SAFETY IN A CRAZY MARKET?

Some charts on ETFs performing well.

what is an ETF: https://www.investopedia.com/terms/e/etf.asp

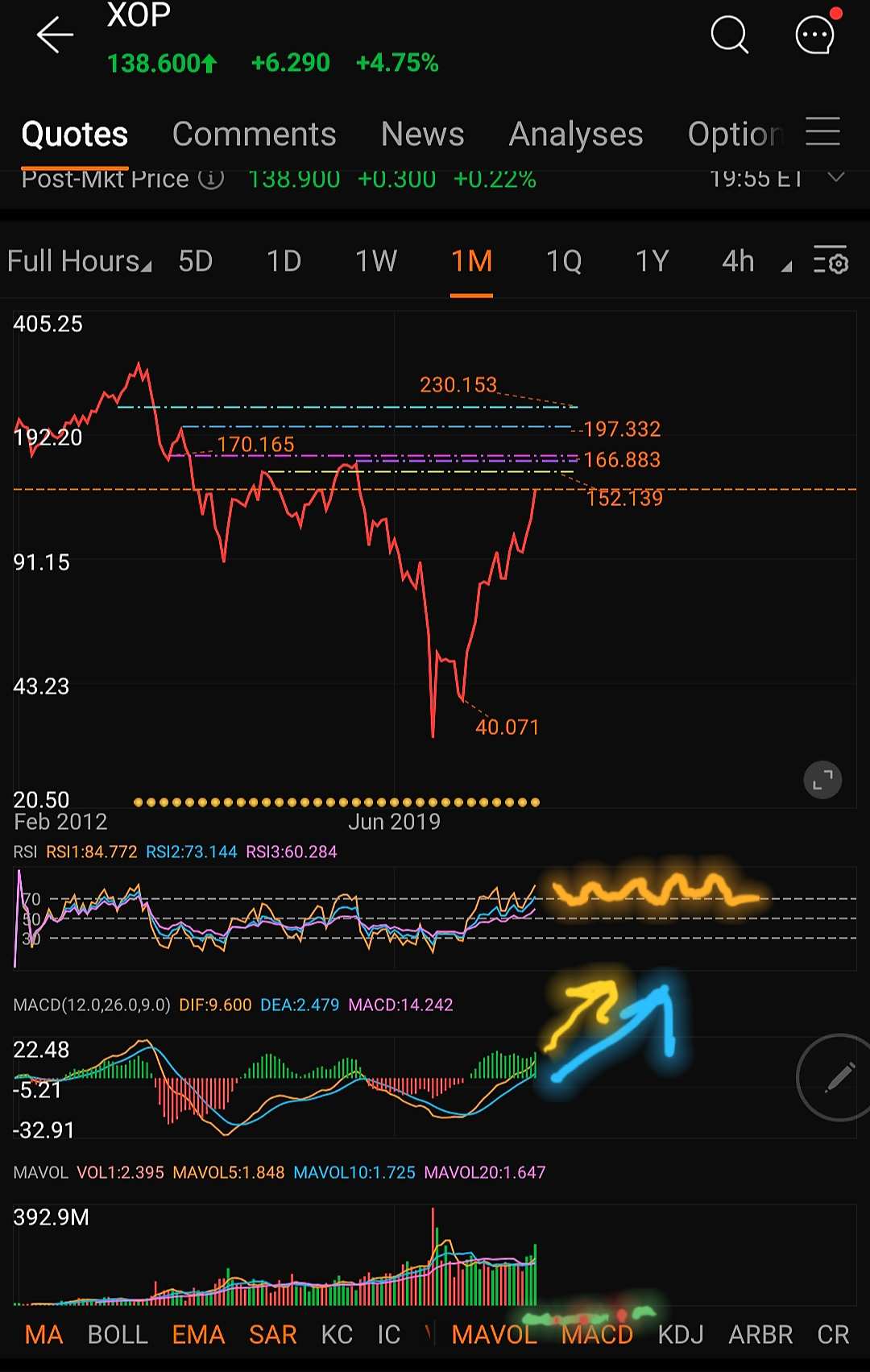

$SPDR S&P Oil & Gas Exploration & Production ETF(XOP.US$ This is a basket of pipeline operators, gas explorers, and refiners. No single position is more that 3% so it is a very diversified oil and gas ETF. It pays a quarterly dividend (the last few have been around .48). Showing the monthly and weekly charts because these are ETFs and long holds (especially now)

what is an ETF: https://www.investopedia.com/terms/e/etf.asp

$SPDR S&P Oil & Gas Exploration & Production ETF(XOP.US$ This is a basket of pipeline operators, gas explorers, and refiners. No single position is more that 3% so it is a very diversified oil and gas ETF. It pays a quarterly dividend (the last few have been around .48). Showing the monthly and weekly charts because these are ETFs and long holds (especially now)

145 for the first resistance, then you can see other resistance points as the trend continues. This shows no signs of slowing, in fact it looks to me like it wants to run and break into the upper channel. If it does 300 is not off the table.

$VanEck Oil Services ETF(OIH.US$ This oil ETF is over 32% 2 companies in its basket. $Schlumberger(SLB.US$ & $Halliburton(HAL.US$ The fuel of the war machine (every politician owns these). Pays a yearly dividend around a dollar but ZIM just payed 17 dollars so???? if these companies keep making money the way they are they will return it to investors.

$VanEck Oil Services ETF(OIH.US$ This oil ETF is over 32% 2 companies in its basket. $Schlumberger(SLB.US$ & $Halliburton(HAL.US$ The fuel of the war machine (every politician owns these). Pays a yearly dividend around a dollar but ZIM just payed 17 dollars so???? if these companies keep making money the way they are they will return it to investors.

Look at that bottom and then reversal (it matches the US election![]() )

)

Breaking into the upper channel. I don't know what to say, see you at 400!

$Energy Select Sector SPDR Fund(XLE.US$ Now the black gold companies- 45% of XLE is $Exxon Mobil(XOM.US$ & $Chevron(CVX.US$ They are not what they were 20 years ago, the last administration made them trim and become better ran and more efficient/effective, and now without willingly hemorrhaging money they are making loads of it. Pays a quarterly dividend around .70 and again I expect these dividends to increase.

$Energy Select Sector SPDR Fund(XLE.US$ Now the black gold companies- 45% of XLE is $Exxon Mobil(XOM.US$ & $Chevron(CVX.US$ They are not what they were 20 years ago, the last administration made them trim and become better ran and more efficient/effective, and now without willingly hemorrhaging money they are making loads of it. Pays a quarterly dividend around .70 and again I expect these dividends to increase.

This has broken the all time high of 72, so where it goes is anyone's guess, its creating it's own support and resistance. Ride the wave!

$SPDR S&P Metals & Mining ETF(XME.US$ The XME, no position is higher than 5% of the basket. It's made up of mostly 🏗 STEEL🏗 companys. The largest holding being my favorite $Cleveland-Cliffs(CLF.US$ It also holds over 10% in energy companies, because steel prices depend on energy prices so you might as well have both, like XME and XLE![]() . Pays a quarterly dividend of about a nickel (.05) but there are more than rumors that the steel companies will once again bring back the dividends

. Pays a quarterly dividend of about a nickel (.05) but there are more than rumors that the steel companies will once again bring back the dividends![]()

$SPDR S&P Metals & Mining ETF(XME.US$ The XME, no position is higher than 5% of the basket. It's made up of mostly 🏗 STEEL🏗 companys. The largest holding being my favorite $Cleveland-Cliffs(CLF.US$ It also holds over 10% in energy companies, because steel prices depend on energy prices so you might as well have both, like XME and XLE

What to say. MOON!!!!

"Earth we have lift off, the pull of gravity is weak and all I see is green"

hope this helps @TinkerB3ll

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment

iamiamOP : @LuckyPiggie here is a little explanation of the ETFs

LuckyPiggie iamiamOP: Thank you @iamiam i have some of these in my watchlist like Hal and Zim. You mainly play on the etf ?

like Hal and Zim. You mainly play on the etf ?

i used them as a guide to track oil and gold price. Many of the stocks themselves are at ATH... so wasnt sure to enter or wait.

For O&G , was looking at Exonn , Shell and BP and others etc .

For metal, Paan Barrick , Sibanye , Vale.