Here's a breakdown of how the Fed's expected rate hike will impact your portfolio

The Federal Reserve will raise interest rates this week for the first time since 2018. It's probably not going to stop there.

With a 25 basis-point hike expected by the market on Wednesday, investors will be looking for clues from Chair Jerome Powell as to what will follow with the so-called dot plot of projections likely to draw eyeballs.

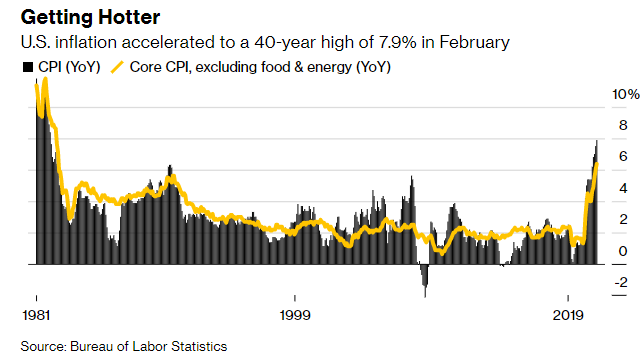

Federal Reserve Chair Jerome Powell and the rest of the fed are preparing for a complicated task: They're trying to increase interest rates to change the upward trending of inflation without crashing the U.S. economy into a recession.The ideal result would be the so call "soft landing" by economists.

What's a soft landing and why?

It's basically the Fed's main job over the past few months: Slow the economy enough to cool down demand and rein in sky-high inflation, without triggering a contraction in gross domestic product and a rise in unemployment. The fed would need both smart policy making and luck to accomplish such objective.

Historical Impact of Rate Hikes

Stock Market

In the past three decades, the Fed has taken on four isolated rate hike cycles. None have weakened the equity markets. As of technology industry, which has seen wild swings this year amid the faster rate increases, has normally been the best-performing S&P 500 sector over all 4 cycles, with an average annualized return of 20.6%. But overall, leadership varies with no sector outperforming in all four instances, the data show.

Commodity

The following chart illustrating the inverse relationship between interest rates and commodities: when interest rates increase, commodities prices decrease; when interest rates decrease, commodities prices increase. That is because of the cost of carrying—the costs associated with holding inventory.

Housing

While not completely mirroring each other over the past 5 years, home values rocketed when interest rates lowered in 2020.

A similar pattern could occur this year with the fed expected to begin its first interest rates cycle, with housing prices projected to grow at a lesser pace rather than fall instantly considering the high demand.

Sources: Fred St. Louis, Bloomberg, thebalance

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

High Profit Low Loss : Good, balancing the supply v demand!