6 things you don't know about Nvidia including its price target

1- Much of Wall Street thinks the chip makers earnings results and outlook (released on Wednesday in the US) will be strong. Options suggest Nvidia's shares could swing 11% up or downon the day. This will ripple through financial markets given Nvidia is the third biggest company in the US. And as such it will ripple toS&P500, the Nasdaq 100 and related ETFs such as the $SPDR S&P 500 ETF(SPY.US$ $iShares Core S&P 500 ETF(IVV.US$ $Invesco QQQ Trust(QQQ.US$ and $BetaShares NASDAQ 100 ETF(NDQ.AU$.

2 - Nvidia is the fastest growing company in the world. It's expected to report 237% revenue growth for the fourth quarter of 2023 buoyed by demand from data centers and artificial intelligence (AI). This would market the second quarter of 200%+ revenue growth.

2a- Recently Nvidia has been filling orders for its H100 AI chip in 3-4 months, instead of 8-11 months, meaning it is getting more immediate revenue and has boosted its efficiency.

2b- Nvidia's H100 chips power most of the large language models that big tech use. For example, Nvidia's chips are what power OpenAI's ChatGPT. The H100 is also used by tech hyperscaler clients like Microsoft, Meta and Amazon who are making AI-related products.

3 –Nvidia's biggest customers include Microsoft $Microsoft(MSFT.US$ and Meta $Meta Platforms(META.US$ , who account for 27% of Nvida's revenue. Amazon and Alphabet account for 12% of Nvidia's revenue. So about 40% of Nvidia's orders are coming from the biggest tech giants. Other large clients include BYD, Tencent, LG, Cisco, Deer & Co. The list goes on.

3a- Also note 81% of Nvidia's revenue is from 'data centres’, as in selling GPUs to big tech businesses like the ones mentioned above..

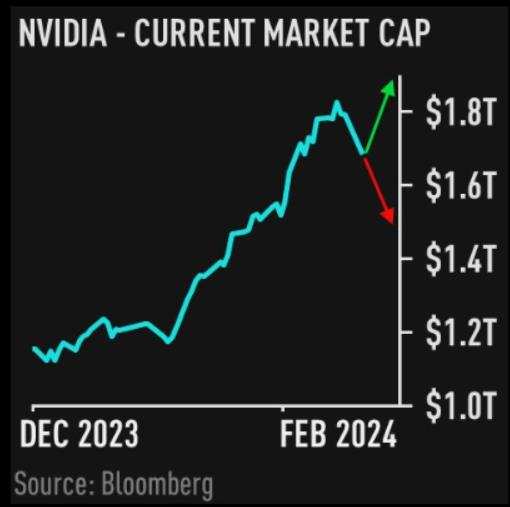

4 - If Nvidia profit results beat expectations and if it upgrades earnings,it would fuel a rally in $NVDA's stock.

Inversely, disappointment in its announcement could fuel a selloff In Nvidia given it's priced at 94 times forward earnings, while that will also impact big tech and markets in general.

If Nvidia's shares do fall, it probably won't stay down and out, as AI demand is strong.

Nvidia's client book is growing. It's charging higher prices its new AI chip, the H200, which has higher processing speeds

5 - Nvidia's average price target is $734.48. UBS has a $850 price target. On Tuesday Feb 20, Nvidia closed at $694.52.

6- Consider that some traders and investors use leveraged ETFs to maximize moves of Nivida shares. if Nvidia shares charge higher, watch the 2x Long Nvidia ETF GraniteShares NVDA Daily ETF $GraniteShares 2x Long NVDA Daily ETF(NVDL.US$. Inversely, if Nvidia's shares swing low, keep an eye on the Nvidia BEAR ETF 1.25 short ETF $Tradr 1.25X NVDA Bear Daily ETF(NVDS.US$

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

グレナダ : Thanks for the easy-to-understand explanation.

Jue J : When is the best time to buy Nvidia ?

102589848 Jue J: yesterday.

rational Ibex_9813 102589848: Brutal!!

SisiGuan 102589848: Buying one today?