AAII Sentiment Survey: Pessimism continues to fall as optimism rises

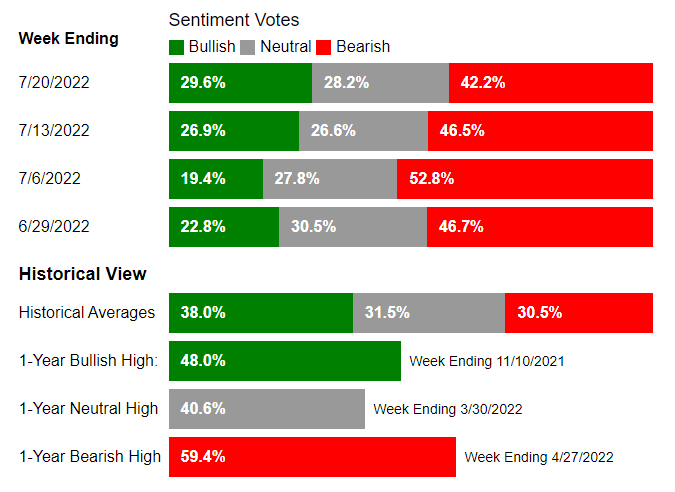

Pessimism among individual investors about the short-term direction of the stock market continued to decline, falling to a seven-week low in the latest AAII Sentiment Survey. At the same time, optimism extended its rebound into a second week by rising to a seven-week high.

Sentiment

Bullish sentiment

- Expectations that stock prices will rise over the next six months, rose 2.7 percentage points to 29.6%.

- The increase puts optimism back within its typical range of readings for the first time since June 2, 2022. (The breakpoint between typical and unusually low readings is currently 27.7%.)

- Nonetheless, bullish sentiment is below its historical average of 38.0% for the 35th consecutive week.

Neutral sentiment

- Expectations that stock prices will stay essentially unchanged over the next six months, increased 1.6 percentage points to 28.2%.

- It is below its historical average of 31.5% for the 12th time in 13 weeks.

Bearish sentiment

- Expectations that stock prices will fall over the next six months, dropped 4.3 percentage points to 42.2%.

- Pessimism was last lower on June 2, 2022 (37.1%). Bearish sentiment is above its historical average of 30.5% for the 34th time out of the past 35 weeks and is at an unusually high level for 23rd time out of the last 27 weeks.

- The breakpoint between typical and unusually high readings is currently 40.5%.

Opinion: Continued volatility in the major stock indexes along with inflation, corporate earnings and increased chatter about the possibility of a recession are all likely weighing on individual investors' short-term expectations for the stock market.

The bull-bear spread (bullish minus bearish sentiment) is –12.6% and is unusually low for the 23rd time in 26 weeks. The breakpoint between typical and unusually low readings is currently –10.8%.

Historically, the S&P 500 index has gone on to realize above-average and above-median returns during the six- and 12-month periods following unusually low readings for the bull-bear spread. Unusually high bearish sentiment readings historically have also been followed by above-average and above-median six-month returns in the S&P 500.

Continued volatility in the major stock indexes along with inflation, corporate earnings and increased chatter about the possibility of a recession are all likely weighing on individual investors’ short-term expectations for the stock market. Also influencing sentiment are monetary policy, the coronavirus pandemic, politics and the ongoing invasion of Ukraine by Russia.

Current AAII Sentiment Bull-Bear Spread:

About AAII Semtiment Survey

- Measures the percentage of individual investors who are bullish, bearish, and neutral on the stock market short term.

- Individuals are polled from the AAII Web site on a weekly basis.

Source: AAII

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

StaQ : ..

wendytan : p

Richard6398 : Good sharing

Richard6398 Richard6398: Good

James 101542649 : Good