Dividend investing is back. Why and how to invest?

- Dividend stocks investing is back in the market

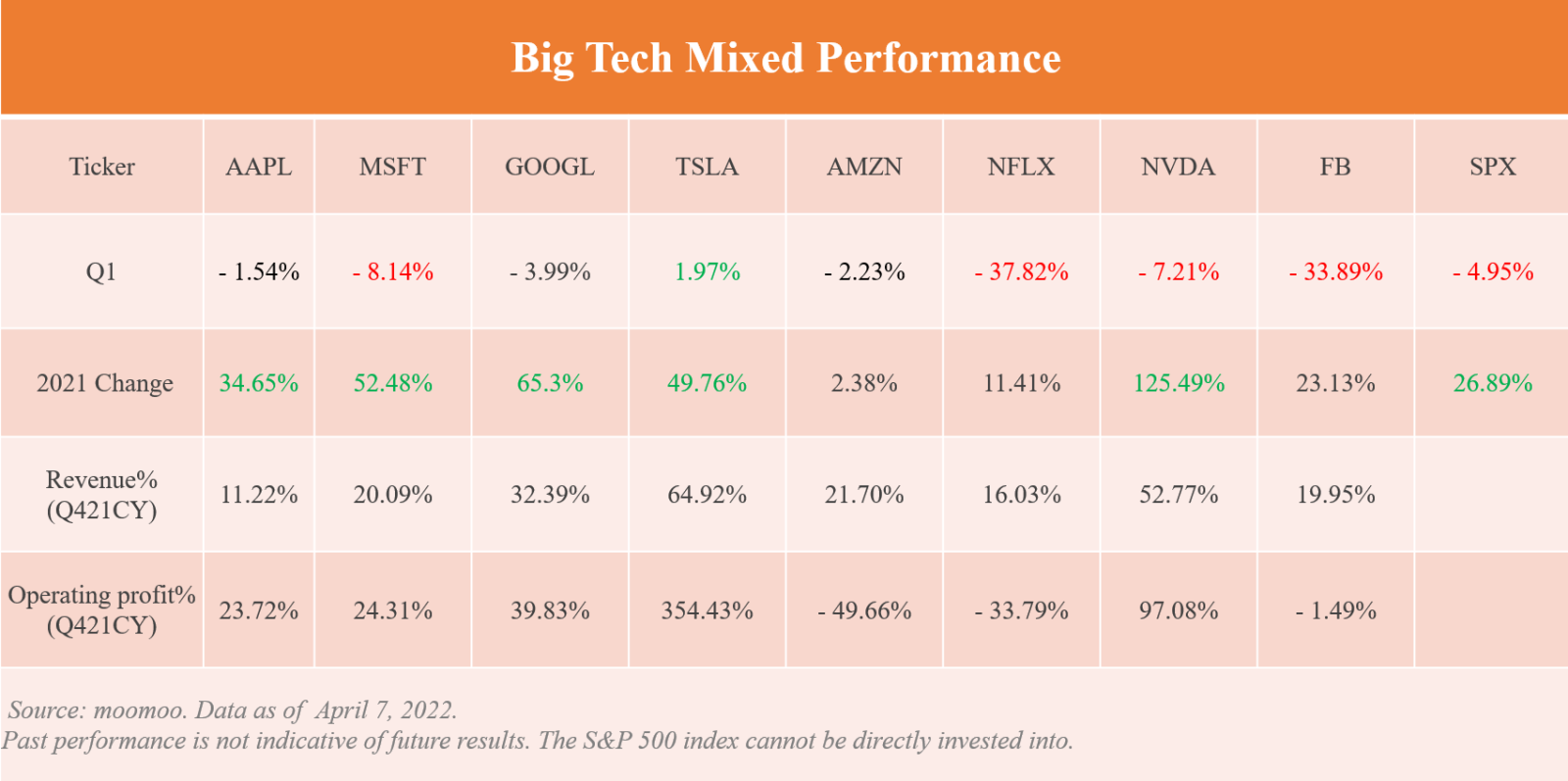

How to survive a volatile market has been on investors' minds since an uneven start to 2022. The market has ended Q1 in the negative territory with the $S&P 500 Index(.SPX.US$ down 4.95% and mixed big tech performance.

Multiple headwinds disrupted the stock and bond markets. Investors have become more vulnerable and therefore more sensitive and conservative in investing amid the chaos of high inflation, a tenacious war in Ukraine and a resurgent pandemic and, more importantly, an unstable geopolitical environment.

A survey by CNBC finds that professional investors' attention to dividend stocks is back.

* Polled 400 chief investment officers, equity strategists, portfolio managers and CNBC contributors who manage money about where they stood on the markets for the rest of 2022. Data published March 30, 2022.

When asked “what are you most likely to buy now?,” the percentage of stocks paying high dividends, or 30%, leads the way.

When asked “what are you most likely to buy now?,” the percentage of stocks paying high dividends, or 30%, leads the way.

- Understanding dividend stocks

Companies could distribute a portion of their profits as dividends or retain an amount to reinvest in the business or both.

Dividends can be paid in cash or additional shares. Most dividends are paid quarterly, but some are paid monthly, annually or even as a special dividend.

The dividend yield is the financial ratio that measures the amount of cash dividends paid out to shareholders relative to the stock price per share.

Dividend Yield

= Annual dividend per share / Stock price per share * 100%

- Why invest in dividend stocks

An income stream

The main purpose of a dividend yield portfolio is not to outperform the broad market but to generate a regular and passive income stream that is reliable, and has the potential to grow in the future.

Risk management

In general, stocks that have a strong history of dividend payout belong to mature companies with stable earnings, which may be less susceptible to large swings in the market.

In general, stocks that have a strong history of dividend payout belong to mature companies with stable earnings, which may be less susceptible to large swings in the market.

Those above are benefits related to investors. For a company, a reasonable payout ratio and dividend yield can be a boost to the stock price and an indicator of the company's good use of its cash reserves.

It's worth mentioning, however, that high dividend yields don't always signal a good investment choice. Let's go back to the formula:

Dividend Yield

= Cash dividend per share / Stock price per share * 100%

The dividend yields are correlated to the cash dividend (payout ratio) and stock price(valuation).

For one thing, cash can be returned directly to investors or used to reinvest in the business. Higher yields could mean less money for future growth or limited dividend growth potential.

On the flip side, lower valuations may lead to higher dividend yields, but that could mean that the growth of these companies remains stable or stagnant or worse.

Therefore, avoid blindly pursing high dividend stocks and keep in mind that a sustainable business model, a long track of profitability, rising cash flows, good liquidity, a strong balance sheet should be taken into considerations as well. Last but not least, dividend investing is one of the protective investing strategies, and if your goal is to build a diversified and resilient portfolio, it's best not to be your only strategy.

- How to invest in high dividend stocks?

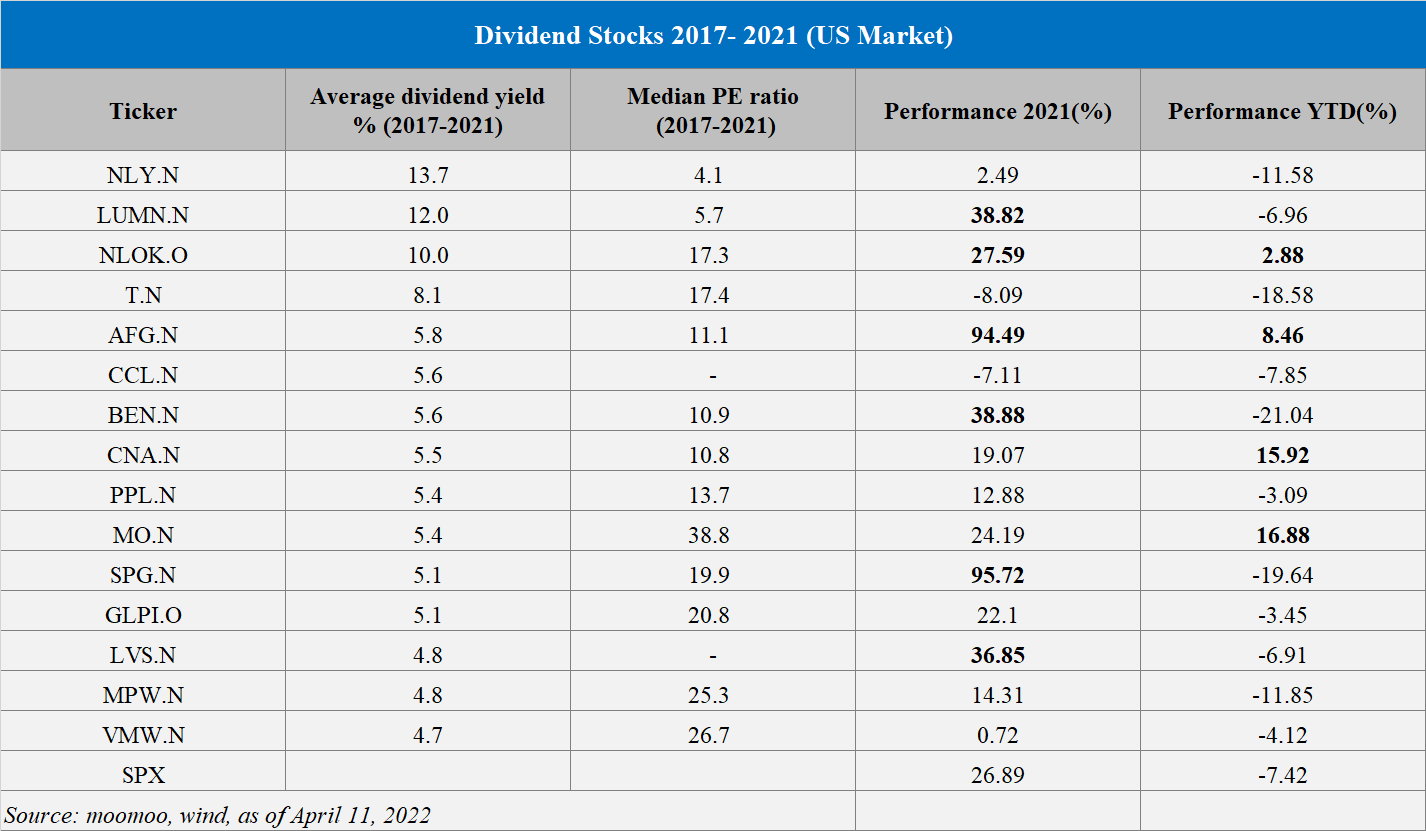

With stated above, moomoo Learn has put together a list of dividend-paying stocks that can help you start your own search.

Criteria:

Market Cap: US stocks with a market cap above USD 10 billion

Ranked by: Average Dividend yield over past five years

The above content is for stock screening reference only and should not be regarded as investment advice.

Dividend ETFs, mutual funds that invest in dividend stocks could be a better choice for investors who want your money to be managed and stocks picked by professional managers. Importantly, if it's a dividend fund, the company's choice to cut or suspend its dividend distribution has limited impact on your overall investment.

Dividend ETFs, mutual funds that invest in dividend stocks could be a better choice for investors who want your money to be managed and stocks picked by professional managers. Importantly, if it's a dividend fund, the company's choice to cut or suspend its dividend distribution has limited impact on your overall investment.

- How to search dividend stocks on moomoo?

Moomoo provides 3 easy ways to find dividend stocks:

1. Stocks screeners ( iOS)

Quotes-Markets-Opportunities-Stock Screener- Profitability-Dividend Yield

You can also search the indicator in the search bar

2. High Dividend List

Quotes – Markets-Opportunities-Featured List-High Div

3. Detailed Quotes Pages

Detailed Quotes- Summary Tab-Dividends. Take APPL as an example:

Can you figure out how to use these advanced tools to help you pick stocks? moomoo Learn plans to provide customized user guides for this purpose. Please follow us and stay tuned.

Latest courses: Why dividend investing is back?

For more investment knowledge and trends, go to Learn on moomoo.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

Mama Cass : FANTASTIC article and learning opportunity!!

I have several dividend paying companies in my retirement portfolio.

One of my favorite things about these investments are how the stocks with dividend reinvestment allow you to buy more of that stock 4x/yr without adding a dime.

Disney, IBM and AT&T are 3 that I bought over 30 years ago and watched grow to large share numbers simply thru dividend reinvestment/splits/etc.

The key is obviously to buy stocks that you'll hold onto. Dividends are paid to the shareholders of record by a specific date - buy late you miss that quarter, same if you sell before that date (even if you've owned for years).

71403390 : Then why did GameStop stock fall when it was announced bahahahaha you guys suck!

Moomoo LearnOP : We want your advice: GIF or video guide, which one do you prefer?

Zequalizer : These stocks are set to outperform over the next few years as we enter a period of fast rising interest rates

steady Pom pipi Moomoo LearnOP: Kids make choices. I want them all.

But GIF is so fresh, it's a good choice.

71085325 Mama Cass: $Amazon (AMZN.US)$

Moomoo LearnOP steady Pom pipi:

71576866 : so they can touch things but you're not supposed to take your s***

FBI888 Moomoo LearnOP: Personally, I prefer GIF

Ben Goh2 : passive income is the way to.financial.freedom

View more comments...