Investing tips for the earnings season

- The decade-high CPI rattled the market.

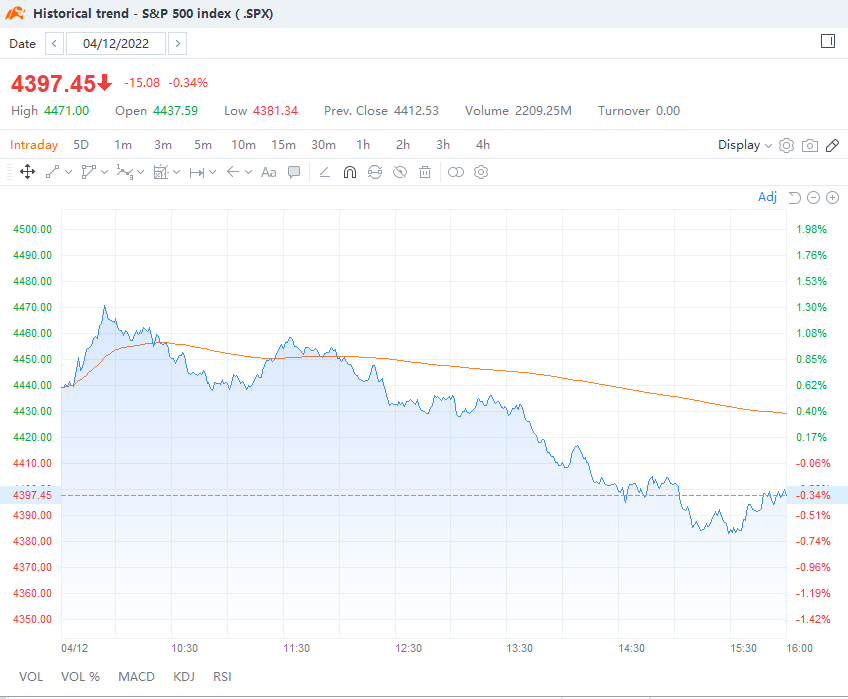

An eye-catching data released on Tuesday, April 12, 2022, put the market on some roller coaster rides in the U.S. trading session as the three major stock indexes edged higher after CPI beat expectations and plunged into negative territory to close out.

U.S. consumer prices rose 8.5% in March year over year, the fastest pace since December 1981, and above the Dow Jones estimate of 8.4%, according to official data.

Why is there such a brief market change? This is an indication of current market sentiment, broadly passive and cautious, ready to change course if there is any indication.

- How will it affect the market? Relief or grief?

The Consumer Price Index (CPI) is a measure that examines the weighted average of prices of a basket of consumer goods and services, such as transportation, food, and medical care.

Changes in the CPI are used to assess price changes associated with the cost of living.

The CPI is one of the most frequently used statistics for identifying periods of inflation or deflation.

The soaring CPI has undoubtedly spoken of the emergency and necessity of the Fed’s tightening measures to bring down inflation.

In the fact, the data showed that Fed rate hike premium eases from late 2022 into 2023 after March CPI, according to Bloomberg. However, modest rate hikes to combat inflation remain the tone in inflationary times, which may not affect how aggressive the Fed is, but not the course.

Richmond Fed President Thomas Barkin said rates should reach a neutral range as soon as possible, and they could rise above that range if price pressures persist, as reported by Bloomberg.

- How to deal with market fluctuations amid inflationary times?

A new round of earnings season is approaching. With complex headwinds complicating investment decisions, investors awaited financial results for any possible clues.

Would earnings help break out of the bear market, or does the bottom still take time to consolidate? What should investors do when the stock markets are full of volatility?

Good investments begin with attitude

Warren Buffett says when the stock market goes down, "don't watch the market closely", but stay calm and continue the holding.

Graham says there are two investing rules. The first one is "never lose money", and the second one is "never forget" the first rule.

Peter Lynch says a stock market crash is the best opportunity to make big money: great wealth is often created in such crashes.

Practical trading strategies prepared

However, theories usually lose efficacy when applied to practices. Therefore, trading requires a more practical strategy.

Scenario 1: The stock price has fallen to your holding cost

Tips: Cautious investors should leave the market while aggressive ones should set stops according to your trading rules and make no further decisions until the trend is clearer.

Don't blindly chase the market to sell and avoid impulse trades.

Scenario 2: You start to lose money

Tips: A case-by-case analysis is required for a complicated situation. If a stock is bought by many funds, it’s better to hold positions and adjust positions according to the market environment than to blindly cut positions.

Some investors tend to see a correction as an opportunity to lower the costs. (But not for extreme situations like prolonged bear markets or market crashes).

If a stock is easily manipulated by large investors or has a low trading volume, ordinary investors with limited information are better off liquidating or reducing their positions accordingly.

Scenario 3: Half stocks, half cash

Tips: If stocks in your portfolio are profitable, it is best to take profits and cash out while the market trend is still subdued. After all, market opportunities are reserved for those with cash.

However, if you are losing money, it would be a time to buy more quality stocks when the downward trend is subdued. Some investors will day trade to profit from the pullback because realized gains are real profits.

Scenario 4: With abundant cash

Tips: Aggressive investors who like to trade on trends and charts could grab the chance to buy dips and sell highs. Remember, never forget your original trading motivation - short-term trading for rebound gains.

- The bottom line

If you don't have your trading rules and expectations in place, you shouldn't act rashly. Strategies require practice to achieve good results. If you’re concerned about actual trading, you can try paper trading first.

Also, while trading strategies often have an impact on your portfolio in the short term, investors should focus more on finding undervalued stocks that may offer greater potential returns in the long run.

Just like what Peter Lynch said, a stock market crash is the best opportunity to make big money.

You might like:

How to identify potential tops and bottoms using technical analysis

You might like:

How to identify potential tops and bottoms using technical analysis

Moomoo Learn plans to roll out a course on How To Find Undervalued Stocks In A Bearish Market. Share with us your interest in suchlike courses.

For more investment knowledge and trends, go to Learn on moomoo.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

HarDWireD : as much comprehend able info as possible. this is like learning another language. while juggling. and wondering why am I juggling put down the knives.

Ramidon Decatur alur : waiting for my financial situation to change. my school put it in black and white, I need to change my living arrangements.

KillaKobe314 : Let’s get it