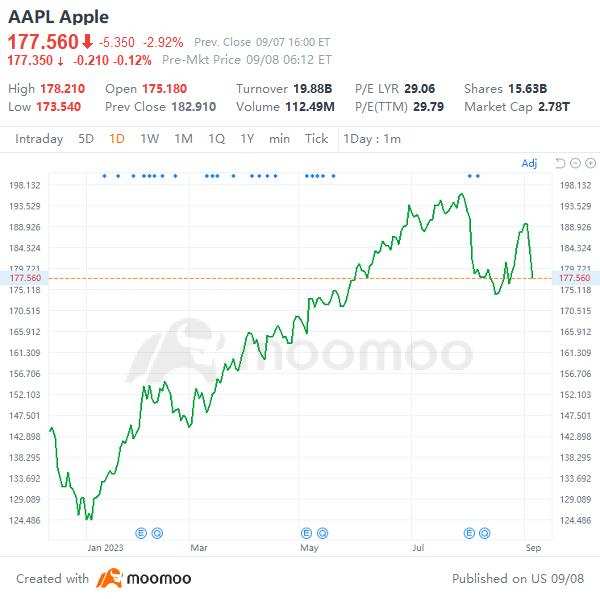

Apple has experienced two consecutive days of sell-offs, resulting in a cumulative drop of over 6%, leading to a market capitalization loss of $190 billion

On Thursday, $Apple(AAPL.US$ 's stock price briefly dipped over 5%, falling below the 100-day moving average line, marking two consecutive days of investor sell-off, resulting in a total decline exceeding 6%, causing the market capitalization to evaporate by $190 billion.

Analyst Laura Martin from the renowned Wall Street institution Needham stated in a report on Thursday that the AI revolution might challenge Apple's dominance as the world's largest market capitalization company. With the growth of AI, the market capitalizations of $Microsoft(MSFT.US$ , $Alphabet-A(GOOGL.US$ 's parent company Alphabet, and $Amazon(AMZN.US$ could potentially surpass that of Apple.

Currently, Apple's market capitalization stands at approximately $2.77 trillion, Microsoft at around $2.5 trillion, Alphabet at about $1.7 trillion, and Amazon at roughly $1.4 trillion. All four of these companies are members of the trillion-dollar market capitalization club.

Martin believes that Apple's lack of a strategic focus on generative artificial intelligence and large language models (LLMs) exposes it to risks. Apple isn't a core beneficiary of generative AI, even though the company can protect its top-tier ecosystem from intrusion.![]()

Martin points out that the other three tech giants, Microsoft, Alphabet, and Amazon, are more mature players in the rapidly evolving field of AI. Alphabet is poised to surpass Apple in market capitalization, driven by its cloud business, generative AI capabilities, and unparalleled global consumer data. Microsoft and Amazon also have first-mover advantages in the large language model space, an area where latecomers are likely to struggle. With extensive cloud operations, Microsoft, Amazon, and Alphabet can operate their large language models more cost-effectively, giving them an edge in the field of artificial intelligence.

Previously, analysts from $NVIDIA(NVDA.US$ , another tech giant, have suggested that Nvidia's market capitalization has the potential to exceed Apple's current market capitalization.

In fact, Apple has not remained idle in the field of AI.![]() Recently, the Wall Street Journal mentioned that, in an effort to accelerate the development of large language models, Apple has significantly increased its research funding, burning through millions of dollars daily. They have also poached numerous engineers from Google and made a bold bet on a 2 trillion parameter model called Apple GPT. Apple employees unanimously believe that their Apple GPT large model capabilities have already surpassed those of GPT-3.5. However, analysts suggest that running such massive models requires not only immense computational power but also substantial storage space, which might pose challenges for a relatively small device like the iPhone.

Recently, the Wall Street Journal mentioned that, in an effort to accelerate the development of large language models, Apple has significantly increased its research funding, burning through millions of dollars daily. They have also poached numerous engineers from Google and made a bold bet on a 2 trillion parameter model called Apple GPT. Apple employees unanimously believe that their Apple GPT large model capabilities have already surpassed those of GPT-3.5. However, analysts suggest that running such massive models requires not only immense computational power but also substantial storage space, which might pose challenges for a relatively small device like the iPhone.

Currently, Apple's market capitalization stands at approximately $2.77 trillion, Microsoft at around $2.5 trillion, Alphabet at about $1.7 trillion, and Amazon at roughly $1.4 trillion. All four of these companies are members of the trillion-dollar market capitalization club.

Martin believes that Apple's lack of a strategic focus on generative artificial intelligence and large language models (LLMs) exposes it to risks. Apple isn't a core beneficiary of generative AI, even though the company can protect its top-tier ecosystem from intrusion.

Martin points out that the other three tech giants, Microsoft, Alphabet, and Amazon, are more mature players in the rapidly evolving field of AI. Alphabet is poised to surpass Apple in market capitalization, driven by its cloud business, generative AI capabilities, and unparalleled global consumer data. Microsoft and Amazon also have first-mover advantages in the large language model space, an area where latecomers are likely to struggle. With extensive cloud operations, Microsoft, Amazon, and Alphabet can operate their large language models more cost-effectively, giving them an edge in the field of artificial intelligence.

Previously, analysts from $NVIDIA(NVDA.US$ , another tech giant, have suggested that Nvidia's market capitalization has the potential to exceed Apple's current market capitalization.

In fact, Apple has not remained idle in the field of AI.

To make matters worse, concerns about the resilience of the U.S. economy have led the Federal Reserve to potentially increase its efforts to combat inflation. This has resulted in a sell-off of U.S. Treasury bonds, causing yields on U.S. government bonds to rise. This, in turn, has had a negative impact on Apple's stock price.![]()

![]()

![]()

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment

李倩倩 : This will be a nerve-wracking session