Tencent Earnings: How Options Activity Implies Price Moves

Chinese Tech giant $TENCENT(00700.HK$is slated to report its Q2 earnings at 20:00 HKT / 8:00 EDT on Aug. 17.

If you are a Tencent shareholder or considering investing in Tencent, you may be desperate to know how the price will go after the earnings report.

In the long run, a company's stock price represents its growth expectations. So in the case of Tencent, video games, ads, and financial services are key business lines to be watched.

In the short run, however, risk hedging seems to be a bigger concern since the company faces uncertainties. Here're two approaches that may help you identify the trend and act early.

First, track Tencent Holdings Ltd ADR.

The historical data shows that Tencent Holdings' ADR price fluctuated during US stock trading sessions after its earnings release. Generally, the ADR performance would impact its share price in the Hong Kong market that opened the following day.

So we might get an idea of investors' reaction to the company's earnings by monitoring its ADR performance. But the stock price may not necessarily move the same way as the ADR price. Market sentiment and the earnings report itself should be considered as well.

Check out moomoo Learn: What is ADR?

Second, monitor options activity.

Apart from being a risk-hedging tool, options can also tell a good story of market sentiment.

For more: Introduction to Option

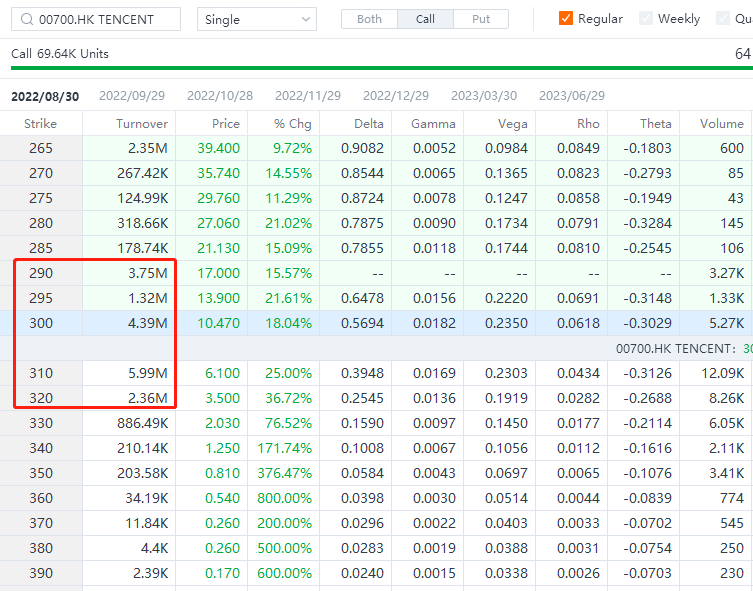

For example, below shows a chain sheet of Tencent's call options with an expiration date of Aug. 30 as of 08-16 16:00 HKT.

For example, below shows a chain sheet of Tencent's call options with an expiration date of Aug. 30 as of 08-16 16:00 HKT.

We can see that those with a strike price of HK$310 got the largest turnover (HK$5.99 million). Calls with a HK$300 strike ranked second, with a turnover of HK$4.39 million. In contrast, the turnover of calls with a strike in the HK$300-600 range was way smaller.

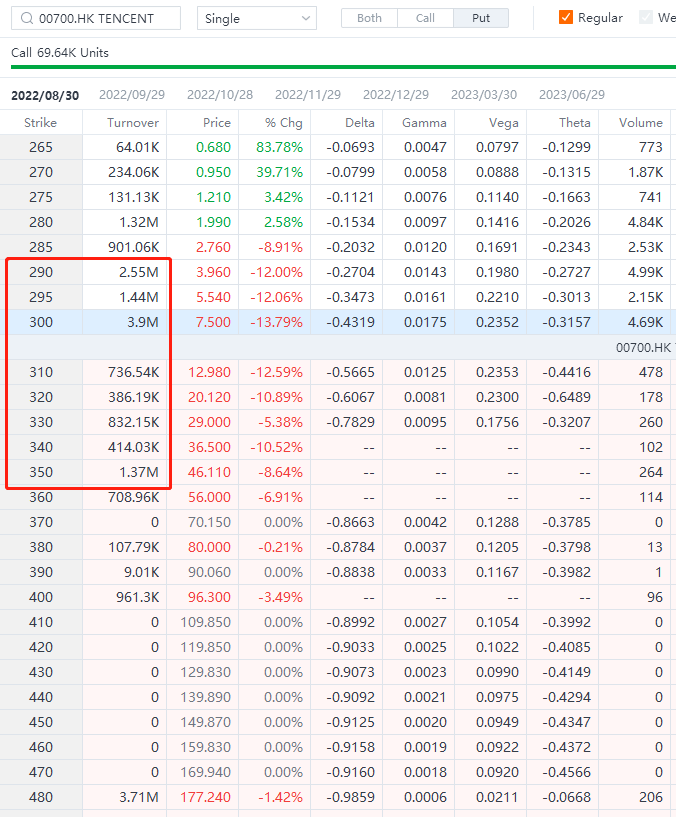

As for puts with the same expiration date, the top 1 traded were those with a HK$300 strike. Puts with a HK$290 strike came next, with a 2.55 million turnover.

So it seems that option traders primarily target the HK$300 contracts before the release. The size of calls slightly surpassed that of puts as a whole.

Not sure how to read options?

How about taking an exam before venturing into complex trading>>

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

GODGIVENFOOL139 : Ok Den

GODGIVENFOOL139 : Ok

102449178 :