Housing sales heading for recovery, Inventory buildup only a short-term impact

On June 20, Hong Kong stocks of domestic housing stocks continued to move higher, with Cinnamon rising over 8% and China Overseas Land Development up over 9%. Bloomberg points out: The recent surge in housing inventory in major Chinese cities could be transitory as homebuyers may return once Covid restrictions are removed.

Key Takeaways:

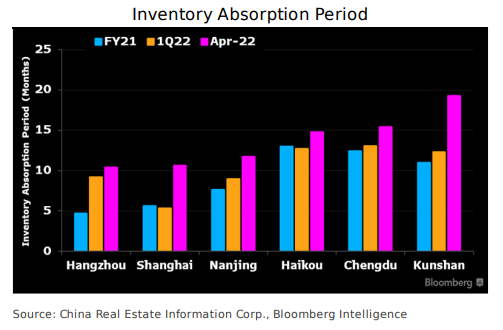

1. Transient Inventory Glut Due to City Lockdowns

Shanghai's surging inventory backlog, to 11 months of average sales as of end-April, could be short-lived as buyers were locked at home for two months with pent-up demand accumulating in the housing market. New homes in the city stayed undersupplied in 2021 and 1Q22 with average absorption periods of six and five months, implying strong home-purchasing demand. Similar home sales recovery may occur in Hangzhou, Nanjing, and Kunshan where residents' normal activities were curbed by Covid in the past months.

2. Sales Recovery in Larger Cities on the Way

Home sales in larger cities may slowly recover in 2H as local municipal governments have relaxed property-purchase curbs in past weeks, and this is set to bring new buyers to the table in coming months. Better records of inventory absorption in the cities could support a rebound of market sentiment encouraged by provincial governors. The property backlogs in Xian, Jinan, Chongqing, Shenzhen, and Changsha covered only 6-10 months of sales through last year.

3. Developers' Sales Divergences May Persist

Chinese developers with hefty land-bank exposure to cities mentioned in the exhibits above may deliver better-contracted sales in the coming months, but this may be limited to companies with state ownership and private firms with good reputations, given homebuyers' concern about new-home completion in the next 2-3 years.

Yuexiu's 65% land-bank exposure to cities with the potential for near-term sales rebounds sits at the high end, followed by Jinmao's 48%, COLI's 46%, Longfor's 40%, and CIFI's 38%. Country Garden and Seazen may struggle to boost sales in 2H with less than 20% land-bank exposure to those cities.

KWG, Sunac, and Shimao may find it difficult to lift sales even though 35-49% of their land banks are located in the cities mentioned above, as their liquidity problems could deter potential purchasers.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment