Apple Stock: 23 Reasons To Rally In 2023

$Apple(AAPL.US$ 2022 was a bad year for Apple stock, but maybe it is time for investors to turn the page. Here are 23 reasons why AAPL could climb in 2023.

Apple Stock And The Global Economy

1.A recession is likely priced into stocks already, at least to an extent. But one may not materialize in the end or be less severe than anticipated.

2.After a year of record-high inflation, prices are expected the stabilize, which bodes well for consumer spending — including for discretionary products or services.

3.Spending can also benefit from lower gas prices. Crude oil reached highs of around $120 per barrel in 2022 but is now 30%-plus below peak levels.

4.The Federal Reserve remains generally hawkish about interest rates, but the market is starting to see less of a need to be aggressive about monetary policy in the foreseeable future.

5.Economic activity seems to be under more severe pressure in parts of Europe, for example, than in the US. Nearly half of Apple’s revenues come from the Americas, especially the US, which investors may appreciate during times of global economic uncertainty.

6.At least for a moment, between 2021 and 2022, Apple stock was considered by many an inflation play. For as long as consumer prices remain hot, AAPL could benefit from this kind of positive investor sentiment.

Apple Stock And The Global Economy

1.A recession is likely priced into stocks already, at least to an extent. But one may not materialize in the end or be less severe than anticipated.

2.After a year of record-high inflation, prices are expected the stabilize, which bodes well for consumer spending — including for discretionary products or services.

3.Spending can also benefit from lower gas prices. Crude oil reached highs of around $120 per barrel in 2022 but is now 30%-plus below peak levels.

4.The Federal Reserve remains generally hawkish about interest rates, but the market is starting to see less of a need to be aggressive about monetary policy in the foreseeable future.

5.Economic activity seems to be under more severe pressure in parts of Europe, for example, than in the US. Nearly half of Apple’s revenues come from the Americas, especially the US, which investors may appreciate during times of global economic uncertainty.

6.At least for a moment, between 2021 and 2022, Apple stock was considered by many an inflation play. For as long as consumer prices remain hot, AAPL could benefit from this kind of positive investor sentiment.

Apple Stock And The Markets

1.Historically, it has been rare for Apple stock to have two materially negative years in a row. The last time that this happened was during the dot-com crash, in the early 2000s. Therefore, the odds favor the bulls in 2023.

2.A close cousin to the bullet point above, history has shown that the best time to buy Apple stock is after a pullback. Buying shares 15% or more below all-time highs have produced about 5 percentage points in extra gains for the year. Apple ended 2022 down about 27% from the peak.

3.2022 has been a great year to be a short seller, and the last two weeks set a bearish tone to kick off the new year. With short interest at a high, a first leg higher in AAPL or even in a key broad market index could send bears to the exits as they close positions and lock in gains, helping to create a “melt-up effect”.

4.All Big Tech names (maybe with the exception of Microsoft) have been suffering from issues that do not directly impact Apple — think of Meta’s ill-received pivot to the metaverse or Amazon’s struggles at running an efficient e-commerce business during challenging times. Tech investors may, defensively, shift their portfolio allocations to Apple in 2023.

1.Historically, it has been rare for Apple stock to have two materially negative years in a row. The last time that this happened was during the dot-com crash, in the early 2000s. Therefore, the odds favor the bulls in 2023.

2.A close cousin to the bullet point above, history has shown that the best time to buy Apple stock is after a pullback. Buying shares 15% or more below all-time highs have produced about 5 percentage points in extra gains for the year. Apple ended 2022 down about 27% from the peak.

3.2022 has been a great year to be a short seller, and the last two weeks set a bearish tone to kick off the new year. With short interest at a high, a first leg higher in AAPL or even in a key broad market index could send bears to the exits as they close positions and lock in gains, helping to create a “melt-up effect”.

4.All Big Tech names (maybe with the exception of Microsoft) have been suffering from issues that do not directly impact Apple — think of Meta’s ill-received pivot to the metaverse or Amazon’s struggles at running an efficient e-commerce business during challenging times. Tech investors may, defensively, shift their portfolio allocations to Apple in 2023.

Apple Stock And Company-Specific Factors

1.Supply chain constraints have been one of Apple’s big problems in 2022. While the overhang remains, certain assembly plants in China have started to operate at a much higher capacity. AAPL could jump as soon as the supply worries become old news.

2.There has been a debate about whether missed iPhone sales in the holiday quarter have been lost for good or will be merely pushed forward to 2023. If bulls are proven right and Apple ends up having a great first half of sales in the new year, the stock could climb.

3.The iPhone 14 seems to be experiencing high demand, but the 2022 holiday season is likely to be disappointing due to supply issues. Later in 2023, the new iPhone is less likely to suffer from the same issues, and Apple could finally have the luxury of reporting a great holiday quarter.

4.Apple stock seems to have taken a hit in Q4 due, in great part, to de-risked expectations for iPhone sales in the holiday period. After Apple reports fiscal Q1 results, the near-term headwinds could ease or be mostly left in the past.

5.Apple has a history of consistently delivering results above expectations. In 2023, maybe the Cupertino company will manage to hop over a bar that has been lowered substantially by analysts and investors lately.

6.The App Store made the news once again in Q4, and not for good reasons. However, at least one analyst explained why fears over allowing third-party application platforms on iOS and iPadOS might be overblown. Perhaps the market will agree with this view and Apple stock will react positively.

7.Apple seems to be doing a great job at refreshing its product portfolio to incorporate new technology, including the company’s ARM architecture supported by the M-series chips. New and better devices, particularly within the iPad and Mac families, are likely to be announced in 2023.

8.A mixed-reality product (augmented and virtual) will likely be unveiled in 2023. It is unlikely that most analysts have already adjusted their estimates for this growth opportunity. Once they do, financial results forecasts could rise and push AAPL higher.

9.Apple’s entry into the autonomous vehicle space is not expected until around 2025. However, news or even rumors about this initiative could surface in 2023, and the stock could react positively to the developments – as it has in the past for this same reason.

10.With interest rates having risen fast, money has become much more expensive. But Apple has lots of it in the bank, and the company can put its dry powder to use in 2023. Share buybacks are likely to remain in full force, which could help to support the stock.

11.Another good use for Apple’s cash in 2023 could be strategic acquisitions — especially if asset prices remain discounted. Apple is not known for making large acquisitions, but the right deal could move the stock in the right direction.

12.It is no secret that Apple has been shifting its supply base away from China as a diversification move, and investors seem to like the strategy. If Apple can move faster than expected on this front, the stock could rise.

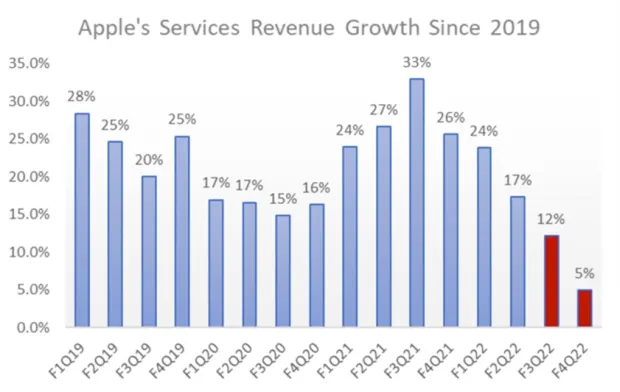

13.The services segment is Apple’s crown jewel, but it has been suffering lately from unreasonably tough comps. Compares should improve substantially in the back half of 2023 (see chart below, red bars), which could be favorable to investor sentiment.

1.Supply chain constraints have been one of Apple’s big problems in 2022. While the overhang remains, certain assembly plants in China have started to operate at a much higher capacity. AAPL could jump as soon as the supply worries become old news.

2.There has been a debate about whether missed iPhone sales in the holiday quarter have been lost for good or will be merely pushed forward to 2023. If bulls are proven right and Apple ends up having a great first half of sales in the new year, the stock could climb.

3.The iPhone 14 seems to be experiencing high demand, but the 2022 holiday season is likely to be disappointing due to supply issues. Later in 2023, the new iPhone is less likely to suffer from the same issues, and Apple could finally have the luxury of reporting a great holiday quarter.

4.Apple stock seems to have taken a hit in Q4 due, in great part, to de-risked expectations for iPhone sales in the holiday period. After Apple reports fiscal Q1 results, the near-term headwinds could ease or be mostly left in the past.

5.Apple has a history of consistently delivering results above expectations. In 2023, maybe the Cupertino company will manage to hop over a bar that has been lowered substantially by analysts and investors lately.

6.The App Store made the news once again in Q4, and not for good reasons. However, at least one analyst explained why fears over allowing third-party application platforms on iOS and iPadOS might be overblown. Perhaps the market will agree with this view and Apple stock will react positively.

7.Apple seems to be doing a great job at refreshing its product portfolio to incorporate new technology, including the company’s ARM architecture supported by the M-series chips. New and better devices, particularly within the iPad and Mac families, are likely to be announced in 2023.

8.A mixed-reality product (augmented and virtual) will likely be unveiled in 2023. It is unlikely that most analysts have already adjusted their estimates for this growth opportunity. Once they do, financial results forecasts could rise and push AAPL higher.

9.Apple’s entry into the autonomous vehicle space is not expected until around 2025. However, news or even rumors about this initiative could surface in 2023, and the stock could react positively to the developments – as it has in the past for this same reason.

10.With interest rates having risen fast, money has become much more expensive. But Apple has lots of it in the bank, and the company can put its dry powder to use in 2023. Share buybacks are likely to remain in full force, which could help to support the stock.

11.Another good use for Apple’s cash in 2023 could be strategic acquisitions — especially if asset prices remain discounted. Apple is not known for making large acquisitions, but the right deal could move the stock in the right direction.

12.It is no secret that Apple has been shifting its supply base away from China as a diversification move, and investors seem to like the strategy. If Apple can move faster than expected on this front, the stock could rise.

13.The services segment is Apple’s crown jewel, but it has been suffering lately from unreasonably tough comps. Compares should improve substantially in the back half of 2023 (see chart below, red bars), which could be favorable to investor sentiment.

Apple stock sank 27% in 2022. What do you think is most likely to happen to the share price in the new year?

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment