Earnings Volatility | Options Traders Bet on Huge Post-Earnings Swing in NIO Shares

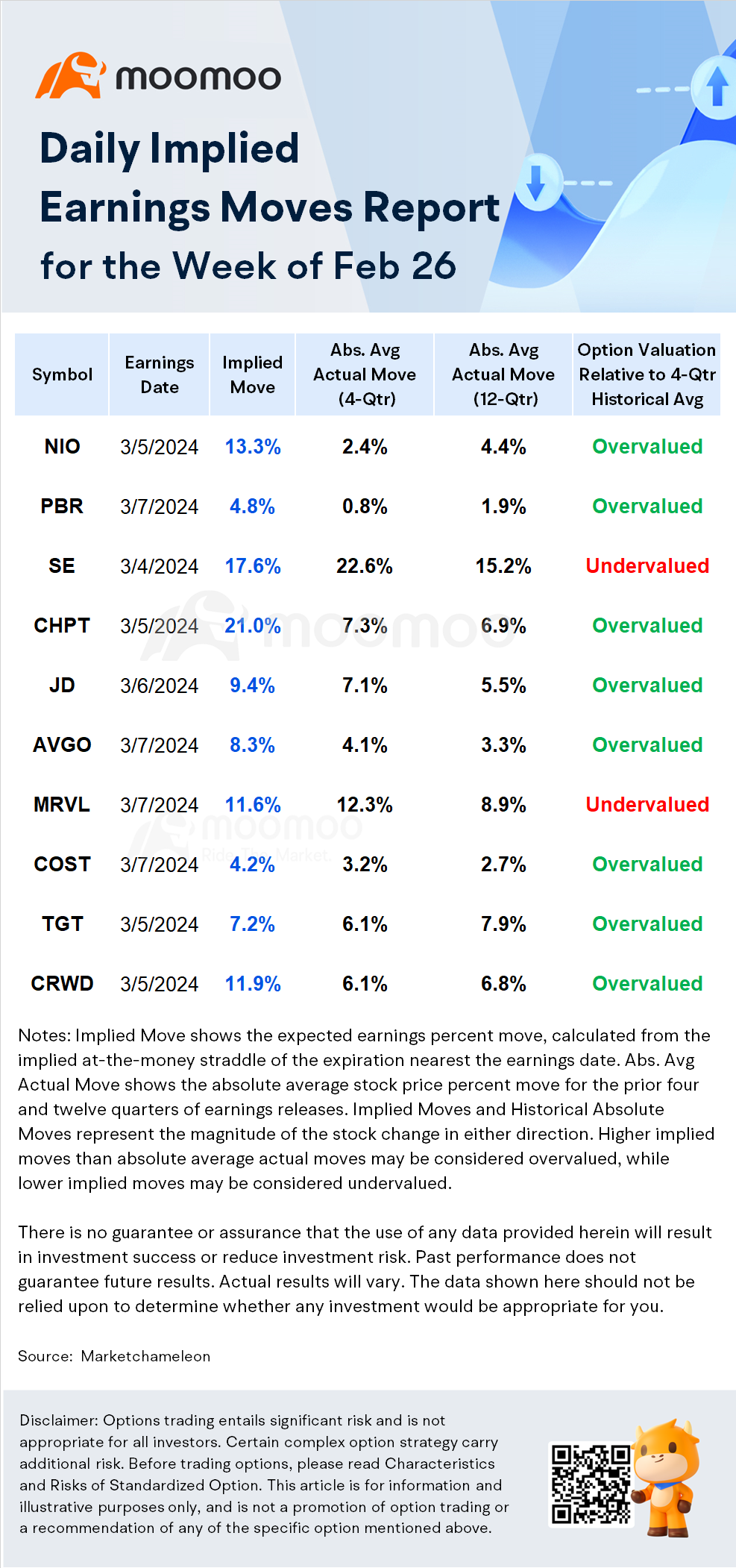

Stock prices may see larger-than-normal moves during earnings season, making it a potentially attractive time for options traders. For investors looking to trade against these moves, you should always keep track of how the options might shift after their earnings. Here are the top earnings and volatility for the week:

-Earnings Date: 2/26 After Market Close

-Implied Move: 13.3%

-Absolute Average Actual Move for the past 4 Quarters: 2.4%

-Absolute Average Actual Move for the past 12 Quarters: 4.4%

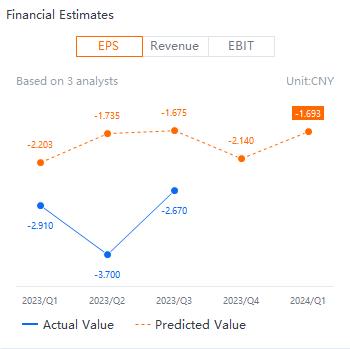

-Earnings Normalized Estimate: USD $-2.14

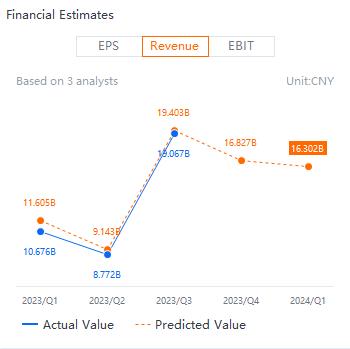

-Revenue Estimate: USD 16.827 billion

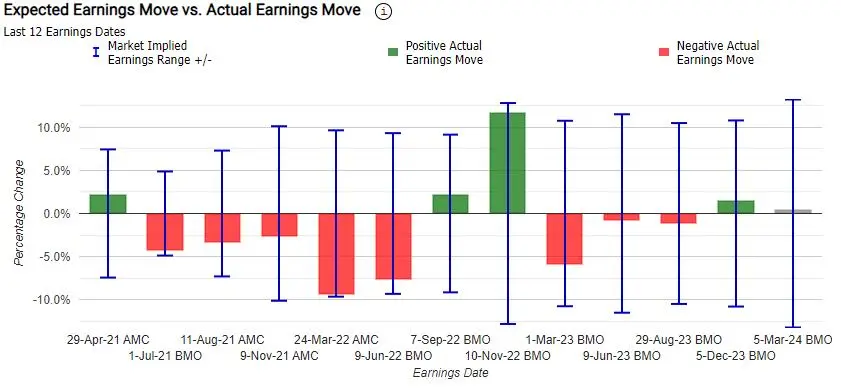

According to recent data from Market Chameleon, options for NIO are overvalued with the implied move of 13.3% significantly higher than the average actual move for the past 4 quarters (2.4%) and its average actual move for the past 12 quarters (4.4%). The options market overestimated NIO stocks earnings move 100% of the time in the last 12 quarters. The predicted move after earnings announcement was ±9.5% on average vs an average of the actual earnings moves of 4.4% (in absolute terms).

The Marathon Digital stock options market shows a call option wall at $6 and put option wall at $5.5 for the options expiring this Friday, reflecting concentrated trading interest.

Earnings Catalyst

NIO Inc., the Chinese electric vehicle maker, is set to report its fourth-quarter earnings amidst a challenging backdrop of intense price competition that has seen its share price and sales mired in difficulties. Analysts believe that the EV makers are facing significant challenges, with a market shake-up expected within the next two years.

Despite these pressures, the consensus forecast for the fourth quarter of 2023 is optimistic, with expected revenue of 16.827 billion yuan, marking a 4.75% increase year-on-year, and a narrowed loss per share of 2.14 yuan. Boosting investor confidence, eight analysts have recently rated NIO as a "buy" or higher, with an average target price of $10.28.

In the fourth quarter of 2023, NIO delivered 50,045 new vehicles, representing a 25% increase compared to the same period last year, and exceeding its delivery guidance. For the full year, NIO's deliveries totaled 160,038 vehicles, up 30.7% from the previous year, bringing cumulative deliveries to 449,594 units by the end of 2023. In the previous quarter, NIO's revenue surged to 19.067 billion yuan, a 46.6% increase year-on-year, while net losses narrowed to 4.557 billion yuan from 4.111 billion yuan in the same period last year. Moreover, the automotive gross margin reached 11%, a significant increase of 480 basis points from the previous quarter, indicating a recovery bolstered by rising sales volumes and an enlarged cash reserve.

Bloomberg analysts expect that with declining battery costs, NIO's gross margin, which improved to 11% in the third quarter from 5.6% in the first half of the year, could further rebound to around 10% in the fourth quarter. Despite stagnant sales growth due to market competition and organizational restructuring, which led to a quarter-over-quarter reduction in deliveries, NIO has maintained stable vehicle pricing to protect profitability.

Additionally, analysts predict that NIO might not see a significant growth in sales until the second quarter of this year, but operational efficiency is expected to improve following sales network reforms. The company has been intensifying efforts to cut costs, including a recent 10% reduction in its workforce and trimming of non-core R&D projects.

In terms of infrastructure, NIO has expanded its network to 2,379 battery swap stations and 21,634 charging piles, with plans to reach over 3,310 swap stations and more than 41,000 charging piles by year's end.

Looking ahead, NIO's CEO William Li is confident that the shift from high-end fuel vehicles to pure electric will accelerate in 2024, suggesting brighter prospects for the company in the coming year.

Don't Get Crushed by Earnings. Here are things you should know before considering a trade.

Knowing the IV Crush

Before significant corporate events such as earnings announcements, product launches, or clinical trial results, implied volatility tends to increase. However, after the news has been released, the implied volatility can drop significantly due to the sudden clarity in the market and the stock price reaction to the news. This phenomenon is referred to as IV crush.

IV Crush And Option Prices

IV crush can lead to a decrease in option prices because the Implied volatility is lowered dramatically. This decrease in option prices due to IV crush can be a risk for options traders who have purchased options at a higher price with the expectation of making a profit from a significant move in the underlying stock price. Conversely, IV crush may not be as prevalent if the option is undervalued and the stock price moves drastically, which can pose a risk for option sellers. It's important for traders to be aware of IV crush and factor it into their trading strategy when considering options trades around significant corporate events.

Not all options are affected equally by an IV crush. IV crush affects short-term option prices more than long-term option prices.

Nonetheless, it's important to note that trading options always involve risks, and investors should consult with a financial advisor before making any trades.

Source: Dow Jones, Market Chameleon, Bloomberg

Disclaimer:

Options trading entails significant risk and is not appropriate for all customers. It is important that investors read Characteristics and Risks of Standardized Options before engaging in any options trading strategies. Options transactions are often complex and may involve the potential of losing the entire investment in a relatively short period of time. Certain complex options strategies carry additional risk, including the potential for losses that may exceed the original investment amount. Supporting documentation for any claims, if applicable, will be furnished upon request. Moomoo does not guarantee favorable investment outcomes. The past performance of a security or financial product does not guarantee future results or returns. Customers should consider their investment objectives and risks carefully before investing in options. Because of the importance of tax considerations to all options transactions, the customer considering options should consult their tax advisor as to how taxes affect the outcome of each options strategy.

The data and information provided has been obtained from sources considered to be reliable, but Moomoo Financial and its affiliates do not guarantee that the foregoing material is accurate or complete. Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment