Robust credit market is denting stock investors now

Credit is often served as a bellwether of corporate health and tends to lead other markets. This time, however, stories have flipped when equity investors are facing a resilient credit market.

Based on a report from Bloomberg, the credit market is bludgeoning the stock market, suggesting that investors have priced in more aggressive interest rate hikes when the bar is that much higher for the Fed to back down from its plan to withdraw liquidity from the financial system. Instead, bond investments gradually come to the spotlight, considered a better hedge than equity to slower economic growth and faster inflation.

Healthy credit market fends off significant default risk

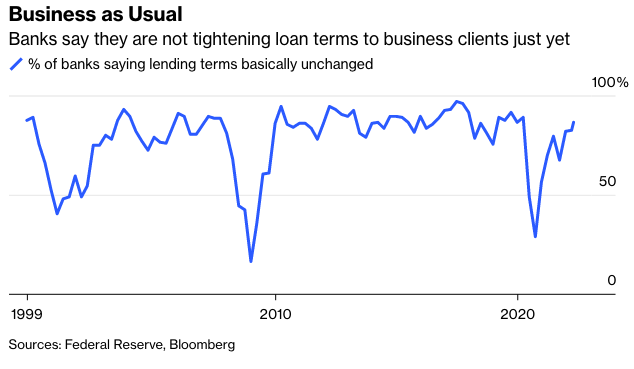

Bond investors don't have to worry about a significant risk in default rates after the Fed prioritized its mission to bring inflation down. No banks reported notably tightening lending standards in the latest survey, even with concerns about a slowing economy. Lenders have confidence because corporate balance sheets are in some of the strongest positions in 20 years, after they refinanced a significant amount of their obligations on historically low rates, pushing out maturities years into the future.

Besides, yield rises on US investment-grade bonds and high-yield, high-risk, or junk bonds are largely due to a broad repricing linked to higher rates on US Treasury rather than worries about deteriorating credit quality and potential defaults. And yield spreads on corporate bonds, despite recent hikes, are still fat off panic levels.

Surging bond returns are luring back stock investors

Stocks are getting buffeted by yields rising in the credit market, making equities less valuable on a risk-adjusted basis. For example, the $S&P 500 Index(.SPX.US$'s dividend yield is near the lowest since May 2019 relative to real 10-year Treasury yields, which have climbed to 0.18% from as low as negative 1.08% in March.

Therefore, there is no credit crisis, and corporate bond investors are finally earning the income they've been craving with little risk of not being paid in full and on time. But for stock investors, the picture has shifted in the opposite direction, with the Fed seemingly unlikely to back away from its monetary-tightening plans in the face of such a buoyant credit market.

Source: Bloomberg

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

lauracky : ok

Degenerate Doc : Lmao