BTC price blasts through $70K — 5 things to know in Bitcoin this week

$Bitcoin(BTC.CC$ begins a new week with a wobble and fresh all-time highs as BTC price volatility stays firmly in charge.

The largest cryptocurrency has sealed its highest-ever weekly close, but bulls continue to face stiff resistance when it comes to breaking higher.

As the battle for price discovery rages, Bitcoin is caught in a familiar state of flux — selling pressure at key psychological price levels combined with the relentless bid from the spot exchange-traded funds (ETFs).

The largest cryptocurrency has sealed its highest-ever weekly close, but bulls continue to face stiff resistance when it comes to breaking higher.

As the battle for price discovery rages, Bitcoin is caught in a familiar state of flux — selling pressure at key psychological price levels combined with the relentless bid from the spot exchange-traded funds (ETFs).

1. Record weekly highs precede BTC price discovery

Bitcoin enjoyed classic volatility into the March 10 weekly close — which turned out to be easily the highest in history.

At $69,000, the high nonetheless failed to last, as a precipitous downside wick took BTC/USD to $67,120 minutes later, data from Cointelegraph Markets Pro and TradingView confirmed.

2.CPI week looms with Fed rate cut bets absent

Another “classic” week in terms of U.S. macroeconomic data is due to be headlined by the Consumer Price Index (CPI) print for February.

Due on March 12, CPI makes for volatile short-term trading across risk assets, while Bitcoin offers mixed reactions.

The current narrative around inflation and Fed policy remains disjointed. Markets are eager to see interest rate cuts, while Fed officials, including Chair Jerome Powell last week, are attempting to cool their expectations.

The nature of CPI figures and other data points will thus form a key reference point, with the next Fed meeting just over one week away.

Due on March 12, CPI makes for volatile short-term trading across risk assets, while Bitcoin offers mixed reactions.

The current narrative around inflation and Fed policy remains disjointed. Markets are eager to see interest rate cuts, while Fed officials, including Chair Jerome Powell last week, are attempting to cool their expectations.

The nature of CPI figures and other data points will thus form a key reference point, with the next Fed meeting just over one week away.

3.ETF Bitcoin buyer pressure seen expanding

Bitcoin market observers are waiting for one thing as the week begins: the resumption of buying by the spot ETFs.

Now the most successful ETF launch in history, the nine participants have presided over a BTC price transformation that many see continuing.

While reservations are visible, ETFs may see waning demand and thus no longer buoy the price trajectory, so a sense of optimism among institutions now stands out.

Last week, Cathie Wood, CEO of asset manager ARK Invest, said that the firm’s $1-million BTC price target for 2023 had been “brought forward.”

“No platform has approved Bitcoin yet, so all of this price action has happened before they approve it, and so we haven’t even begun,” she said about the absence of major U.S. wirehouses such as Morgan Stanley and UBS.

As Cointelegraph subsequently reported, industry insiders are gearing up for this to happen and the price impact that could follow.

In a memo on March 9, crypto-native asset manager Bitwise listed “major warehouses,” “institutional consultants” and “large corporations” as being next in line to add BTC exposure.

“Based on current trends, I’d suspect we’ll see our first significant flows from these three groups in Q2 2024, and I think those flows will accelerate throughout the year as these investors become more comfortable with the new products,” chief investment officer Matt Hougan wrote.

Bitcoin market observers are waiting for one thing as the week begins: the resumption of buying by the spot ETFs.

Now the most successful ETF launch in history, the nine participants have presided over a BTC price transformation that many see continuing.

While reservations are visible, ETFs may see waning demand and thus no longer buoy the price trajectory, so a sense of optimism among institutions now stands out.

Last week, Cathie Wood, CEO of asset manager ARK Invest, said that the firm’s $1-million BTC price target for 2023 had been “brought forward.”

“No platform has approved Bitcoin yet, so all of this price action has happened before they approve it, and so we haven’t even begun,” she said about the absence of major U.S. wirehouses such as Morgan Stanley and UBS.

As Cointelegraph subsequently reported, industry insiders are gearing up for this to happen and the price impact that could follow.

In a memo on March 9, crypto-native asset manager Bitwise listed “major warehouses,” “institutional consultants” and “large corporations” as being next in line to add BTC exposure.

“Based on current trends, I’d suspect we’ll see our first significant flows from these three groups in Q2 2024, and I think those flows will accelerate throughout the year as these investors become more comfortable with the new products,” chief investment officer Matt Hougan wrote.

4.Puell Multiple nears multi-year high amid mushrooming miner outflows

Bitcoin has hit a new all-time high before its next halving — a unique event in its history.

This has surprised many, and miners appear to be no exception. Despite the upcoming halving exposing them to 50% less “new” BTC per block, miners have significantly upped their selling around the highs.

The phenomenon has been witnessed throughout 2024, with outflows from miner wallets beginning at the launch of the ETFs on Jan. 11, CryptoQuant data shows.

This has surprised many, and miners appear to be no exception. Despite the upcoming halving exposing them to 50% less “new” BTC per block, miners have significantly upped their selling around the highs.

The phenomenon has been witnessed throughout 2024, with outflows from miner wallets beginning at the launch of the ETFs on Jan. 11, CryptoQuant data shows.

Total daily revenue on March 7, meanwhile, was the second-highest ever at $75.9 million, CryptoQuant contributor Julio Moreno revealed on X.

With the recent price of Bitcoin soaring, miner revenues have rapidly increased,” trading suite DecenTrader continued on the topic on March 11.

DecenTrader referenced the Puell Multiple — a measure of the value of coin issuance against its yearly moving average — hitting some of its highest levels in six years. The multiple functions as a guide to macro tops and bottoms.

“That has resulted in a Puell Multiple score of +2.4 which is historically on the high side — though not as high as previous cycle peaks,” it noted.

DecenTrader referenced the Puell Multiple — a measure of the value of coin issuance against its yearly moving average — hitting some of its highest levels in six years. The multiple functions as a guide to macro tops and bottoms.

“That has resulted in a Puell Multiple score of +2.4 which is historically on the high side — though not as high as previous cycle peaks,” it noted.

5.Hodlers stay resistant to selling

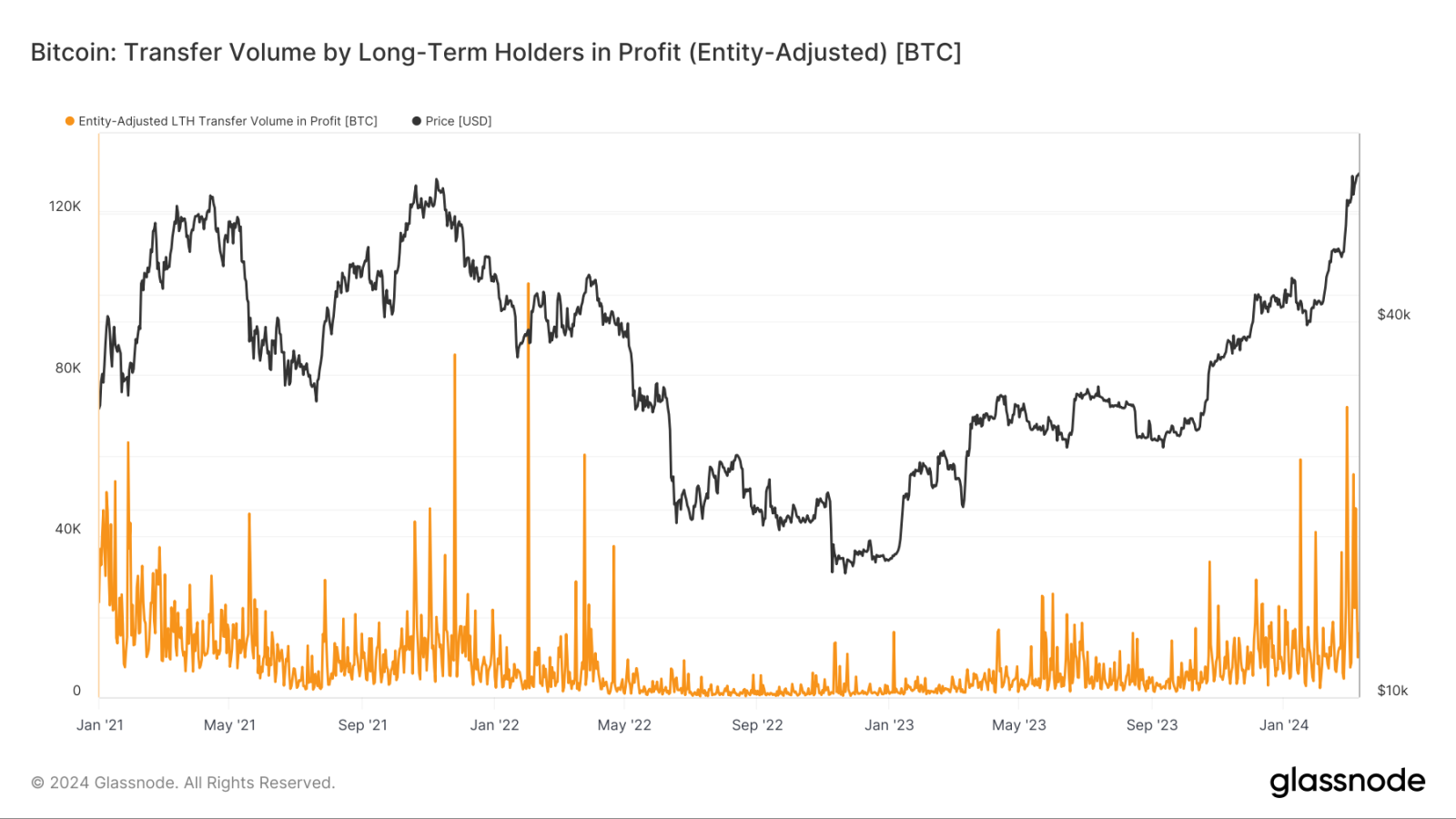

Amid the inbound price discovery, seasoned Bitcoin hodlers are keeping their hard-earned coins firmly in their wallets.

Data from on-chain analytics firm Glassnode shows long-term holders (LTHs) not yet matching transfer volumes seen during 2021, the year when BTC/USD first hit $69,000.

The largest recent spike of around 72,000 BTC, in fact, occurred on Feb. 24, with $70,000 and higher so far not generating a larger single-day tally.

According to crypto education resource On-Chain College, meanwhile, the net unrealized profit/loss (NUPL) for LTHs, while strong, is not yet at levels systematic of a blow-off top.

“Bitcoin’s most convicted holders are still holding at unrealized profit levels that usually occur well before the cycle peak,” it told X followers on March 11.

According to crypto education resource On-Chain College, meanwhile, the net unrealized profit/loss (NUPL) for LTHs, while strong, is not yet at levels systematic of a blow-off top.

“Bitcoin’s most convicted holders are still holding at unrealized profit levels that usually occur well before the cycle peak,” it told X followers on March 11.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment