Options Market Statistics (2/13): Traders Brace for a Blowup as Cost of Protection for US Stocks

U.S. stock futures crept higher, as investors awaited inflation data due later this week that will feed into their assessments of where monetary policy is headed.

On Tuesday, the Labor Department is set to release the January edition of its consumer-price index, a closely watched measure of what consumers pay for goods and services.

The cost of hedging against another equity market blowup has risen to its highest level since October as investors brace for a surge in volatility as U.S. stocks head for their worst week in nearly two months, according to Market Watch.

The CBOE VVIX Index broke above 100 on Thursday for the first time since Oct. 14, according to FactSet data. The gauge is now set to finish Friday's session at its highest level to end a week since mid-October. The VVIX a measure of the change of volatility in the $CBOE Volatility S&P 500 Index(.VIX.US$ which in turn is a popular measure of the stock market's expectation of volatility based on S&P 500 index options.

News Highlights

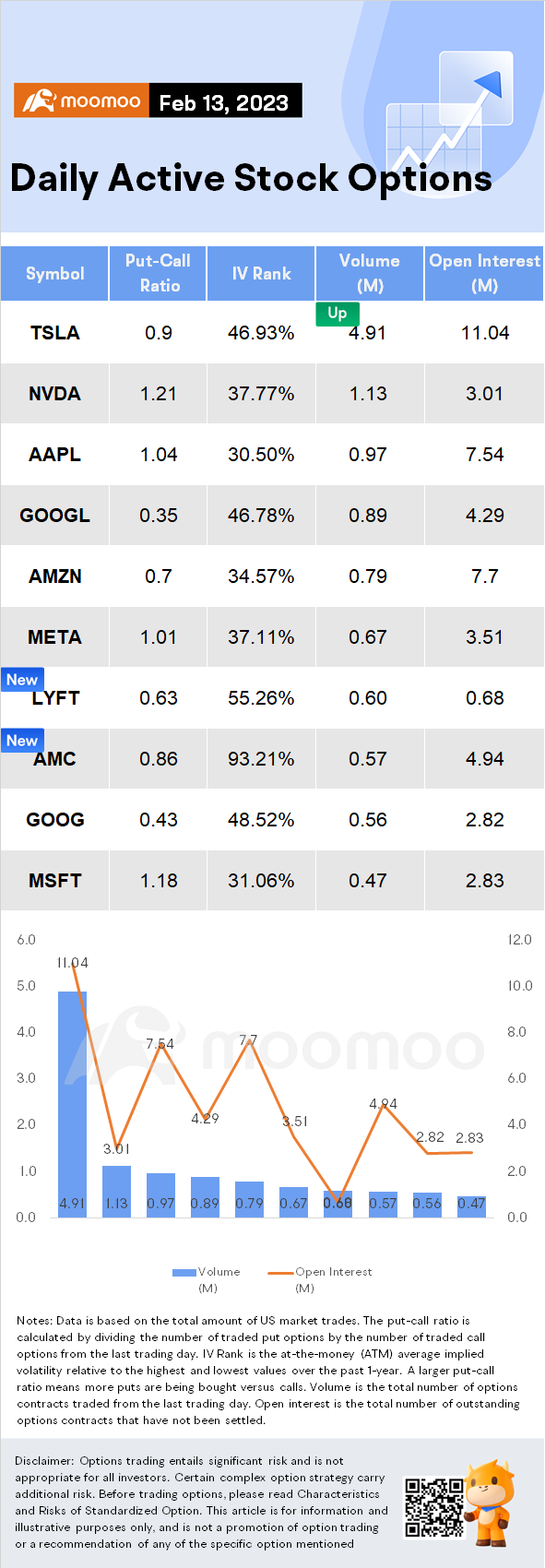

$Tesla(TSLA.US$ shares plunged 5% as the stock price fell to $196.89 last Friday, with option volume of nearly 0.99 million 4.91 million, and calls accounted for 52.7% of the volume.

$NVIDIA(NVDA.US$ shares plunged nearly 5% last Friday, with option volume of almost 1.13 million options traded, and puts accounted for 54.7% of the volume.

$Apple(AAPL.US$ shares edged up last Friday, with option volume of nearly 970,000 options, and puts accounted for 51% of the volume. The 150.00 calls lead the flow with the highest volume.

$Lyft Inc(LYFT.US$ shares plunged over 36% on earnings, with volume 8x normal at nearly 600,000 contracts, and calls accounted for 61.3% of the volume.

$AMC Entertainment(AMC.US$ fell more than 8%, with option volume of almost 570,000 options traded, and puts accounted for 53.8% of the volume. The 10.00 calls expiring in a month were traded most actively.

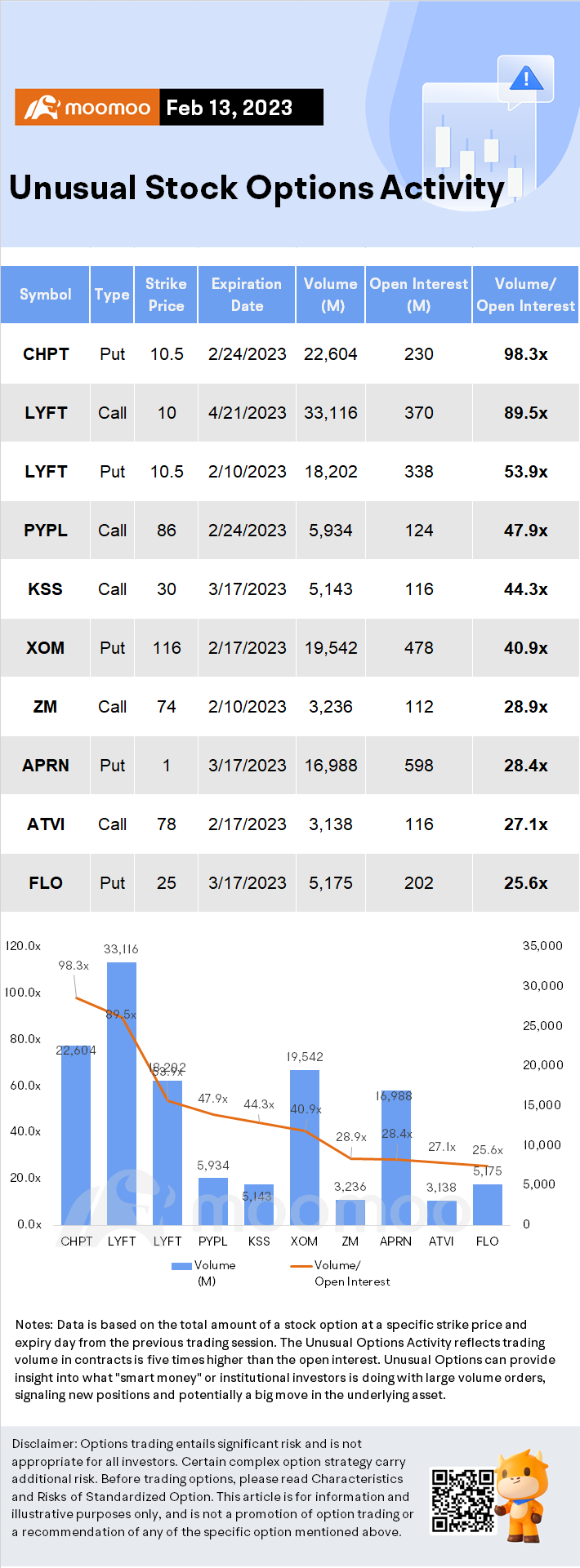

Unusual Stock Options Activity

Source: Benzinga, Dow Jones, CNBC

Disclaimer: Options trading entails significant risk and is not appropriate for all investors. Certain complex option strategy carry additional risk. Before trading options, please read Characteristics and Risks of Standardized Option. This article is for information and illustrative purposes only, and is not a promotion of option trading or a recommendation of any of the specific option mentioned above.

Source: Benzinga, WSJ

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

scrapqueen : This is such a great feature! Especially the infographic on the options! Thank you!

infographic on the options! Thank you!

RIPPER scrapqueen: 17,000 puts on one specific APRN strike ?

104126949 : easy money for investment trading

Options NewsmanOP scrapqueen: Glad you like it, ask anything in the comment!

Options NewsmanOP 104126949: Nice one, I went back and double checked. This strike have 17,557 OI now. Might be something here.