IPO-pedia | Insurer giant AIG's life and retirement unit files for IPO

Global insurance company American International Group (AIG) has made good on plans to separate out its life and retirement business. SAFG Retirement Services, the parent of $American International Group(AIG.US$ 's life and retirement unit, has filed for an initial public offering on this Monday.

SAFG didn’t disclose how many shares it would sell or their price range, according to a filing Monday. The company plans to trade on the New York Stock Exchange under the ticker CRBG.

JP Morgan, Morgan Stanley, and Piper Sandler are the joint bookrunners on the deal.

Business Overview

SAFG is one of the largest providers of retirement solutions and insurance products in the United States, committed to helping individuals plan, save for and achieve secure financial futures.

Its addressable markets are large, with powerful, long-term secular trends given an aging U.S. population and a growing need for retirement solutions.

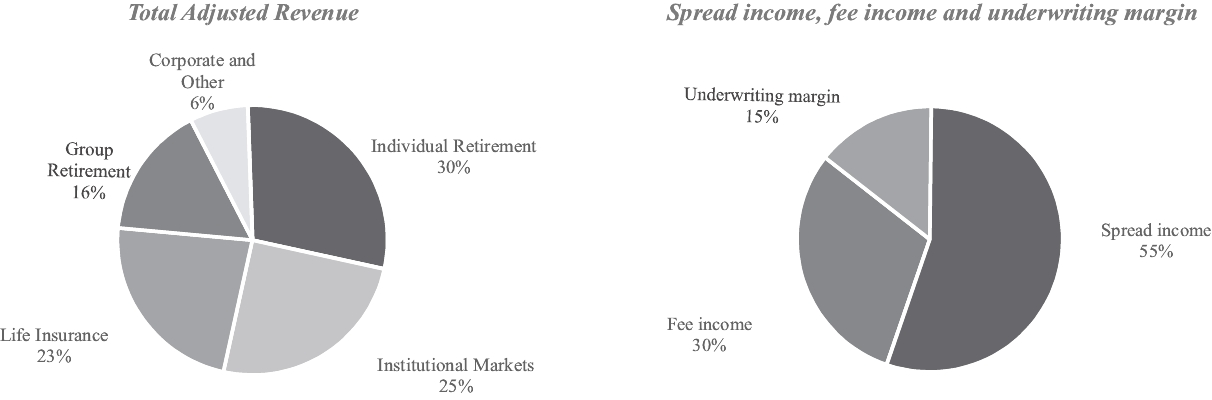

The company offers a broad set of products and services through Individual Retirement, Group Retirement, Life Insurance and Institutional Markets businesses.

The four businesses collectively seek to enhance stockholder returns while maintaining attractive risk profile, which has historically resulted in consistent and strong cash flow generation.

AIG first announced the decision to separate its life insurance and retirement businesses from its property and casualty operations in 2020, years after activist investors targeted the company for a break-up.

The insurer said last year that it began to retool its underwriting in 2017 to make its core business more profitable. The process was largely complete and it was now pivoting to focus on growth.

Financial Performance

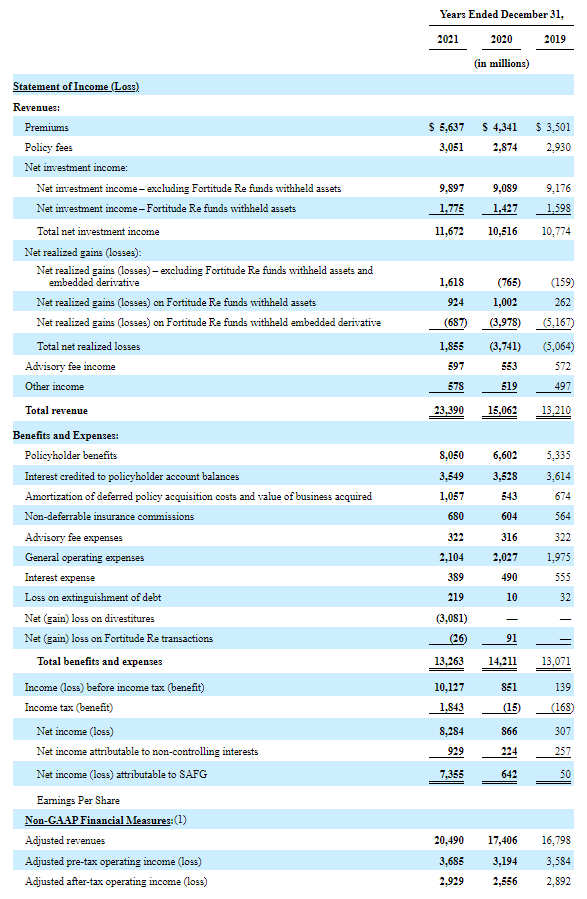

In the filing, SAFG's total revenue increase 55% year-over-year to $23.39 billion for the year ended Dec. 31. In the same period, the company reported adjusted after-tax operating income of $2.93 billion, up 14.5%.

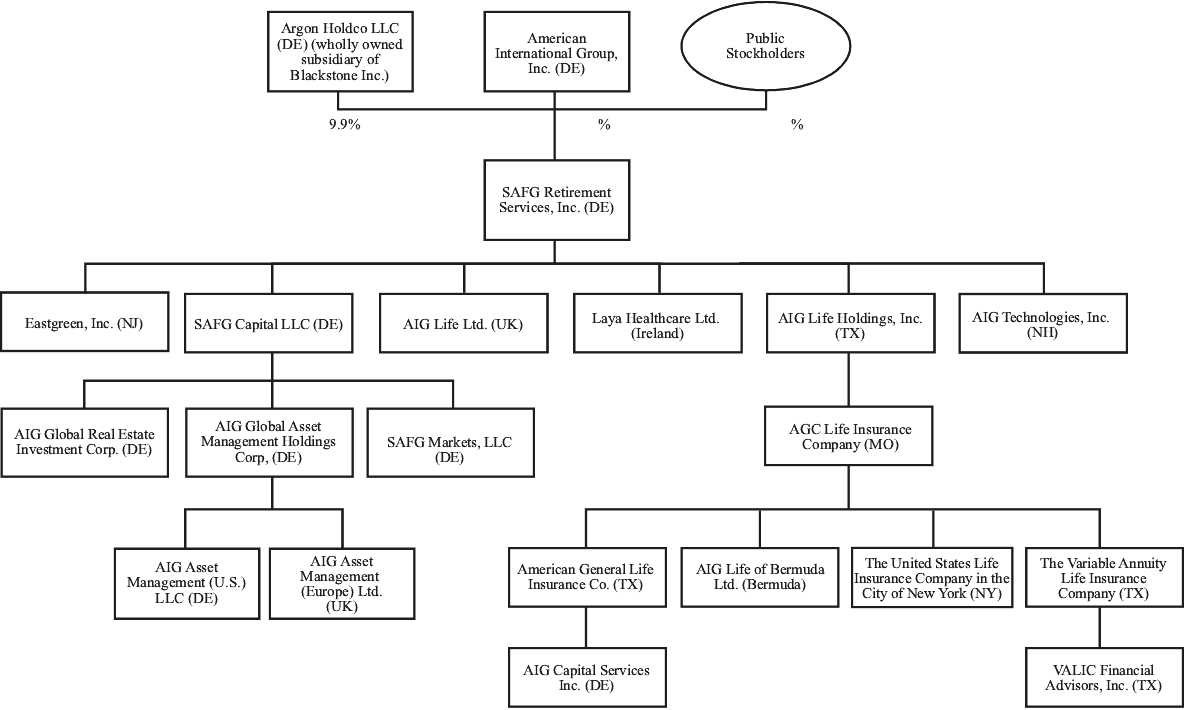

According to the prospectus, following the IPO, AIG will continue to hold a majority of SAFG's outstanding common stock, and as a result AIG will continue to have control of SAFG's business.

$Blackstone(BX.US$ will hold approximately 9.9% of SAFG's common stock after the consummation of the Reorganization and this offering.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment

Cbmshen : keke

搞经济 抄底 加仓 : Good moves. Taking too much heat from Covid hospi/death claims (Life Ins) The impact are yet to reach its peak. Indeed Business Ins are much profitable ^ Good split ^