past. It could possibly act as support again. Last week, the $25.50 price held up the index as a strong support level. If the price can climb out of the short-term price channel I've highlighted, then a bullish swing trade might be warranted. Personally, I would make it a short-term swing trade because the technical and macro picture just look so grim.

Whether you are bullish or bearish, I have highlighted the major Fibonacci levels as well as the other major support and resistance levels to watch for potential reversals or rebounds. These are the areas I like to place my swing trades depending on how the price action reacts once it reaches these price levels.

Conclusion

Things look scary for the German economy. And I would be very careful going long in this ETF. I especially would not be buying any leaps in this ticker symbol.

But sometimes when everybody is fearful, then it is a good time to be greedy. And I just can't ignore the very bullish bet that was placed on Friday in the last hour before close.

I am assuming somebody thinks there will be a small rebound to cool off this overheated selloff, so they are placing their bullish call at this major technical level I just mentioned, $25.50. I like that thesis, so I am considering entering into a swing trade if and when the price crosses above resistance of the near-term price channel I mentioned.

I should also mention that if the price drops below the $25.50 level, then I will flip to bearish and consider a short position. It all depends on what the price action is telling me when the time comes.

So, would you invest in the German economy right now?

As always, I am not a financial professional, and this is not investment advice. Be careful and be patient. Dont anticipate the market. Rather, participate in the market. Give your investments time. Don't be greedy. Don't invest in anything you don't understand. Don't put all of your eggs in one basket. Don't listen to the hype. Don't fomo or panic into or out of trades. Do your own due diligence. And just follow the trends. A trend is your friend. Good luck trading.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment

Gilley : Americas market is looking more fake then any other markets seem svsmmy as all hell righ t now its something that looks purely set up and controlled

SpyderCallOP Gilley: Yup. it always looks like that it seems. The market is very irrational. That is why I just swing trade trade the trends.

BirzeArt1 :

SpyderCallOP Gilley: Whoever bought those options contracts made big money this week.

AkLi : Hard to tell right now. Germany in a recession (before most others if they do go into recession), conflict close by both political and environmental, the energy crisis mentioned yesterday per bloomberg. Might need to see how the rest of the world goes Q1 and Q2 next year maybe

SpyderCallOP AkLi: Agreed. I'm still waiting.

md lukman rahi : Hai