Deep Indicators Moving Averages (Part 1 + Math + Real Time Setup and Trading)

Deep Indicators Counter: 1

Date: 3/24/2024

Introduction

Good morning everyone! I hope you are all doing well, had a great weekend and are gearing up for the new week in markets.

Today, we are going to start a new series called Deep Indicators! This series will go over different indicators and talk about ways to use them, and possible setups we can find in the market with these indicators. There are some popular indicators that traders use, and some less popular indicators that require a bit more knowledge before using them.

For reference, some of the indicators in these articles are ones I use regularly, and other are indicators that are good to know about. I will always specifiy which ones I use and how to use them.

Todays Indicator: The Moving Averages

As a lot of you know already, Moving Averages are powerful and incredibly usefull indicators used by traders of all levels. Whether looking to take a position, exit a position, or even going over the charts, the Moving Averages are used by almost all traders including those on Wall Street. So let's talk about them and how to trade with them.

What are Moving Averages?

A Moving Average (MA) is a trend following indicator. This means that their values are based on previous prices at the level. They take into account volume, trends, and other averages depending on their type.

What does that mean?

Trend following indicators mean that they can warn traders about future price movements, but can also be used in identifying trend changes in the market such as reversal to the upside or downside. Analysts will also use moving averages to examine support and resistance zones by evaluating their price (1). This is where setups are born and we will talk more about that later.

With that said, there are two examples of Moving Averages I am going to talk about today. The Simple Moving Average (SMA) and the Exponential Moving Average (EMA).

Part 1: EMA and SMA Mathematics and Reasonings

SMA

The Simple Moving Average is used mainly when holding a position for a longer period of time and are great with filering out noise in the markets. Because the SMA uses data from larger time frames, the trendlines will represent a larger compilation of data at a given price point. This can generate important long term signals for taking or exiting a position.

-

Formula:

SMA = (A1 + A2 + ……….An) / n

A = Average in period n

n = the number of priods

-

Say we want to calculate the MA's on the weekly. So a 7 day range. The SMA's will take all the prices within the previous 7 days and add them together and device by the range (7) to result in the average.

Let's use the SPY's last 7 days for the calculation

521.21

522.20

520.48

515.71

512.86

509.83

514.95

-

SMA = 3,617.24 / 7

SMA = $516.7486

EMA

The Exponential Moving Average, as you can tell by the name, are used mainly when trading in a shorter period of time. This means that the EMA's give more weight to the most recenent prices, thus better used in shorter time frames and usually with day trading as traders hold positions only on the day. Therefore, as "exponential" implies, they are great indicators when the market is moving quickly.

-

Formula:

Multiplier = [2 / (Selected Time Period + 1)]

-

Multipler = base value after selected time period

Selected time period = number of periods

-

So if I wanted to chart the weekly again, or 7 days, my formula would look like this:

Multipler/100 = [2/(7+1)] = 0.25

Let's call Multupler, M

M/100 = 0.25

Solve for M

M = .25 (100)

M = 25 (as a percentage)

M = 25%

-

The final step in our calulations would take M and plug it in with the previous closing price and previous EMA's value. For this calculation, I will be using the 9EMA and as an example let's say SPY closed at 500 on the previous day just to keep it simple. Remember, our SMA is $516.7486

Current EMA = [Closing Price - EMA(Previous Time Period)] x M + EMA (Previous Time Period)

This can also be written as

EMA = (Price(t) x M) x M + EMA (y) x (1-M)

Where

t = today ($520.42)

y = yesterday (or SMA)

M = Multipler

-

=$520.42 (x .25) + [516.7486 x (1-.25)]

= 130.105 + [516.7486 x 0.75]

= 130.105 + 387.56145

EMA = 517.66645

Summary

The price of writing is $520.42

The previous close = $521.21

The SMA = $516.7486

The EMA = $517.66645

Math Explained

What we can tell from the math is that the EMA is closer to the previous close and today's actual price that I am writing this than the SMA. This is exactly why the EMA is used for day trading shorter time frame positions and the SMA is used for trading longer positions. A key reason why I choose to trade the EMA when trading futures or break out structures occuring on the day rather than the SMA.

Differences

In summary, the key differences between the SMAs and the EMAs are their speed and sensitivity to price fluctuations. The EMAs are more responsive to price changes and the SMA's apply equal weighting to the overall observable data set.

TLDR

EMA = day trading, short term trading, more precise but less accurate levels, faster entries and exits, calculated using shorter time frames

SMA = longer term trading, less precice but more accurate levels, slower entries and exits, calculated using longer time frames.

Part 2: What I use and Setups

When day trading Futures, the indicator I use regularly when taking a trade is the 9EMA.

For this example, we don't be looking at the Future's charts, we are going to chart using the previous trading day on the SPY which is 3/22/2024 and the 1 and 5 minute charts.

I changed my charting format to simulate what yours will most likely look like.

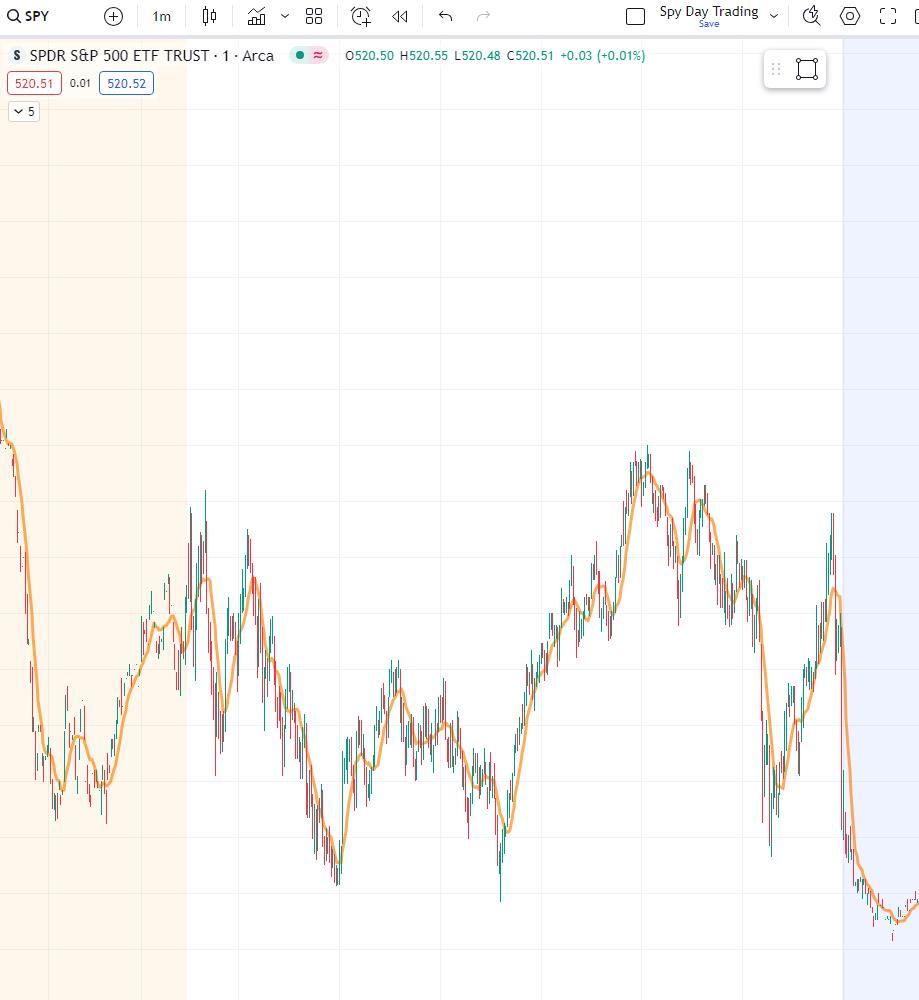

1 Minute

5 Minute

Indicator I use:

This indicator includes the 9ema, 20ema, 50ema, and the legendary 200ema.

Alright, back to the 1 minute chart.

That is a really ugly open, but that's the reason why I chose this day other than it being the last full day of trading.

I usually trade on the open as that is when there is usually the most volume and volatility in the market. If I didn't know what the open would look like, my chart would be like this

Three things I notice right off the bat:

1. The 9EMA is curling up

2. There is a reversal off the $521.25 level on pre-market

3. There is a rising channel

Three othther things I want to mark down:

1. The previous close

2. Any areas of support and resistance

3. The highs and lows of the previous day

Two possible things I think have the most probable outcome when the market opens

1. The market tries to fill this gap and moves to the upside

2. The market tries to fill this gap, and fails moving to the downside

The 5 minute tells me almost nothing, exept for the last 5 minutes of pre-market. The huge green candle to retest the previous close tells me that we might see a retest on open.

Market Opens

We shoot straight up with the first candle, but reject back down below the previous close.

The 9EMA is starting to curl upwards, but below the candle so I don't take a position.

-

The next candle FOMO set in, and we close above the previous close, which a lot of traders would try to enter to get into the possible breakout structure, but because the current price is too far above the 9ema, we don't enter.

And what a good move that was! We rejected straight down off the previous day's support, which tells us it may now be acting as an area of resistance. We are waiting for our Retest and Rejection setup.

However, we reject off of the trendline we made in premarket, this tells me we this trendline could be solid and a stronger than thought indicator.

The 9EMA is still moving upwards though, but we keep rejecting.

I am going to wait to see if we can close above the resistance and retest it.

That doesn't happen and we reject off the the resistance with volume crossing the 9EMA.

My First Position

After letting the market play out, I find no real area to take a short or long position. However, I can now make some new markings.

The market is moving sideways, so I wait for a position.

We move straight back up in a sideways pattern to the resistance again and reject off of it. This is where my first position to the short side will come in.

I would enter here because that is the third rejection to the upside which gives me greater confidence of a higher probability that we move down.

I set a stop loss just above the previous retest wicks

I cut half when we retest the previous close, but since we wick down I keep my position.

Here is where the 9ema comes in

As we move down, I keep my position and switch to the 5 minute chart

I don't want to cut the remaining half of my position just yet. Reason being is that the 9ema is continuing to move down further away from the candles. Since I am already in profit, I feel more secure holding my position as long as the EMA guides down above the candles.

My Exit

There are two areas I would exit my position according to the 9EMA.

Either at or below the lows of pre-market, or when the next candle with volume reaches the 9 EMA. The market could move further down, but I don't care what it could do. I care about if it gets to the level or not.

Remember, the Moving Averages are trend indicators. I want to follow the trend, not fight it. But I also don't want to FOMO buy or sell. So whether I sell at the lows, or cut it as soon as the first few candles, none of it matters. Trading psychology is key. Whether my profit is $2, or $200, I still made profit. If I am already in a position, and the 9ema is moving downwards and away from the candles, that tells me there could be a continuation of the trend and to hold my position.

When I chose to sell is completely up to me.

My Point

The 9EMA is a tool I use to help me gague if I should buy, sell, hold, or cut my position over the shorter time frames. I am not the only one who bundles the 9ema with the 1 minute, or especially the 5 minute.

A lot, and I mean a lot, of day traders use this strategie as a way of using averages rather than emotions when deciding to hold a position to the buy or sell side. The key is to not fight the trend, but to notice the trend and use a bunch of other techniques, indicators, and tools to further examine your position.

However it is also important to mention that I never take a trade off the 9ema alone. I almost always use other tools and resources that are available to me when taking a trade.

Look at today for example.

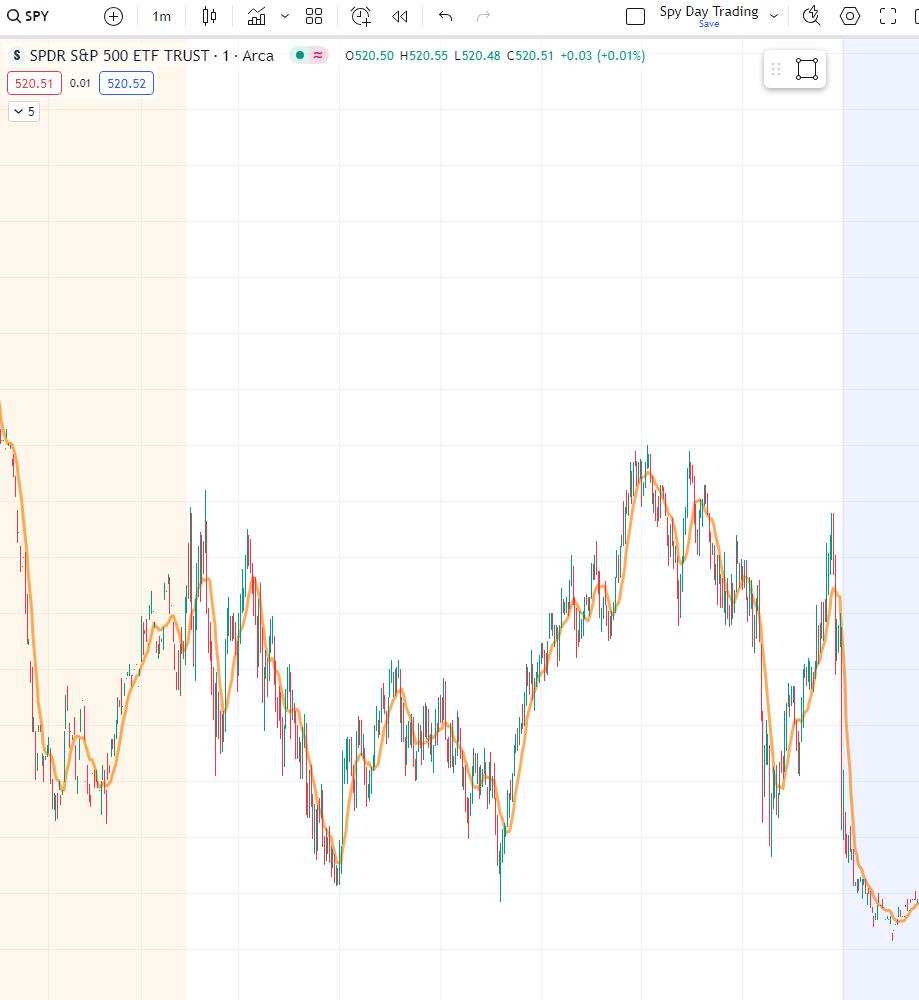

Spy 3/24/2024

5 Minute

1 Minute

If you missed the move up, would you enter long here or short?

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

If you said neither, you would be correct! There is no reason to enter here. Although the 9ema is moving upwards, you aren't in a position yet. Therefore, you should not take a trade off the 9ema alone. Wait for a structure of some sort. As I charted, there is a rising wedge playing out right into our "Reversal O'Clock".

Three retests and rejections to the upside around the same level, and at the time of writing the SPY is seeing some sellers enter. I still would not enter.

I want to see this

Look at what happened

If you got short, you would have been wiped out. That's why its important to use the 9ema and other indicators or tools as well. Trading off the 9ema alone can work don't get me wrong I have done it and will probably do it again, but I always look for support and resistance, trendlines, and areas of liquidity before taking the trade with the 9ema.

If I were to take a position, I would wait until we get closer to the end of the wedge for a long position to the upside, and maybe just before the end for a short position.

Before I post this, let's wait to see how it plays out.

It looks like my short position might have been a bit too late, as the rejection candle happened here

But I am still not convinced yet. I want to see buyers step in and sell back at the upside liquidity

Took a short here, currently rejecting off the 9EMA, looking for a close below the lower trend line with a rejection off the trend for more downside. This was sort of a bad entry since I should have entered at the upside selling liquidity but I am going to let it ride as the 9ema is acting as resistance here.

My price target is the liquidity down there at $519.92

Here's the retest looks like a sweep candle, still holding. No stoploss unless the 5 minute closes well above the 9ema

Possible retest fail, looking for more downside now.

If this 5 minute candle turns red, closes below the 9ema or trend line my confidence will be increased and I may add to the position. If the inverse happens, I will close the trade. Still holding, the 9ema is acting as strong resistance now.

Sellers trying to close below the previous larger downside candle. Still holding.

Looks like one more possible retest candle if buyers can get it going. If not, the SPY will turn bearish fast. Still holding.

I don't like that the sellers lost control, so I am going to exit the trade for a quick gain.

And that's that! I am not too worried about what happens here. It could be that the market continues going downward, or it could be that we reverse to the upside. I caught the trade that I liked and took profit. In real time for you too.

Some time has gone by and I placed a few other trades but now look where we are!

Yes I bought the wicks, and sold the wicks haha. But my point is, look where the 9EMA is at. If you took a short from the highs, and held on by allowing a close above the 9EMA as a sell indicator, then you would have profited very well. I did not take any trade without the use of other resources.

Conclusion

The 9EMA is a great tool that traders use when already in a position. That's the only way I would take a position with it. I would not take a long or short position without the use of other indicators and tools since it's a short term indicator and not entirley structured.

From this graph, you see me shorting the area of resistance again, but I am selling at the 9EMA as it is beginning to act as support so I closed my position off the ema because of the strength of the buyers from the large wicks from the downside. It looks like it will go bullish.

Regardless, I have to apologize for today as it is a really bad day to try and demonstrate the 9EMA's strength.

We have been moving sideways since 10-11am NYC and as you can see, the 9EMA does not really work when the martket is moving sideways.

Thank you for reading! I hope this information was clear and consistent. I know these candles aren't the best, and I could have traded a whole lot better, it is INCREDIBLY difficult to do so when the market is moving sideways. I hope I also don't lose credibility for not includng the VWAP or RSI on my charts. I hope to make those lessons as well themselves. However today we took a look at what the Simple and Exponential moving averages are and how I use the 9EMA when trading.

Enjoy your day in the market and thank you for all the support. Expect more of these posts including tutorials and possible live trading! I can't guarentee that I will post how I use the indicators in real time like this article, but if I can I will.

This right here is a MUCH more solid breakout structure. The 9EMA is catching up to where the price retested and rejected off of and now we are sitting in our longs. Although this is a heavily choppy Monday so I might not hold it for long but I am going to let it play out.

1 Minute chart finding support off the zone and 9ema as well. I think this is a very good trade to take and we should get right back up to liquidity.

Your wicks don't scare me bro! Hahaha, a great setup, 9ema acting as support, and a great trade overall.

Thank you

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment

74164542 : Thank you