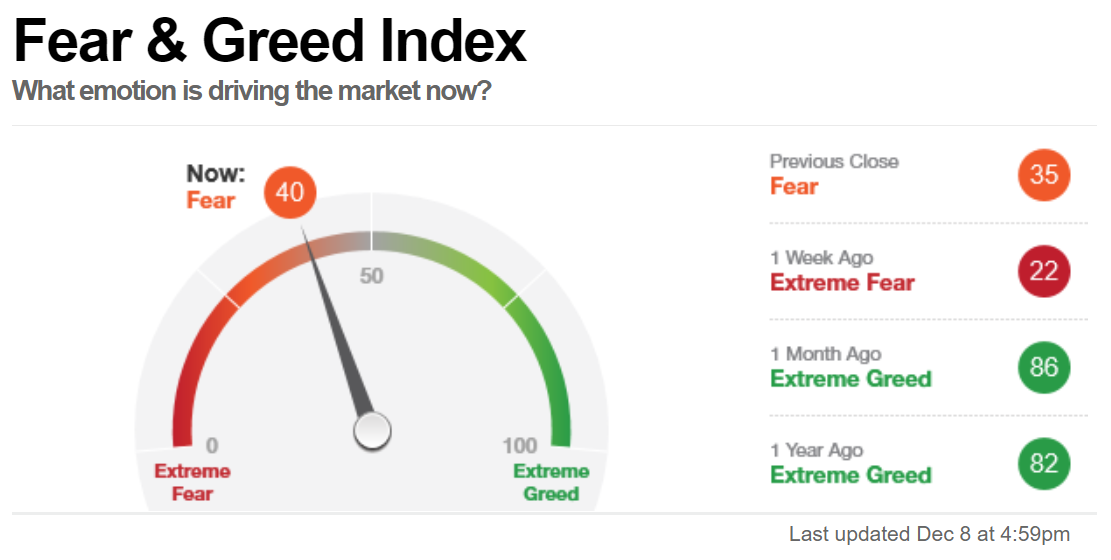

Market temperature (12/9)

The fear and greed index was developed by CNNMoney to measure two of the primary emotions that influence how much investors are willing to pay for stocks.

The fear and greed index is measured on a daily, weekly, monthly, and yearly basis. In theory, the index can be used to gauge whether the stock market is fairly priced. This is based on the logic that excessive fear tends to drive down share prices, and too much greed tends to have the opposite effect.

Be fearful when others are greedy. Be greedy when others are fearful.

---Warren Buffett

---Warren Buffett

Fear & Greed Index

What emotion is driving the market?

What emotion is driving the market?

Junk Bond Demand: Extreme Greed

Investors in low quality junk bonds are accepting 1.79 percentage points in additional yield over safer investment grade corporate bonds. While this spread is historically high, it is sharply lower than recent prices and suggests that investors are pursuing higher risk strategies.

Last changed Dec 3 from a Greed rating.

Market Momentum: Extreme Greed

The S&P 500 is 5.40% above its 125-day average. This is further above the average than has been typical during the last two years and rapid increases like this often indicate extreme greed.

Last changed Dec 7 from a Greed rating.

Market Volatility: Neutral

The CBOE Volatility Index (VIX) is at 19.90. This is a neutral reading and indicates that market risks appear low.

Last changed Dec 6 from an Extreme Fear rating.

Source: CNNmoney

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

JohnnyPapa454 : Nice