ETF inflows top $1 trillion for first time

A historic surge of cash has swept into exchange-traded funds, spurring asset managers to launch new trading strategies that could be undone by a market downturn.

This year's inflows into ETFs world-wide crossed the $1 trillion mark for the first time at the end of November, surpassing last year's total of $735.7 billion, according to Morningstar Inc. data. That wave of money, along with rising markets, pushing global ETF assets to nearly $9.5 trillion, more than double where the industry stood at the end of 2018.

Most of that money has gone into low-cost U.S. funds that track indexes run by Vanguard Group, $Blackrock(BLK.US$ and $State Street(STT.US$, which together control more than three-quarters of all U.S. ETF assets. Analysts said rising stock markets, including a 25% lift for the S&P 500 this year, and a lack of high-yielding alternatives have boosted interest in such funds. $Fidelity Blue Chip Growth Etf(FBCG.US$ $SPDR S&P 500 ETF(SPY.US$

You have this historical precedent where you have tumultuous equity markets, and more and more investors have made their way to index products.”

--- said Rich Powers, head of ETF and index product management at Vanguard.

--- said Rich Powers, head of ETF and index product management at Vanguard.

Follow me to know more about ETFs![]()

![]()

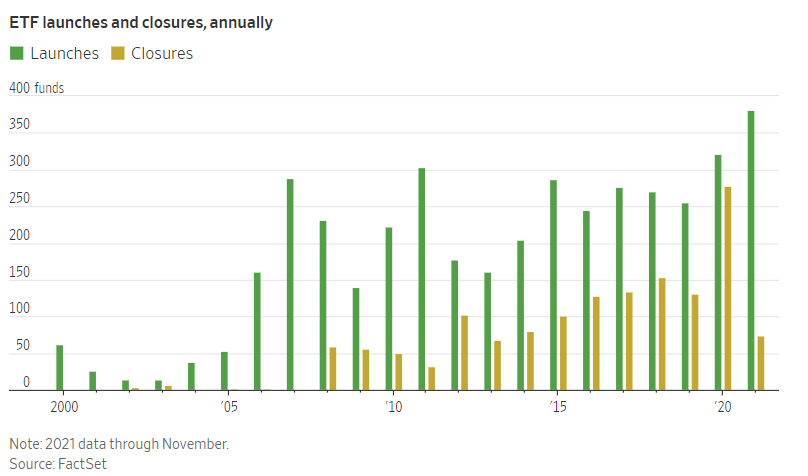

Asset managers long known for running mutual funds are rushing to take advantage of investors' interest in active ETFs. More than half of the record 380 ETFs launched in the U.S. this year are actively managed.

--- according to FactSet.

--- according to FactSet.

Fidelity, Putnam and $T. Rowe Price(TROW.US$ are among the firms that have rolled out actively managed ETFs in 2021. Firms new to ETFs have also entered the fray. The top 20 fastest-growing ETFs, largely run by Vanguard and $Blackrock(BLK.US$, this year pulled in nearly 40% of all flows, charged an average fee of less than 0.10 percentage point and tracked benchmarks of some sort.

Many active ETFs remain comparatively small and charge fees higher than passive funds, putting a swath of new products at risk of closing over the next several years. ETFs usually need between $50 million and $100 million in assets within five years of launching to become profitable, analysts and executives say; funds below those levels have tended to close.

Of the nearly 600 active ETFs in the U.S., three-fifths have less than $100 million in assets; more than half are below $50 million.

--- according to FactSet data.

--- according to FactSet data.

You' re going to see a lot of those firms take a hard look at their future.”

--- said Elisabeth Kashner, FactSet’s director of ETF research.

--- said Elisabeth Kashner, FactSet’s director of ETF research.

Analysts also said the success of ARK Investment Management Chief Executive Cathie Wood in 2020 showed how active ETFs can score big returns and pull in substantial sums of money. Several of ARK's funds doubled last year, and its assets approached $60 billion earlier this year, though many of its bets have slumped in 2021. $ARK Innovation ETF(ARKK.US$ $ARK Genomic Revolution ETF(ARKG.US$

Most other active managers aren't doing much better. Two-thirds of large-cap managers of mutual funds have fallen short of benchmarks this year, while roughly 10% of the 371 U.S. active ETFs with full-year performance data are beating the S&P 500. More than a third are flat or negative for 2021.

Did you invest in ETFs this year? How was your return?![]()

![]()

Source: Wall Street Journal

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment

Winner01 :

tangobravoromeo : which ones!??

Shawn Threeton9 : some one has hacked my shit and stolen everything

DeShawn W Keys : Put it writing

ur wifes boyfriend Shawn Threeton9: what

ur wifes boyfriend : you never deposit or bought any looking at ur badges

Giovanni Ayala : Oww! Yess! Let's Goooo!!