Earnings Volatility: Apple Options Priced for a 4% Post-Earnings Move. What to Expect?

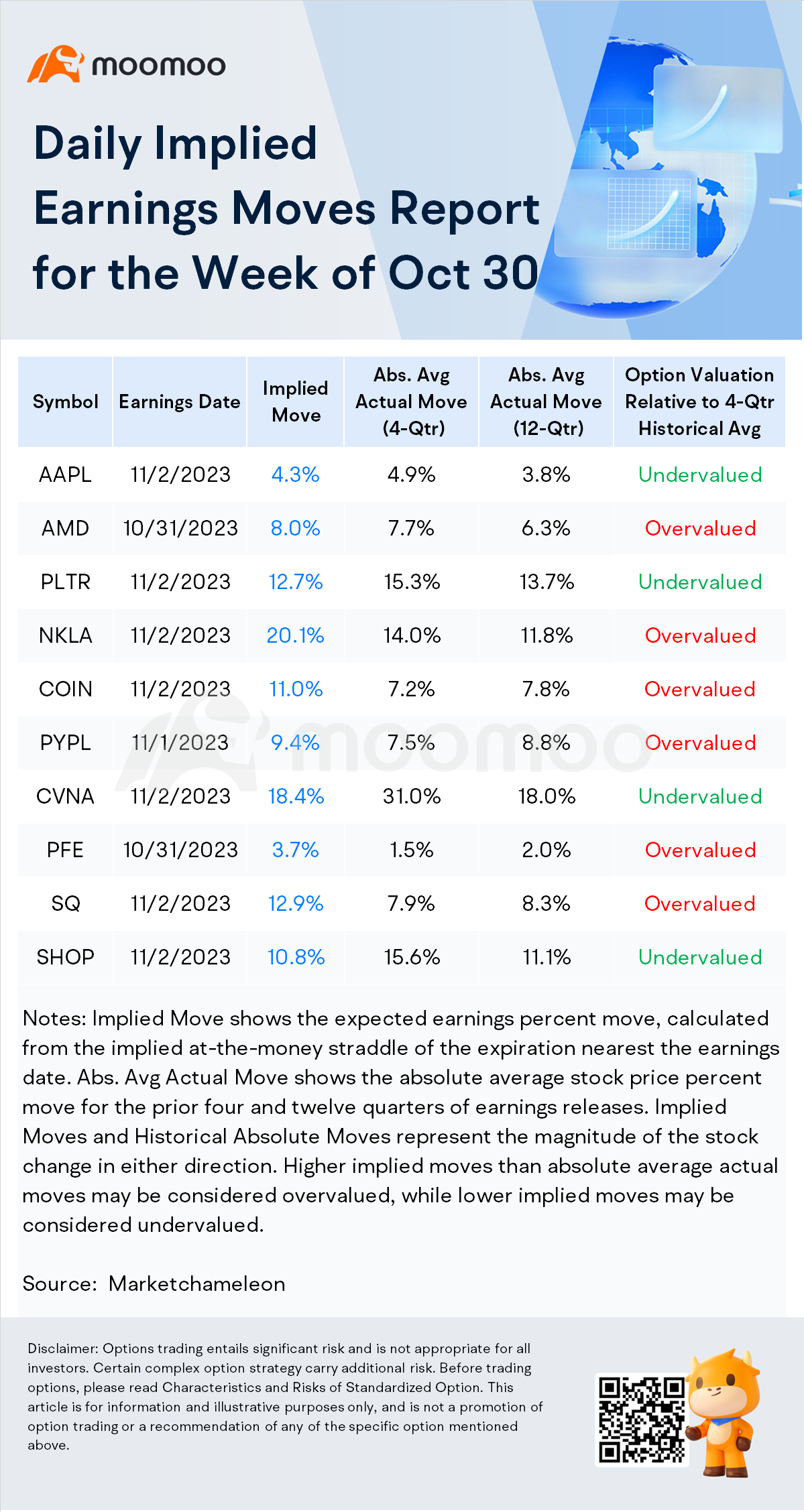

Stock prices may see larger-than-normal moves during earnings season, making it a potentially attractive time for options traders. For investors looking to trade against these moves, you should always keep track of how the options might shift after their earnings. Here are the top earnings and volatility for the week:

-Earnings Date: 11/2 after market close

-Implied Move: 4.3%

-Absolute Average Actual Move for the past 4 Quarters: 4.9%

-Absolute Average Actual Move for the past 12 Quarters: 3.8%

-Earnings Normalized Estimate: $1.39 per share

-Revenue Estimate: $88.37 billion

According to recent data from Market Chameleon, options for Apple are undervalued compared with its average actual move for the past 4 quarters of 4.3%, and overvalued compared to 12 quarters. The options market overestimated AAPL stocks earnings move 58% of the time in the last 12 quarters.

Apple Earnings

Apple's earnings is expected to show lower revenue for iPhones and Macs amid "soft demand" in the US and China, UBS Securities said this week in a note.

Ahead of Apple earnings, we trim Sept qtr iPhone and Mac revenue forecasts 1.0% and 4.7% respectively to reflect soft demand across the two largest regions, the US and China," the analysts wrote.

While demand trends have been soft throughout the quarter, checks indicate demand did not materially pick-up in Sept. In fact, iPhone sell-through in the month of Sept came in at just 18.7M units, down 11.6% YoY," they added. "In addition, we est Macs declined ~24% YoY in the quarter, the 4th consecutive YoY decline as excess inventory from Sept-22 was worked off.

Don't Get Crushed by Earnings. Here are things you should know before considering a trade.

Knowing the IV Crush

Before significant corporate events such as earnings announcements, product launches, or clinical trial results, implied volatility tends to increase. However, after the news has been released, the implied volatility can drop significantly due to the sudden clarity in the market and the stock price reaction to the news. This phenomenon is referred to as IV crush.

IV Crush And Option Prices

IV crush can lead to a decrease in option prices because the Implied volatility is lowered dramatically. This decrease in option prices due to IV crush can be a risk for options traders who have purchased options at a higher price with the expectation of making a profit from a significant move in the underlying stock price. Conversely, IV crush may not be as prevalent if the option is undervalued and the stock price moves drastically, which can pose a risk for option sellers. It's important for traders to be aware of IV crush and factor it into their trading strategy when considering options trades around significant corporate events.

Not all options are affected equally by an IV crush. IV crush affects short-term option prices more than long-term option prices.

Nonetheless, it's important to note that trading options always involve risks, and investors should consult with a financial advisor before making any trades.

Source: Dow Jones, Market Chameleon, Bloomberg

Disclaimer:

Options trading entails significant risk and is not appropriate for all customers. It is important that investors read Characteristics and Risks of Standardized Options before engaging in any options trading strategies. Options transactions are often complex and may involve the potential of losing the entire investment in a relatively short period of time. Certain complex options strategies carry additional risk, including the potential for losses that may exceed the original investment amount. Supporting documentation for any claims, if applicable, will be furnished upon request. Moomoo does not guarantee favorable investment outcomes. The past performance of a security or financial product does not guarantee future results or returns. Customers should consider their investment objectives and risks carefully before investing in options. Because of the importance of tax considerations to all options transactions, the customer considering options should consult their tax advisor as to how taxes affect the outcome of each options strategy.

The data and information provided has been obtained from sources considered to be reliable, but Moomoo Financial and its affiliates do not guarantee that the foregoing material is accurate or complete. Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

72894679 : Hi

TradeWithJames : Apple go for it