Can Asean unicorns keep up the momentum they had last year?

Bain released its 2021 report on the South-east Asia PE market on Tuesday (May 10), saying that Southeast Asian unicorns faced a great "re-rating" in 2021 as they moved into public markets and suffered from the global hit to high-growth tech stocks.

PE activity in South-east Asia rebounded from the lows of 2020 to record growth in deal count, recording 81% year-on-year growth and leading the Apac sector. During the time, giants such as $Sea(SE.US$, $Grab Holdings(GRAB.US$, Bukalapak and Goto went public but have since seen their share prices drop.

Singapore drove the growth of exits in 2021, notably with Grab's US$4.3 billion SPAC IPO in November 2021 accounting for the bulk of the US$8 billion exit value in South-east Asia.

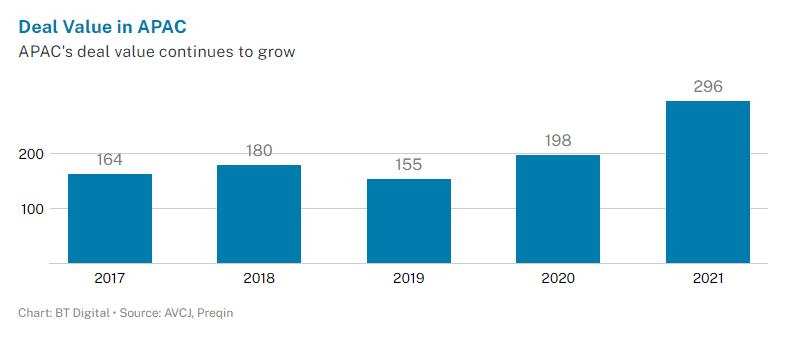

Asia now makes up slightly over 25% the global PE market with US$1.7 trillion in assets under management. Deal value in Apac grew accordingly, reaching US$296 billion from US$198 billion in 2020. Exit value has shot up to S$172 billion from US$83 billion a year prior. South-east Asian deal value hit a record US$25 billion from US$10 billion in 2020, while exit value grew to US$8 billion from US$3 billion.

The IT sector continue to dominate South-east Asia's PE deals, making up 57% of all PE deals in the region. But that dominance is waning a bit, as the sector has declined from a high of 66% in 2019.

Looking ahead, growth stage and late-stage startups are not likely to constitute the bulk of investments as it did in 2021. As a region, South-east Asia has not fared as well with exits, with fewer than anticipated happening in 2021.

The frothy valuations that startups have been enjoying aren't helpful either, and can impact exit strategies for investors in the region. Not having an obvious natural buyer is also another issue that the tech sector is facing in the region.

What do you say?

Do you think Asean unicorns can keep up the momentum they had before? Leave your comments!![]()

![]()

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment

102326563 : Biden is useless unlike Trump. Now Fed is pulling out their money that they put in 2020 during Trump.

Stock Watch 102326563: Agreed . Trump around good for stock markets

b34r : What does PE in the article refer to?

doctorpot1 b34r: private equity. so is those Venture Capital (VC), Angel investors, etc pumping money to startups.