Haidilao Net Profit Is Still Negative in 2022H1, Hot Pot Industry Leader Can Break Through the Epidemic Blockade?

If you like this article, please give us a like and subscribe to 'wise shark' to get the latest information from the research report.![]()

Trigger event: $HAIDILAO(06862.HK$ delivered solid 1H22 revenue and could have realized slight profit if excluding the losses of restaurant close-down. In 2022H1, Haidilao has realized revenue of RMB16.764bn (-16.6% yoy), gross margin of 58.0% (+0.3pct yoy) and maintained stable expenditure.

The company's net profit declined by 381.7% yoy to -RMB270mn, because of 1) a one-time loss of approximately RMB310mn due to disposal of long-term assets under the "Woodpecker Plan"; 2) ongoing expenses such as rents, D&A and staff cost even if restaurants were shut down or dine-in service was suspended due to the pandemic resurgence in mainland China from March to May. Excluding the losses resulted from restaurant close-down, Soochow Securities estimate that the company could have realized profit of approximately RMB40mn in 2022H1.

Key Takeways:

1.Key operating indicators have risen and fallen, and it is difficult to impact stock prices in the short term.

1) Number of restaurants: The number of restaurants in 2022H1 was 1435, with 18 newly-opened and 26 closed due to the "Woodpecker Plan". The number of Haidilao'srestaurants in Tier-1/Tier-2/Tier-3 cities and below cities/ overseas was 238/521/551/125, respectively; up by -10/-1/-8/+11 compared to the end of 2021.

2) Table turnover rate: Table turnover rate (overall) in 2022H1 was 2.9 times/day, while the table turnover rate of same restaurant was 3.0 times/day (-6.25% yoy), with tier1 cities (3.1 times/day) slightly better than Tier 2 and Tier 3 and below (3.0 times/day).

3) ASP (average selling price): Increasing ASP in Tier-1 cities drove the rebound of Haidilao's overall ASP. The 1H22 ASP in mainland China stores was RMB109.1 (+1.7% yoy); ASP in Tier-1/Tier-2/Tier-3 and below cities was RMB117.4/104.3/97.8 (+2.2%/-0.3%/-1.2% yoy), respectively.

2. The effects of "woodpecker plan" reform gradually manifest, and the "hard bone" store-restarting plan will be launched

1) Thanks to region-based management system brought up in the "woodpecker plan", the restaurant quality in 1H22 has improved. Since May 2022, Haidilao's operating indicators have continued to improve month by month. July is the ‘rush hour’ for hot pot consumption so that the overall table turnover rate is higher in July than that in June, up by ~115% yoy.

2) At the same time, the company intends to restart some of the stores that meet the opening standard. Soochow Securities are cautiously optimistic about the "hard bone" store-restarting plan as the pandemic situation is still uncertain.

3. Earnings Forecast & Rating

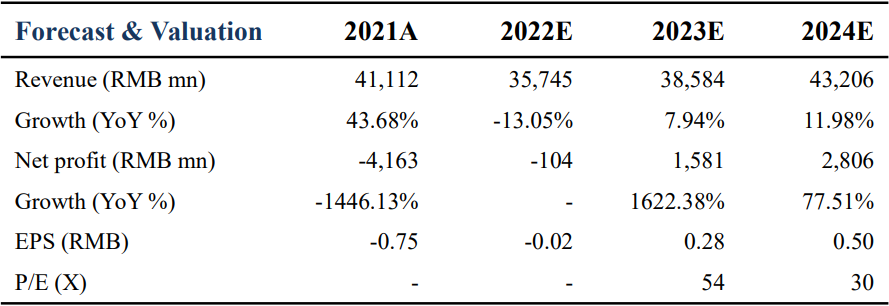

Considering the operating recovery, Soochow Securities maintain previous forecast and expect the company's net income to be RMB-100mn/1.58bn/2.81 bn in 2022/2023/2024, with a yoy growth of 1622.4% and 77.5% in 2023 and 2024. The current share price implies P/E at 54x/30x for 2023/2024. Soochow Securities maintain a "Buy" rating.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment