How Stock Chart Patterns are Used in Trading?

Stock chart patterns are tools commonly used by investors and traders who are looking to understand market patterns. Forming the basis of technical analysis, stock chart patterns can be used alongside a wide range of technical indicators and tools in order for traders to build insights and strategy around stock patterns, past performances and emerging trends.

Moomoo is an online stock broker that offers a robust mobile and desktop trading platform to millions of users around the globe. With advanced research and stock charting tools, beginner and experienced investors alike can make the use of stock chart patterns within moomoo’s apps in order to maintain and develop their investment strategies and market approach.

What are Stock Chart Patterns?

Stock chart patterns are the shapes formed within price charts that indicate what a stock price is likely to do next, based on its past behavior. There is no single superior chart pattern, with a variety of stock chart patterns useful in examining varying trends across different markets. Chart patterns can provide comprehensive frameworks that identify progress in the market between bullish investors and bearish investors, enabling technical analysts to forecast how the market is responding and moving. They can be viewed through either a short-term or long-term lens, informing the strategies of day traders and traditional long-term investors alike.

In 1932, Richard Schabacker published Technical Analysis and Stock Market Profits, the basis of modern stock chart pattern analysis. In this formative book, Schabacker stated:

‘The science of chart reading… is not as easy as the mere memorizing of certain patterns and pictures and recalling what they generally forecast. Any general stock chart is a combination of countless different patterns and its accurate analysis depends upon constant study, long experience and knowledge of all the fine points, both technical and fundamental, and, above all, the ability to weigh opposing indications against each other, to appraise the entire picture in the light of its most minute and composite details as well as in the recognition of any certain and memorized formula.’

It’s important for investors to remember that while technical analysis helps to forecast market outcomes, all trading carries inherent risk within it. Patterns can also be open to subjective interpretation, with multiple traders spotting different levels of risk or opportunity within the same pattern. This means that stock charting patterns must be considered within a wider market context in order to serve individual investment strategies.

Generally speaking, there are two major forms of patterns, with chart patterns taking the form of one or the other. The first, continuation patterns, indicating pauses in trends, forecasting that the previous direction will continue after some time; the second, reversal patterns, point to changes of trends that can be allocated into either top or bottom formations.

Trend Lines in Technical Analysis

Trend lines are used by technical analysts to investigate directions in stock prices, with trends identifying where they may be able to enter the market and make a profitable trade. Trend lines are formed when a minimum of two points on a price chart are connected by a line, with traders able to set specific periods and indicators in order to personalize their trend lines.

What do different Chart Patterns mean?

Different chart patterns speak to different takeaways for traders, with some patterns more useful in bullish markets, and others more suited to bearish markets. Sophisticated traders understand the importance of knowing the most suitable chart pattern for their particular market, as the application of the wrong chart could lead to missed opportunities within their investment strategies.

Why is it important to analyze Chart Patterns?

Chart Patterns are based on methods which have been carefully tested in order to prove their usefulness to investors. They reveal factors that are necessary to consider in building a strategic investment approach, including calculations around where to enter a market, how to set appropriate stop-loss orders, and viable profit targets.

How to Recognise Chart Patterns

Learning to identify chart patterns is a fundamental part of putting them to use across your investment portfolio. For beginners, recognizing chart patterns can be difficult, so learning how to navigate popular patterns is foundational in developing ongoing trading skills.

Once you’ve built the necessary skills to recognize chart patterns, these can become a core part of your ongoing technical analysis, providing you with key indicators that support a robust ongoing investment strategy.

Types of Stock Chart Patterns

Learning how to identify different types of stock chart patterns? Here’s your easy guide!

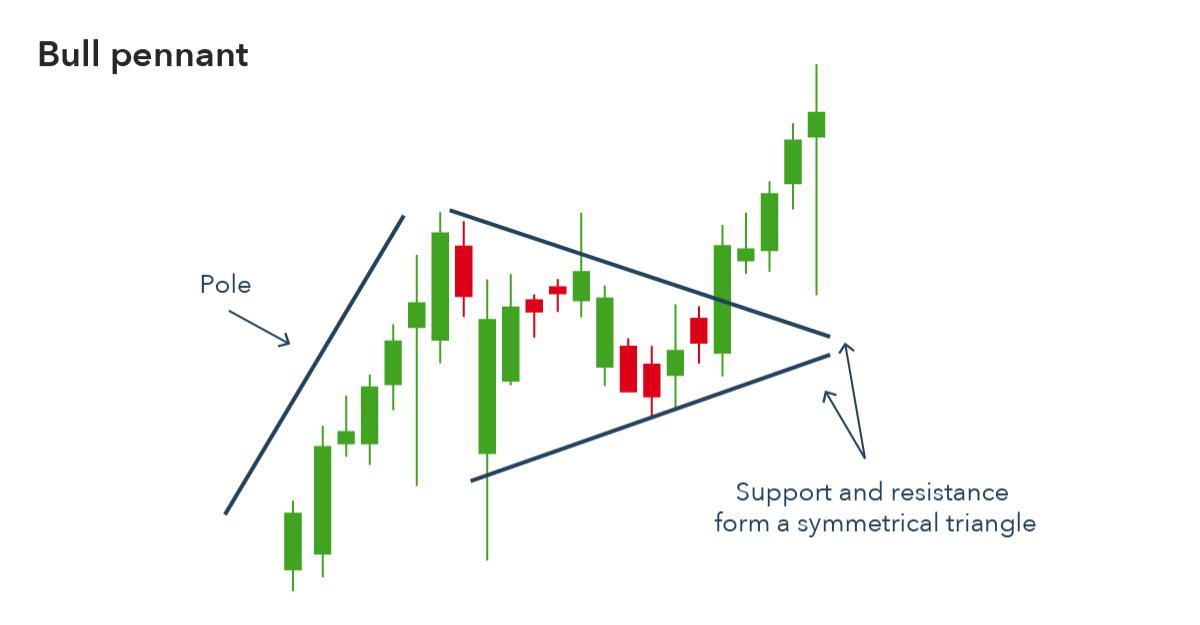

Pennant

A pennant chart pattern is a continuation pattern, shaped with two trendlines converge. These trendlines move in two different directions, with one being a down trendline and the other an up trendline. It’s common for the stock volume to decrease during the formation of the pennant, which is often followed by an increase due to a price break out.

Bullish pennants may indicate the continuation of upward trending prices, while bearish pennants tend to indicate the continuation of downward trends.

Flag

A flag chart pattern is another form of continuation pattern that is formed with two parallel trendlines that slope up, down, or horizontally. These form the loose shape of a flag. Flags with upward slopes (bullish flags) are often identified as a pause within a down trending market, while a flag with a downwards slow demonstrates a break in an up trending market. It’s common for declining volume to be present when a flag is formed, which then bounces back as the price steps outside of the flag pattern.

Wedge

This form of continuation pattern is similar to a pennant pattern, but is differentiated by the fact that both trendlines move in the same direction, whether that’s up or down. A wedge chart pattern is useful in identifying either pause in an uptrend (when angled down) or momentary interruptions in falling markets (when angled up). In this pattern, it’s also common for volume to reduce during the pattern’s formation, and then to increase once the price has broken above or below the pattern’s parameters. One of the key differences of a wedge pattern, when compared to triangles or pennants, is they solely reflect upwards and downwards price movements, resulting in the appearance of an angled wedge.

Ascending Triangle

Ascending triangles are continuation patterns that identify trends across a specific entry point, profit target and stop loss level. Within an ascending triangle, there’s an intersection of the resistance line and the breakout line. This intersection identifies the potential entry point, displaying a bullish trading pattern.

Descending Triangle

The opposite of a descending triangle, this pattern demonstrates a decrease in demand, with a descending upper trend line that indicates a likelihood of a breakdown.

Symmetrical Triangles

This form of chart pattern is created when two trend lines converge toward each other, pointing to a breakout that’s likely to occur without an upward or downward trend. Traders can interrogate the potential size of the breakout or breakdown by looking at the height of the left vertical side of the triangle, which is often mimicked in the subsequent market movement.

Cup and Handle

This kind of bullish continuation pattern reveals where an upward trend has reached a pause that’s likely to continue when the pattern is confirmed. It’s named Cup and Handle because of the way its design looks like a cup with a handle, with the ‘U’ shape similar to a rounded bowl, rather than a ‘V’ shape, which points to equal highs on both sides.

The ‘handle’ which takes shape to the right of the cup shares a resemblance with a flag or a pennant chart pattern, pointing to a completion that may lead to a resumption of the stock’s trend even higher than before.

Head and Shoulders

A Head and Shoulders pattern isn’t a continuation pattern, but a reversal pattern, often making itself known at market tops or bottoms. Head and Shoulder patterns take the form of three pushes, including an initial high or low, followed by a second, larger high or low, before a final push that’s similar to the initial push.

When uptrends are interrupted by a Head and Shoulders pattern, it’s likely there may be a trend reversal that ends in a downtrend. On the other side of the equation, a downtrend that results in a head and shoulders bottom speaks to a potential trend reversal to an upside.

It’s common for stock volumes to decline across the course of this pattern’s development, before it bounces back as the price breaks either above or below the trendline.

Double Top and Bottom

These are more forms of reversal patterns that identify places where the market has made multiple unsuccessful attempts to break through either support or resistance levels. Double tops take the shape of the letter M, demonstrating a push up to a resistance level that’s quickly followed by a second, also failed, attempt. The result of this is a trend reversal.

Double bottoms are inverted, looking like the letter W and taking place when a price is trying to push through a support level without success, followed by a second unsuccessful attempt. The outcome of these attempts tend to be a trend reversal.

Gaps

Gaps (reversal patterns) take the shape you may assume by the name itself. They occur when there’s a gap between two trading periods that finds its roots in either a large increase or decrease in price. Traders can look at three main types of gaps…

Breakaway gaps - these are formed at the beginning of a trend

Runaway gaps - these form during the middle of a trend

Exhaustion gaps - these take shape near the end of a trend

How to use Charting Tool in the Moomoo App to draw trend lines

Moomoo gives investors and traders the tools they need to make the most of stock charting patterns. With advanced charting tools that can be customized to suit individual trading strategies, moomoo’s desktop and mobile app equips users to monitor stock performance within an easily accessible interface. The apps offer 62 technical indicators and 37 drawing tools, including financial indicators, technical indicators, historical K-line, moving averages, multiple stock comparisons and more.

Key features within moomoo’s charting tools include:

Switch period - allowing users to view different charts

Zoom in/zoom out - enabling users to zoom in or out of candlestick charts

Translation - allowing a drag left or a drag right to view historical trends

Indicators - giving users the tools to choose which technical indicators will be displayed

Switch adjustment type - a tool that allows users to switch adjustment types to backward adjusted, actual, or cumulative price

Settings - with customization options to display or hide lines on the main chart, including cost lines and show lines

You can learn more howabout to use moomoo charting tool here.

Get started with moomoo

Ready to get started with moomoo’s stock charting tools? Sign up for a free account today and download moomoo’s desktop and mobile app to give you the full suite of moomoo tools. Moomoo is used by millions of traders worldwide who make the most of its feature-packed app to propel their investment capacities forward. With over 63 technical indicators and 38 drawing tools, you’ll find it easier than ever before to trade with confidence and insight.