Moo Picks in November: Take advantage of market volatility with mooers

Inflation cooled much more than expected in October. Big tech companies have embarked on mass layoffs. Chinese stocks fly amid eased Covid measures. Trading is like surfing, let's see how mooers navigate the ups and downs.

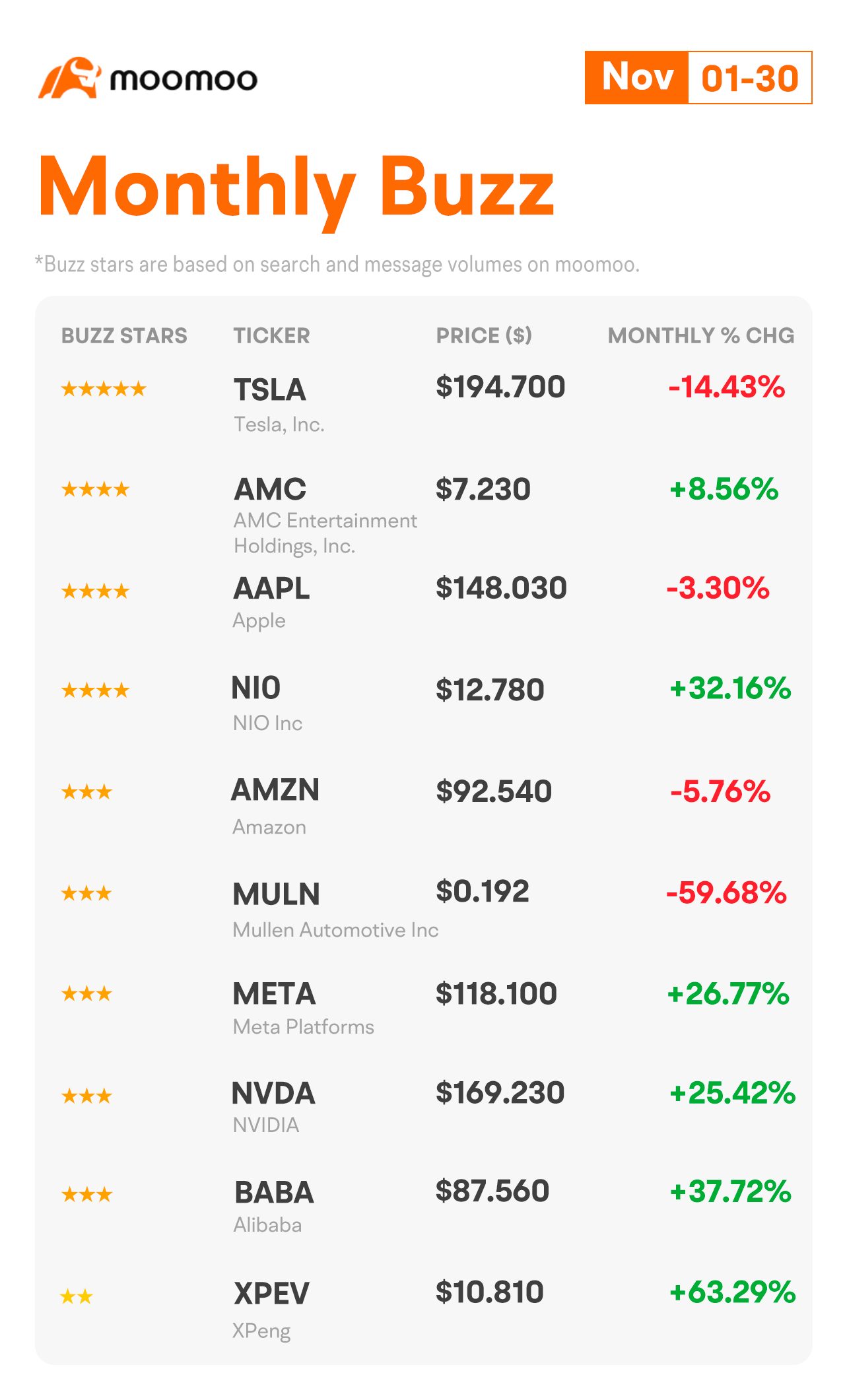

Monthly Buzz

Traders' Insights

Earnings Roundup

Mooers' Stories

Chill Moments

Don't Miss Out!

Make Your Choice

Words of Wisdom

Comment below to let us know.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

RDK79 : Mullen needs some serious reality public exposure directly between investors and CEO, and not just band-aide kicking the can down the road like reverse stock splits! When are the critical milestones, dates, risk factors, and risk mitigation steps! Again, not just a prototype car tour and reverse stock splits!

NgKennykk : Nice

Venture118 : In d midst of every crisis, lies great opportunity ….. all it takes is to spot d winner ! !

Milk The Cow : I just heck care the volatility & continue to hold onto my belief/ conviction on my DYODD. Until more new data of evidence proven an improvement, I will still stick to my plan (actually does not really impact my plan even the market go opposite of what I predicted = the most I earn less that's all ).

).

involved

involved  .

.

Well, at the same time, can temperory play with moomoo paper trading to see if ur prediction is true or not in the future, since no real

posenton : History is always amazingly repeated, and every in-depth investigation is an opportunity to buy.

lastnite24 : the only way to cope with volatility is to have a game plan and stick to it. if you have a stable income the best thing to do would be to buy in on good stocks at regular intervals.

if the market goes down slowly shorting it may only lose money in premiums.

there will be bear market rallies and if you are fortunate enough to catch one you can take profits. you can also do small trades and such as well. but the only way to be a profitable trader is to have a game plan and stick to it. Only after having done research into the company's growth rate and financials can you determine what it should be worth in the future

tothemoon : 1. Invest regularly — in good and bad times

2. Avoid jumping in and out of the market: Successful market timing is very difficult because it requires getting out at the right time and getting back in at the right time.

3. Maintain a diversified portfolio

alsmoov : Diversification is a staple of investing. But as markets change, your portfolio may need to evolve. Times of volatility offer a great opportunity to reevaluate and possibly rebalance your asset mix.

Deezy_McCheezy : Market fickleness is the norm – get used to it

Tyler Maltz : Stick to investment goals and don’t bite off more than you can chew

View more comments...